Compare Motor Trade Insurance

Motor Trade Insurance Quotes

Quick & Easy Process – Complete our simple form.

Cover All Traders – Cover for road risk and combined traders insurance.

Expert Support – No-obligation quotes tailored to your needs.

Compare motor traders insurance quotes with some of the UK's top providers, including:

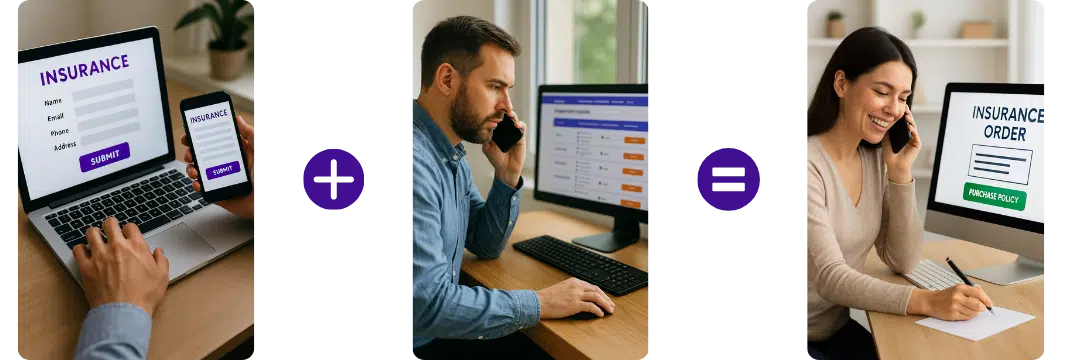

How does it work?

Complete the Simple Form

Provide details about your business, drivers, vehicles and driving history.

Compare Prices

Compare from multiple UK providers to find the best value and features.

Purchase Cover

Select the policy that fits your business and purchase directly with the provider.

Gets quotes within minutes of completing our simple form

Compare Road Risk Motor Trade Insurance Quotes

As a business owner, you may have control or custody of customers and stock vehicles for motor trade purposes. For this reason, it’s imperative to have road risk insurance to protect your business from claims and accidents that may result from the operation of your business.

Road risk motor trade insurance protects your business when driving vehicles you don’t own. If you work as a mechanic, run your own car valeting business, or buy and sell cars from home, road risk insurance offers peace of mind that your business is protected if things go wrong.

Some of the Traders Which Can Be Covered:

What Is Road Risk Motor Trade Insurance?

Road risk motor trade insurance is the minimum legally required policy of motor trade insurance. It’s designed to protect your business from claims of damage or injury caused by a vehicle that’s in your company’s care.

Road risk motor trade insurance is necessary if you run a motor trade business full- or part-time or work in any area of the motor trade business that deals with vehicles. This may include repair and service work for customer vehicles in the care, custody, or control of your business.

Road Risk Motor Trade Insurance can cover:

Product Liability Insurance

Flexible Monthly Payments

24hr Claims Helpline

Motor Trade Insurance FAQs

What is motor trade insurance and who needs it?

Motor trade insurance is a specialist policy for businesses that repair, buy, sell, service, move, or work with vehicles. It covers traders such as mechanics, valeters, dealers, bodyshops, tyre fitters, and mobile technicians.

How much does motor trade insurance cost?

Prices vary depending on your trade type, experience, claims history, vehicle types, location, and whether you need road risk or combined cover. Part‑time traders may pay from around £800-£1,500 per year, while full combined policies for workshops or dealerships can cost significantly more.

What is the difference between road risk and combined motor trade insurance?

Road risk insurance covers you to drive customer vehicles and your own trade vehicles on public roads. Combined motor trade insurance includes road risk plus cover for your premises, tools, equipment, stock, money, and liabilities.

Do I need motor trade insurance if I work from home?

Yes. Home‑based traders such as mobile mechanics, part‑time dealers, and valeters still need road risk cover. If you store vehicles or tools at home, you may need additional protection.

Can part‑time traders get motor trade insurance?

Yes. Many insurers offer part‑time policies for traders who buy and sell vehicles or repair cars alongside another job.

Does motor trade insurance cover customer vehicles in my care?

Yes. Road risk policies cover customer vehicles while being driven, and combined policies can cover them while stored on your premises.

What types of businesses need combined motor trade insurance?

Combined cover is ideal for workshops, MOT stations, bodyshops, tyre centres, valeting centres, and dealerships that need protection for premises, tools, machinery, stock, and liabilities.

Does motor trade insurance cover tools and equipment?

Only combined policies include tools and equipment cover. You can insure hand tools, diagnostic machines, lifts, compressors, and specialist equipment.

Can I drive any car with motor trade insurance?

Not always. Policies usually cover customer vehicles and trade vehicles, but high‑performance, modified, or high‑value cars may require approval.

Does motor trade insurance cover test drives?

Yes, as long as the policy includes demonstration cover. This allows customers to test drive vehicles under your supervision.

What factors affect the cost of motor trade insurance?

Insurers consider:

-

Your trade type

-

Experience and qualifications

-

Claims history

-

Number of vehicles handled

-

Premises security

-

Tools and equipment value

-

Location and risk level

Can I get motor trade insurance without premises?

Yes. Mobile mechanics, valeters, and part‑time traders can get road risk‑only policies without needing a workshop or forecourt.

Does motor trade insurance cover employees?

Employees can be added as named drivers or included under an any‑employee driving extension, depending on the insurer.

What documents do I need for a motor trade insurance quote?

You’ll typically need:

-

Proof of trading activity

-

Driving licence

-

Claims history

-

Details of tools, equipment, and premises (if applicable)

-

Vehicle types handled

Does motor trade insurance cover vehicles kept overnight?

Yes, but insurers may require secure storage, CCTV, alarms, or locked compounds, especially for high‑value vehicles.

Can I get motor trade insurance if I’m under 25?

It’s possible, but premiums are higher. Some insurers specialise in younger traders with experience or qualifications.

Does motor trade insurance include public liability cover?

Combined policies often include public liability, and you can add employers’ liability if you have staff.

Does motor trade insurance cover buying and selling vehicles?

Yes. Traders who buy and sell vehicles need road risk cover for driving them and stock cover for vehicles held for sale.

Can I pay for motor trade insurance monthly?

Yes. Most insurers offer monthly instalments through finance agreements.

How can I reduce the cost of motor trade insurance?

You can lower premiums by improving security, reducing claims, storing vehicles safely, installing CCTV, maintaining a clean driving record, and using a specialist motor trade broker.

Helpful links

The Institute of the Motor Industry Website

Retail Motor Trade Federation – The Retail Motor Industry Federation (RMI) is the UK’s leading automotive trade body, representing franchised car and commercial vehicle dealers, independent garages, bodyshops, motorcycle dealers, petrol retailers, auction houses and cherished number plate dealers,

Gets quotes within minutes of completing our simple form

Last Updated | 26th January 2026

Page updated and reviewed by Sarah Hampton – Insurance specialist