Commercial Property Insurance Quotes

Compare tailored commercial property insurance for UK offices, shops, warehouses and mixed-use premises, covering buildings, contents and business interruption.

Quick & Easy Process – Compare tailored quotes in minutes

All Commercial Premises – Including offices, shops and warehouses.

Expert Support – UK specialists helping you find the right cover.

Compare commercial landlord insurance quotes with some of the UK's top insurers, including:

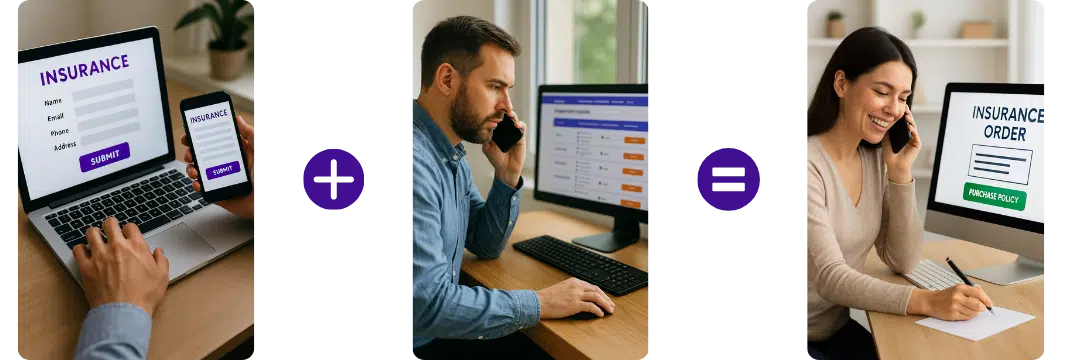

How does it work?

Complete the Simple Form

Provide details about your business and property informaton.

Compare Prices

Compare from multiple UK providers to find the best value and features.

Purchase Cover

Select the policy that fits your business and purchase directly with the provider.

Gets quotes within minutes of completing our simple form

Compare Commercial Buildings Insurance

Running a business can be stressful. On many occasions, people refuse to take up the responsibility to secure their business. One thing these people keep forgetting is that business is very unpredictable. Anything can happen and you might be out of business. How can you get commercial property insurance which will give you peace of mind?

There’s no need to keep stressing over what can happen and what will not. Compare business building insurance today and get yourself the best insurance policy. You should also make sure you read the terms in the fine print carefully so as not to miss out on vital information.

Commercial Property Insurance FAQs

What is commercial property insurance and what does it actually cover?

Commercial property insurance protects business premises against risks such as fire, flood, storm damage, theft, vandalism, and accidental damage. It can also cover fixtures, fittings, stock, machinery, and business interruption if the property becomes unusable.

How much does commercial property insurance cost?

Prices vary widely depending on the building type, location, construction materials, security, occupancy, and claims history. Small retail units may start from a few hundred pounds per year, while large warehouses, industrial units, or multi‑tenanted buildings can cost significantly more. Only a specialist broker can provide an accurate premium.

What types of commercial properties can be insured?

Most insurers cover a wide range of premises, including offices, shops, restaurants, warehouses, factories, industrial units, salons, pubs, hotels, surgeries, mixed‑use buildings, and commercial landlords’ portfolios.

Does commercial property insurance cover tenants or just the building owner?

It depends on the policy. Landlords typically insure the building, while tenants insure their own contents, stock, and improvements. Some policies can be structured to cover both parties if required.

What factors affect the price of commercial property insurance?

Insurers assess:

-

Building size, age, and construction

-

Location and flood/crime risk

-

Business type and occupancy

-

Security measures

-

Claims history

-

Rebuild cost

-

Fire protection systems

Do I need commercial property insurance if I rent my premises?

Yes. Even if you rent, you may be responsible for insuring your contents, stock, equipment, and any improvements you’ve made to the property. Your lease may also require certain cover.

Does commercial property insurance cover loss of income?

Yes, if you add business interruption insurance. This covers lost revenue if your premises become unusable due to an insured event like fire or flood.

Can I insure multiple commercial properties under one policy?

Yes. Multi‑property and portfolio policies are available for landlords, investors, and businesses with several locations, often reducing costs and admin.

Does commercial property insurance cover unoccupied buildings?

Standard policies usually don’t. Unoccupied properties require specialist cover due to higher risks like vandalism, theft, and water damage.

Does commercial property insurance cover restaurants, takeaways, and food businesses?

Yes, but insurers treat them as higher risk due to cooking equipment and fire exposure. You may need additional cover for stock, refrigeration breakdown, and public liability.

Can I get commercial property insurance for a warehouse or industrial unit?

Yes. Warehouses and industrial units can be insured, but premiums depend heavily on the type of goods stored, fire protection, and security measures.

Does commercial property insurance cover mixed‑use buildings?

Yes. Mixed‑use buildings (e.g., shop with flats above) can be insured under a single policy, but insurers will assess both the commercial and residential risks.

What is the rebuild cost and why is it important?

The rebuild cost is the amount required to completely rebuild your property after a total loss. Insurers use this figure to calculate premiums. Underestimating it can lead to reduced payouts.

Does commercial property insurance cover accidental damage?

Some policies include accidental damage as standard, while others require it as an add‑on. It’s important for businesses with expensive equipment or high‑value interiors.

Can I get commercial property insurance if my building has a flat roof?

Yes, but insurers may charge more due to increased water‑ingress risk. You may need to provide evidence of regular maintenance.

Does commercial property insurance cover flooding?

Many policies include flood cover, but properties in high‑risk areas may require specialist insurers or additional terms.

What documents do I need for a commercial property insurance quote?

You’ll typically need:

-

Property address and usage

-

Rebuild cost

-

Construction details

-

Security and fire protection info

-

Claims history

-

Tenant details (if applicable)

Does commercial property insurance cover damage caused by tenants?

Some policies include malicious or accidental damage by tenants, while others require it as an optional extra. Landlords should check this carefully.

Can I pay for commercial property insurance monthly?

Yes. Most insurers offer monthly instalments through finance agreements.

How can I reduce the cost of commercial property insurance?

You can lower premiums by improving security, installing fire alarms and sprinklers, maintaining the building, reducing claims, and ensuring your rebuild cost is accurate.

Useful links - Insurance Associations

ABI – Association of British Insurers – The Association of British Insurers is the leading trade association for insurers and providers of long term savings. … need to contact their insurer for a Green Card which they will need to carry on them if they wish to drive their vehicle in the EU.

BIBA – British Insurance Brokers’ Association – The British Insurance Brokers’ Association (BIBA) is the UK ‘s leading general insurance organisation.

Gets quotes within minutes of completing our simple form

Last Updated | 26th January 2026

Page updated and reviewed by Sarah Hampton – Insurance specialist

MyMoneyComparison.com connects UK businesses with specialist brokers for commercial buildings, contents and combined insurance.