Compare Block of Flats Insurance

Block of Flats Insurance Quotes

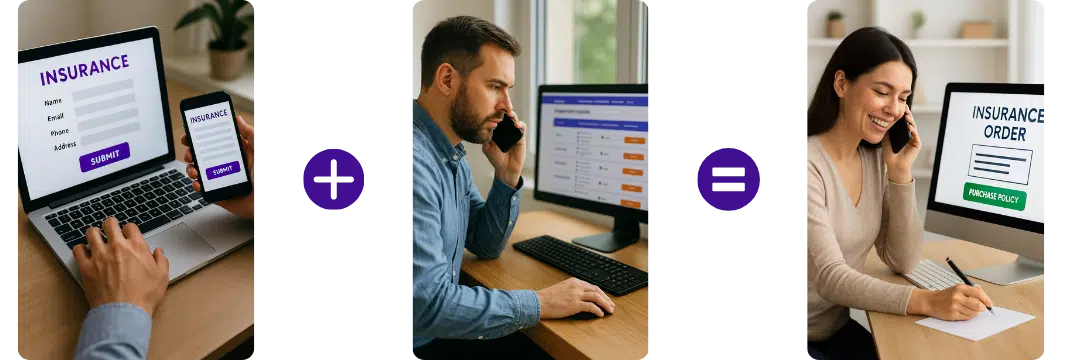

Quick & Easy Process – Complete a simple form or call the broker direct.

Trusted Partners – Work with leading UK Providers.

Expert Support – No-obligation quotes tailored to your needs.

Compare block of flats insurance quotes with some of the UK's top providers, including:

How does it work?

Complete the Simple Form

Provide details about your property details and policy requirements.

Compare Prices

Compare from multiple UK providers to find the best value and features.

Purchase Cover

Select the policy that fits your business and purchase directly with the provider.

Get quotes within minutes of completing our simple form

Block of Flats Insurance Comparison

Managing a residential building can be very stressful. Although rewarding, still stressful. You are working with a number of different characters and there’s no way to ascertain an anomaly. There’s a hundred per cent chance of running into problems on the job, however, with blocks of flats insurance, your business is in safe hands.

You can get cover for the loss of rent, public liability, landlord’s content, buildings, etc. all at a reduced cost. Besides, you get the assurance that you will not suffer the loss alone if any disaster occurs. So, how can you get more knowledge about this? The process begins when you compare block of flats insurance here.

Block of Flats Insurance FAQs

What is block insurance for flats?

Block insurance, often known as a block of flats insurance or block policy, covers an entire building or complex of flats or apartments rather than individual units. It is typically purchased by the freeholder, a management company, or a residents’ association that is responsible for the common parts of the building or complex.

Key areas usually covered by block insurance include:

- Buildings Insurance: This protects the physical structure of the building against damage from events such as fire, flood, or storm. This includes walls, roofs, floors, and all permanent fixtures and fittings.

- Public Liability Insurance: This covers you against claims made by third parties who have suffered injury or damage to their property whilst in the common parts of your property.

- Employer’s Liability Insurance: This is a legal requirement if you have any employees. It provides protection against claims from employees who have suffered injury or illness as a result of their work.

- Legal Expenses Insurance: This covers legal costs and expenses incurred in legal action.

- Directors and Officers Liability Insurance: This protects individual members of the residents’ association against personal liability claims.

- Engineering Insurance: This covers machinery and equipment, such as lifts or heating systems, in the property.

- Terrorism Insurance: This provides cover for loss or damage to property caused by acts of terrorism. This may be required in certain areas or by certain mortgage lenders.

- Communal Contents Insurance: This covers items in communal areas, such as furniture or gym equipment.

Who pays for building insurance on a block of flats?

The building insurance for a block of flats is usually arranged and paid for by the freeholder or the management company. They have a legal responsibility to ensure the building is adequately insured.

The cost of the building insurance is typically recouped from leaseholders through service charges. This will be outlined in the lease agreement for each flat. The lease will detail what proportion of the costs each flat must contribute, which is typically determined by the size of the flat or equally amongst all the flats.

In some cases, where a Right to Manage (RTM) company or residents’ association has been formed, and they have taken over the responsibilities of the freeholder, they may arrange and pay for the building insurance.

Ultimately, while the leaseholders usually end up bearing the cost through service charges, the responsibility of arranging the insurance lies with the party identified in the lease, usually the freeholder or management company. It’s important for each leaseholder to review their lease agreement to understand their obligations.

What does block insurance cover?

Block insurance, also known as block of flats insurance, covers the entire building or complex of flats rather than individual units. The exact coverage will depend on the policy, but it typically includes:

- Buildings Insurance: This is the primary aspect of block insurance. It covers the physical structure of the building against damage caused by perils such as fire, flood, or storm. It generally includes walls, roofs, floors, and permanent fixtures and fittings, including kitchens and bathrooms.

- Public Liability Insurance: This covers claims made by third parties who have suffered injury or damage to their property whilst in the communal parts of the building.

- Employer’s Liability Insurance: If there are any employees working in the building, such as cleaners, gardeners, or concierges, this provides protection against claims from them if they have suffered injury or illness as a result of their work.

- Legal Expenses Insurance: This covers the legal costs and expenses incurred in legal action related to the management and maintenance of the building.

- Directors and Officers Liability Insurance: If a residents’ association or a Right to Manage (RTM) company protects individual members against personal liability claims.

- Engineering Insurance: This covers machinery and equipment in the property, such as lifts or heating systems, for breakdowns and necessary inspections.

- Terrorism Insurance: This provides cover for loss or damage to the property caused by acts of terrorism. Depending on the location, this might be required.

- Communal Contents Insurance: This covers items in communal areas, such as furniture or gym equipment.

Who can take out a block of flats insurance policy?

A block of flats insurance policy, commonly known as block insurance, is typically taken out by parties responsible for the entire building or complex, rather than individual units. The insurance is meant to provide coverage for the building and shared spaces, offering protection from a range of risks such as structural damage, legal liabilities, and others.

In most cases, the entity that arranges the block insurance is either the freeholder, who is the owner of the building or land, or the management company responsible for maintenance and day-to-day operations. They have a legal responsibility to ensure that the building is adequately insured against potential risks and damages.

However, it’s not only freeholders or management companies who can secure such policies. There are instances where a Right to Manage (RTM) company or a residents’ association takes on this responsibility. If leaseholders are unhappy with the current building management, they can establish an RTM company to take control of services, repairs, maintenance, and insurance. In such scenarios, the RTM company can take out the block of flats insurance policy.

It’s also worth noting that in a situation where a property owner owns a whole block of flats as an investment, they might choose to take out block insurance themselves to ensure the entire property is adequately protected.

Regardless of who arranges the block insurance, the cost is typically passed on to leaseholders as part of their service charges. The exact proportion of the cost each leaseholder pays is generally outlined in their lease agreement and is often determined by the size or value of their individual flat.

So, to summarise, a block of flats insurance policy can be taken out by the freeholder, the management company, a residents’ association, an RTM company, or the property owner. The choice largely depends on the specific management structure and agreements in place.

How much does block of flats insurance cost?

The cost of block of flats insurance, also known as buildings insurance or landlord insurance, can vary significantly based on a range of factors. Some of the main factors that insurance companies consider include:

- Location: If the property is located in an area with high crime rates, or in a region prone to natural disasters such as flooding, the insurance premium may be higher.

- Age and Condition: Older buildings may require more maintenance and be more susceptible to damage, which can increase the insurance cost.

- Building Size and Number of Flats: Larger buildings with more flats typically cost more to insure because there’s a greater risk of something going wrong.

- The Level of Cover Required: A comprehensive insurance policy that covers a wide range of potential damages will cost more than a basic policy. Extra cover for things like accidental damage or legal expenses will also increase the price.

- Claims History: If there have been a number of previous insurance claims related to the property, this could result in higher premiums.

Because of these variables, it’s hard to provide a specific cost without more information about the property and the level of coverage required. However, as a general guide, in the UK, the cost of a block of flats insurance policy can range from hundreds to thousands of pounds annually. Always consult with a number of insurance providers to get quotes and ensure you’re getting a policy that suits your needs at the best possible price.

It’s also important to note that many companies offer discounts if you have safety and security features in place, like fire alarms, security systems, or flood defences. So, it’s worth discussing these features with your provider to see if they can help lower your premium.

Helpful links

NLA – The National Landlords Association – The National Landlords Association (NLA) and the Residential Landlords Association (RLA) announced today (August 29th 2019) their intention to unite to create a single organisation for landlords after more than 20 years of friendly competition.

ABI – Association of British Insurers – The Association of British Insurers is the leading trade association for insurers and providers of long term savings. … need to contact their insurer for a Green Card which they will need to carry on them if they wish to drive their vehicle in the EU.

BIBA – British Insurance Brokers’ Association – The British Insurance Brokers’ Association (BIBA) is the UK ‘s leading general insurance organisation.

Get quotes within minutes of completing our simple form

Last Updated | 4th November 2025

Page updated and reviewed by Sarah Hampton – Insurance specialist

MyMoneyComparison.com connects UK landlords and property owners with specialist brokers for block of flats insurance, helping compare tailored quotes for residential, mixed-use and leasehold buildings.