Compare Cheap Taxi Insurance

Compare Taxi Insurance Quotes

Quick & Easy Process – Complete our simple form.

Trusted Partners – Working with leading providers.

Cover All Vehicle Types – cars, minicab, black cab, minibuses.

Compare taxi insurance quotes with some of the UK's top providers, including:

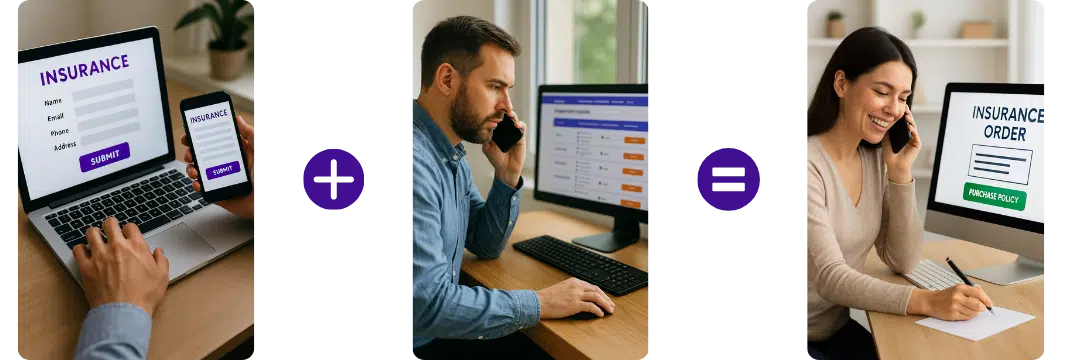

How does it work?

Complete the Simple Form

Provide details about your taxi, driving history and policy requirements.

Compare Prices

Compare from multiple UK providers to find the best value and features.

Purchase Cover

Select the policy that fits your business and purchase directly with the provider.

Gets quotes within minutes of completing our simple form

Why Compare Taxi Insurance with

My Money Comparison

Operating a taxi business involves managing vehicles, drivers, and customer safety, all of which come with specific responsibilities and risks. Having the right taxi insurance cover is crucial to safeguard your cars, drivers, and passengers. By comparing quotes from different providers, you can secure the most comprehensive policy while reducing costs and ensuring peace of mind.

Fully Authorised & Regulated

We are Financial Conduct Authority (FCA) authorised and fully regulated, ensuring you receive a trusted and compliant service

Make Informed Decisions

Our panel providers will provide you with clear, easy-to-understand insurance quotes and policy details, which lets you choose the right cover for your business, giving you confidence in your insurance decision.

Find the most Affordable Quotes & Taxi Cover

Get customised taxi insurance quotes tailored for your vehicle, any drivers, and business needs, so you only pay for the protection that matters.

Save you Time & Reduces Hassle

We help you save time searching the internet for a fleet insurance quote by helping you match the right provider with your fleet requirements which can help you save money and time.

Access Multiple Broker Quotes

Compare offers from trusted UK insurance providers in one place, giving you a complete view of available options.

Large Panel of Specialist Providers

We work with a wide network of leading UK providers who specialise in taxi insurance, offering expert quotes tailored to the specific needs of your taxi business.

Compare Taxi Insurance Comparison Quotes?

As a taxi driver, if your vehicle is off the road following an accident then this costs you money. The longer you’re not working, the longer you’re not earning. As such it is vital that you have the right cover in place to protect you and your vehicle, to ensure you’re back up and running as quickly as possible.

Whether you’re a private hire driver or public hire driver, drive a black cab or a minibus, it doesn’t matter, you still need taxi insurance. You can cover the vehicle, the driver, any passengers and members of the public and their property too – just in case you run into some trouble!

MyMoneyComparison.com work with some of the biggest Taxi Insurance companies in the country. We understand the importance your Taxi means to you and that is why we vet all our broker partners prior to being accepted on our panel. That is why we are confident our partners could beat your current Private or Public hire taxi insurance cover quotes.

Taxi insurance comparison drivers covered:

Experienced Drivers / Taxi Badge Holders

Young / Under 25 Taxi Drivers

Drivers Aged 22+

Driver with Convictions / Clean Licence

No Claims Bonus / Claims History

All Taxi Licensing Authorities

New Taxi Badge Holders

What is covered when I purchase Taxi Insurance?

Our broker panel will discuss in detail with you what is covered in your policy. This can include the following:

- Windscreen and Glass Cover

- Car Hire Cover

- Public Liability Insurance

- Adaptive Payments / Monthly Payments

- Quick and Easy Claims Procedure

- 24/7 Customer Service

- Breakdown cover, including separate onward travel to get your passengers to their destination

- Courtesy-plated taxi in the case of an accident

- Advice/assistance with the recovery of your vehicle from an accident scene

- Repair to your vehicle in the case of an accident

- 24-hour claims assistance

- Home start recovery if your vehicle won’t start

- Personal use cover if you use your vehicle outside of work

- Cover for loss or damage to keys, including locksmith charges, replacement locks and keys, car hire and onward transport

Do you own a taxi fleet or taxi company? Then why not get a taxi fleet insurance quote: Taxi Fleet Insurance Quote

Taxi Insurance Comparison Quotes Covers:

Saloons

Multi-purpose Vehicles (MPVs)

Minicabs

Minibuses

Black Cabs

Hackney Carriage

Wheelchair Accessible

Uber

Public Hire

Private Hire

Taxi Insurance FAQs

What is taxi insurance and why is it different from standard car insurance?

Taxi insurance is a specialist policy designed for vehicles used to carry paying passengers. It includes higher liability protection, commercial use cover, and passenger‑related risks that standard car insurance doesn’t cover.

How much does taxi insurance cost?

Taxi insurance costs vary depending on whether you’re a private hire or public hire driver, your location, mileage, claims history, and vehicle type. Policies can start from around £1,500-£3,000 per year for low‑risk drivers, but city‑based or high‑mileage operators may pay more. Only a specialist taxi broker can give an accurate price.

What’s the difference between private hire and public hire taxi insurance?

Private hire insurance covers pre‑booked journeys only, while public hire insurance covers taxis that can be hailed on the street or picked up at ranks. Public hire policies usually cost more due to higher exposure.

Does taxi insurance cover my passengers?

Yes. Passenger liability is a core part of taxi insurance, protecting you if a passenger is injured during a journey or while entering/exiting the vehicle.

Can I get taxi insurance if I’m a new taxi driver?

Yes, but premiums may be higher. Specialist brokers can arrange cover for new badge holders, including those with limited UK driving experience.

Does taxi insurance cover me for personal use of the vehicle?

Most policies include social, domestic, and pleasure use, but you must check your policy wording. Some insurers require it to be added as an extra.

What factors affect the price of taxi insurance?

Insurers consider:

-

Whether you’re private hire or public hire

-

Your driving and claims history

-

Your age and experience

-

Vehicle type and value

-

Mileage and working hours

-

Operating area (cities cost more)

Can I insure multiple taxis under one policy?

Yes. Taxi fleet insurance is available for businesses operating two or more vehicles, often reducing costs and admin.

Does taxi insurance cover me if I work for Uber, Bolt, or other ride‑hailing apps?

Yes, but you must declare your platform. Many insurers now offer policies specifically designed for app‑based private hire drivers.

Do I need public liability insurance as a taxi driver?

It’s not always included, but many councils require it. Public liability protects you if a member of the public is injured outside the vehicle during your work.

Does taxi insurance cover my vehicle when it’s off duty?

Yes, as long as the policy includes social and domestic use. If not, you may need to add it.

Can I get taxi insurance with previous claims or convictions?

Yes. Specialist brokers can arrange cover for higher‑risk drivers, though premiums may be higher.

Does taxi insurance include breakdown cover?

Not automatically. You can add breakdown cover, including roadside assistance and onward travel, as an optional extra.

What documents do I need for a taxi insurance quote?

You’ll typically need:

-

Taxi badge/licence

-

Vehicle details

-

Claims history

-

Driving licence

-

Council requirements

-

Mileage estimates

Can I get temporary taxi insurance?

Temporary taxi insurance is available but limited. It’s typically used for short‑term work, vehicle collection, or replacement vehicles.

Does taxi insurance cover me for airport runs and long‑distance jobs?

Yes, but you must declare your typical working pattern. Some insurers rate long‑distance work differently.

Can I pay for taxi insurance monthly?

Yes. Most insurers offer monthly payment plans through finance agreements.

Does taxi insurance cover damage caused by passengers?

Some policies include malicious damage by passengers, while others require it as an add‑on. It’s important to check your policy wording.

What is telematics taxi insurance and how does it work?

Telematics uses GPS devices or apps to monitor driving behaviour. Safer driving can reduce premiums and help drivers secure cheaper renewals.

How can I reduce the cost of taxi insurance?

You can lower premiums by:

-

Building a clean claims history

-

Installing CCTV or telematics

-

Driving a lower‑risk vehicle

-

Working fewer high‑risk hours

-

Parking securely overnight

-

Using a specialist taxi broker

Helpful Links

National Private Hire Association – The NPHA is an organisation that provides useful support and help for cabbies everywhere.

Licensed Taxi Drivers’ Association – A membership group for taxi drivers, the LTDA is also a support group for those that work in the trade.

Gets quotes within minutes of completing our simple form

Last Updated | 5th Febuary 2026

Page updated and reviewed by Sarah Hampton – Insurance specialist