Pub Insurance

Compare Pub Insurance Quotes

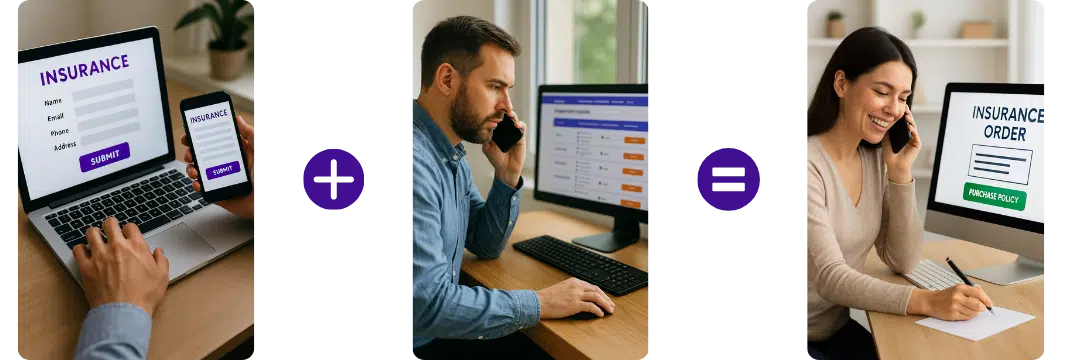

Quick & Easy Process – Complete a simple form or call directly.

Trusted Partners – Work with leading UK Providers.

Expert Support – No-obligation quotes tailored to your needs.

Compare pub insurance quotes with some of the UK's top providers, including:

How does it work?

Complete the Simple Form

Provide details about your pub, public house, bar by our simple form.

Compare Prices

Compare from multiple UK providers to find the best value and features.

Purchase Cover

Select the policy that fits your business and purchase directly with the provider.

Gets quotes within minutes of completing our simple form

Cheap pub insurance quotes online

Running a public house might be regarded as a really cool means of earning a living. You interact with characters from diverse backgrounds and the fun never stops. However, the real work lies in maintaining this business and planning against unforeseen circumstances. A wise businessman will get public house insurance quotes even before the need arises.

Pubs have their specific risks also. No one is excluded. The customers, staffs, suppliers, even the neighbors. Certain situations might arise which require urgent attention. It will be unwise to neglect cheap pub insurance and then pay millions in compensation or damages. Here are some of the insurance covers which covers your pub.

Pub Insurance FAQs

What is pub insurance?

Pub insurance, also known as public house insurance or bar insurance, is a type of business insurance specifically designed to cover the unique risks faced by pub and bar owners.

Pub insurance typically provides a combination of several different types of coverage, including:

- Public Liability Insurance: This covers claims made against the business for injuries or property damage suffered by third parties (like customers) on the pub premises.

- Employers’ Liability Insurance: This is a legal requirement if you employ staff in the UK. It covers claims made by employees who are injured or become ill as a result of working for you.

- Buildings Insurance: This covers the cost of repairing or rebuilding the pub’s physical building structure if it’s damaged due to events like fire, flood, or vandalism.

- Contents and Stock Insurance: This covers the cost of replacing the pub’s contents and stock, such as furniture, fixtures and fittings, kitchen equipment, and the food and drink you sell if they’re damaged, destroyed or stolen.

- Business Interruption Insurance: This covers loss of income and certain additional costs if the pub has to close or limit its operation due to an insured event like fire or flood.

- Money Insurance: This covers money stored on the premises against theft.

- Loss of License Insurance: This covers the pub against financial loss if your alcohol license is revoked or not renewed for reasons beyond your control.

Policies can often be tailored to meet the specific needs of the business. For example, a pub with a beer garden may require additional outdoor equipment cover, while a pub that hosts live music may need additional cover for sound equipment.

As with any insurance policy, it’s important to carefully check the terms and conditions to understand exactly what is and isn’t covered. An insurance broker or adviser can help to understand the coverage requirements and find a policy that suits the pub’s needs.

What establishments can I cover under your pub insurance?

The different types of establishments are typically covered under pub insurance in the UK.

Pub insurance policies are typically designed to cover a range of hospitality businesses, including:

- Pubs: Traditional public houses whether in urban or rural locations.

- Bars: This can include everything from city centre bars to local neighbourhood venues.

- Gastropubs: Establishments that combine the features of a pub and a high-quality food restaurant.

- Inns: These are typically rural pubs that also offer lodging.

- Wine Bars: Specialised bars that primarily serve wine.

- Sports Bars: These are pubs or bars that broadcast sports games and often feature pool tables, dart boards, etc.

- Nightclubs: Some pub insurance providers may also cover nightclubs, which have different risks due to late operating hours and live music.

- Microbreweries with Taprooms: Some insurers will cover these types of establishments under a pub insurance policy.

Keep in mind that every insurance provider will have its own criteria and may not cover all types of establishments. It’s important to discuss your specific business with the insurance provider or an insurance broker to ensure that you get coverage that fits your needs.

What are the different types of pub insurance?

In the UK, pub insurance can come in different forms based on the specifics of the business and the types of coverage included in the policy. Here are the main types of coverages that might be included in a comprehensive pub insurance policy:

- Public Liability Insurance: This covers the cost of legal action and compensation claims made against your business if a third party is injured or their property suffers damage whilst at your business premises or because of your business activities.

- Employers’ Liability Insurance: This is a legal requirement if you employ staff. It covers the cost of compensation claims arising from employee illness or injury, sustained as a result of working for you.

- Buildings Insurance: If you own the pub property, this type of insurance will cover the cost of repairing or rebuilding the structure in case of damage due to events such as fire, flood, or vandalism.

- Contents Insurance: This covers the cost of replacing your pub’s contents and stock, including furniture, fixtures, fittings, and food and beverage stock if they’re stolen, damaged, or destroyed.

- Business Interruption Insurance: This type of insurance covers the loss of income from a disaster that disrupts the operation of your pub, like a fire or flood.

- Loss of License Insurance: This covers you against the financial loss suffered if your pub’s liquor license is revoked or not renewed for reasons beyond your control.

- Money Cover: This protects against the loss of cash from the premises, whether through theft or other means.

- Product Liability Insurance: This covers damage or injury caused to your customers through a product you sell.

- Glass and Signage Cover: This provides coverage for accidental breakage of glass and damage to signage at your pub.

- Goods in Transit Cover: If you transport stock or equipment between locations (for example, between storage facilities and your pub), this type of cover can protect against loss, theft, or damage during transit.

Remember that not every policy will automatically include all these types of coverage, so it’s important to discuss your needs with an insurance broker or agent to make sure you have the necessary coverage for your pub.

What do I have to insure under a licensed trade policy?

A licensed trade policy, also known as licensed premises insurance, is designed to cover businesses that serve alcohol, such as pubs, bars, restaurants, and nightclubs. Here are the key areas that you typically need to consider insuring under a licensed trade policy:

- Building Insurance: If you own the building, it’s crucial to have it insured against damage from risks like fire, storms, floods, or vandalism.

- Contents and Stock Insurance: This will cover the replacement cost of items within your premises, such as furniture, kitchen equipment, and your stock of food and drinks.

- Public Liability Insurance: This covers compensation claims if a customer or member of the public suffers injury or property damage because of your business.

- Employers’ Liability Insurance: If you have employees, UK law requires you to have this type of insurance. It covers compensation claims from employees who suffer work-related injuries or illnesses.

- Business Interruption Insurance: This covers lost income and additional operating expenses if your business is unable to operate normally due to an insured event such as a fire or flood.

- Loss of License Insurance: This covers loss of earnings if you lose your license to sell alcohol for reasons outside of your control.

- Money Cover: This covers cash kept on the premises from theft.

- Glass and Signage Cover: This provides coverage for accidental breakage of windows and signs at your premises.

- Goods in Transit Cover: If you transport stock between locations, this can protect against loss, theft, or damage during transit.

Remember, every business has unique needs, and the exact coverages you require may vary. It’s essential to evaluate your specific risk exposure and discuss it with an insurance professional to ensure you have the right coverage.

Pub insurance policy exclusions

While pub insurance is designed to offer broad protection for your business, as with any insurance policy, there are likely to be some exclusions. These can vary from policy to policy, but common exclusions might include:

- Wear and Tear: Regular depreciation or damage due to ongoing use or lack of maintenance is typically not covered.

- Gradual Damage: Damage that occurs slowly over a period of time, such as dampness or rot, is usually excluded.

- Intentional Damage: Any damage caused intentionally by you or your employees will likely not be covered.

- Uninsured Periods: If the premises are left unoccupied for a period specified in the policy (often 30 days), certain types of damage may not be covered.

- War and Terrorism: Most standard policies exclude damage caused by war, terrorism, or nuclear risk, though separate coverage may be available for these.

- Pollution: Some policies may exclude or limit coverage for pollution and environmental damage.

- Electrical or Mechanical Breakdown: Some policies do not cover the breakdown of machinery or equipment unless specifically added as an extension.

- Loss of License due to Legal Non-compliance: If your alcohol license is revoked due to non-compliance with legal requirements, loss of license cover will not apply.

- Inadequate Security: Some policies may exclude theft if there were inadequate security measures in place, as defined in the policy terms.

- Liability Exclusions: There are often specific exclusions within liability coverage. For example, employers’ liability cover typically won’t apply to punitive damages.

These are general examples and the exact exclusions will depend on the specific policy and insurer. It’s important to read your policy documentation carefully, including the terms and conditions,

How much does pub insurance cost?

The cost of pub insurance can vary widely based on a range of factors. These include the size of the pub, its location, the number of employees, the types of coverage needed, and the specific risks associated with the individual business. As such, it’s hard to provide an exact figure without knowing the specifics of your pub.

However, it’s important to note that while cost is a consideration, it’s essential to ensure that you have the right level of cover to protect your business. Under-insuring can lead to significant out-of-pocket costs if something goes wrong and you’re not fully covered.

To get an accurate quote for pub insurance, you’ll need to provide detailed information about your business to the insurance provider or a broker. This will typically include:

- The location of your pub.

- The size and type of your pub.

- The number of employees you have.

- Your pub’s annual turnover.

- Any claims history.

- The types of coverage and the amount of coverage you require.

It’s a good idea to get quotes from several providers to compare coverages and prices. You should also review your insurance cover annually, or when significant changes occur in your business, to ensure you always have adequate protection.

What is it advisable to insure my pub for?

As a pub owner in the UK, there are several key areas that you should consider insuring to protect your business from a range of risks. Here’s what you might want to consider:

-

Building Insurance: If you own the pub building, insuring it can protect you against significant financial losses in case of damage due to fire, flood, or other insured events.

-

Contents and Stock Insurance: This covers the cost of replacing your pub’s contents and stock, like furniture, kitchen equipment, and your supply of food and drinks if they’re stolen, damaged, or destroyed.

-

Public Liability Insurance: This is essential for any business that deals with the public. It provides cover if a customer or other third party suffers injury or property damage in your pub and decides to sue.

-

Employers’ Liability Insurance: If you employ staff, this type of cover is a legal requirement in the UK. It can cover the cost of compensation claims made by employees who get injured or ill due to their work.

-

Business Interruption Insurance: This can cover loss of income and certain additional costs if your business has to stop operating or reduce its operations due to an insured event like a fire or flood.

-

Loss of License Insurance: This covers your business against financial loss if your alcohol license is revoked or not renewed for reasons beyond your control.

-

Money Insurance: This provides cover for cash kept on the premises, providing protection against theft.

-

Product Liability Insurance: If a product you sell causes harm to a customer, this type of cover can protect you.

-

Glass and Signage Cover: This protects against the costs of accidental damage or breakage to glass and signage at your premises.

-

Goods in Transit Cover: If you move stock or equipment between locations, this cover can protect against loss or damage during transit.

Remember, every pub is different and will have different insurance needs. An insurance broker or advisor can help you assess your pub’s unique risks and determine the right level and types of coverage for your business. Always read the terms and conditions of your policy to understand what is and isn’t covered.

Useful links - Insurance Associations

ABI – Association of British Insurers – The Association of British Insurers is the leading trade association for insurers and providers of long term savings. … need to contact their insurer for a Green Card which they will need to carry on them if they wish to drive their vehicle in the EU.

BIBA – British Insurance Brokers’ Association – The British Insurance Brokers’ Association (BIBA) is the UK ‘s leading general insurance organisation.

Related products

Employers Liability Insurance

Professional Indemnity Insurance

Public Liability

Insurance

Gets quotes within minutes of completing our simple form

Last Updated | 7th October 2025

Page updated and reviewed by Sarah Hampton – Insurance specialist