Motorised Horsebox Insurance Quotes

Compare tailored motorised horsebox insurance for UK horse owners and equine businesses. Get quotes for 3.5t and 7.5t+ vehicles, private or commercial use, with options for breakdown, European use and contents for tack and equipment, so you’re covered when transporting horses nationwide.

Quick & Easy – Compare tailored motorised horsebox insurance quotes.

All Horsebox Types – Vehicles 3.5t & 7.5t+ horseboxes, plus larger vehicles

UK-Based Support – No obligation with a friendly, experienced team.

Compare motorised horsebox insurance quotes with top horsebox insurers, including:

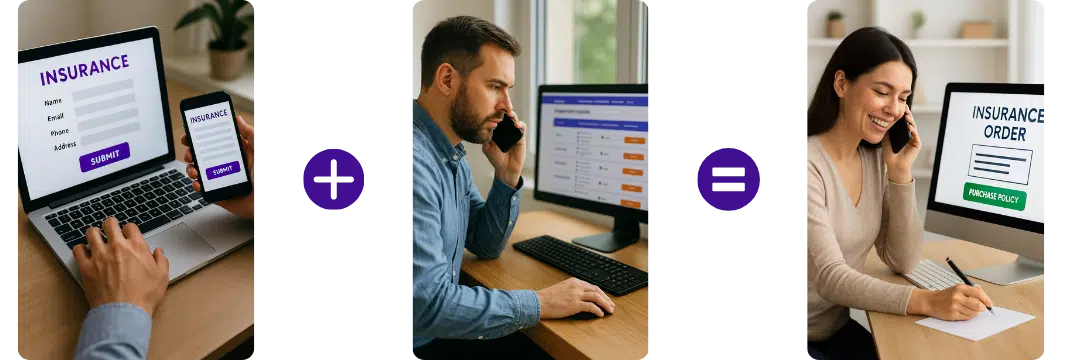

How does it work?

Complete our simple form

Provide details about your motorised horsebox requirements in our simple form.

Compare prices

Compare from multiple UK providers to find the best value and features.

Purchase cover

Select the policy that fits your business and purchase directly with the provider.

Get quotes within minutes of completing our simple form

Why Compare Horsebox Insurance with

My Money Comparison

Managing a motorised horsebox comes with unique responsibilities, risks, and costs. Ensuring your horsebox has the right insurance is essential to protect your vehicle, horses, and operations. Comparing quotes helps you find the best policies while saving time and money.

Fully Authorised & Regulated

We are Financial Conduct Authority (FCA) authorised and fully regulated, ensuring you receive a trusted and compliant service

Make Informed Decisions

Our panel providers will provide you with clear, easy-to-understand insurance quotes and policy details, which lets you choose the right cover for your business, giving you confidence in your insurance decision.

Help You Find Affordable Quotes & Horsebox Cover

Find tailored insurance quotes for all types of motorised horsebox vehicles, ranging from 3.5 ton – up to and beyond 44 tons; however, if you are looking for cover for a horse trailer instead, then please call the number above and somebody will be able to help you with your business needs.

Save you Time & Reduces Hassle

We help you save time searching the internet for a horsebox insurance quote by helping you match the right provider with your vehicle requirements, which can help you save money.

Access Multiple Broker Quotes

Compare offers from trusted UK insurance providers in one place, giving you a complete view of available options.

Large Panel of Specialist Providers

We have partnered up with some of the well-loved brands that specialise in horsebox covers and who have the experience and knowledge to provide you with comprehensive motorised horsebox insurance.

Compare horsebox insurance quotes via a panel of trusted brokers

Quotes can be compared for all horsebox requirements, whether that be a motorised lorry horsebox, horse trailer or horsebox insurance in Northern Ireland, our brokers can help you find the most competitive prices to cover your needs

Compare Motorised Horsebox Insurance?

Motorised horsebox insurance is a specialised insurance coverage designed specifically for owners. A motorised horsebox is a vehicle used for transporting horses, combining the functions of a vehicle and a horse trailer. Motorised horsebox insurance provides protection for both the vehicle and the horses being transported.

This type of insurance typically includes coverage options such as:

- Vehicle Insurance: Motorised horsebox insurance covers the vehicle itself, providing protection against risks such as accidents, theft, fire, vandalism, or damage caused by natural disasters. It ensures that repairs or replacements are covered, allowing the horsebox owner to keep their vehicle in proper working condition.

- Third-Party Liability Insurance: This coverage protects the horsebox owner against claims made by third parties for bodily injury or property damage caused by the horsebox during transit or while parked. It covers legal expenses and any awarded damages.

- Horse Transit Insurance: Motorised horsebox insurance also covers the horses being transported. This covers veterinary expenses in case of injury or illness during transit and the loss or theft of horses during transportation.

Motorised horsebox insurance is essential for horse owners who frequently transport their horses. It provides financial protection and peace of mind, ensuring that the vehicle and the valuable cargo are adequately covered in accidents, damage, or liability claims. Horse owners should consult with insurance providers or brokers specialised in horsebox insurance to find the most suitable coverage options.

Is Motorised Horsebox Insurance Required Legally?

To transport your horse using a motorised horsebox, you are required by law to have appropriate horsebox insurance. For horsebox vehicles that have been registered off-road, they are permitted not to have insurance, however, they must be registered as off-road with a Statutory Off Road Notice (SORN).

If you do not want to go through stress, you can simply compare horsebox insurance quotes online. This will help to protect your pocket and ensure you stay on the road legally. You should know, however, that horsebox insurance or horse trailer insurance won’t provide cover for the animal itself. You will need to arrange for separate horse insurance in addition to motorised horsebox insurance for double protection.

Motorised Horsebox Insurance FAQs

What is motorised horsebox insurance and what does it cover?

Motorised horsebox insurance protects vehicles designed to transport horses. It typically covers the vehicle itself, third‑party liability, accidental damage, fire, theft, and optional extras such as breakdown and horse recovery.

How much does horsebox insurance cost?

Prices vary depending on the size of the horsebox, driver age, mileage, storage location, and whether it’s used privately or commercially. Smaller 3.5‑tonne horseboxes may start from a few hundred pounds per year, while larger 7.5‑tonne or commercial horseboxes can cost significantly more.

What’s the difference between motorised horsebox insurance and trailer horsebox insurance?

Motorised horsebox insurance covers a self‑propelled vehicle, while trailer horsebox insurance covers a towed horse trailer. Trailer cover is usually cheaper, but it must be added to a towing vehicle’s policy.

Does horsebox insurance cover the horses themselves?

Not automatically. Horses are usually covered under a separate equine insurance policy. Some insurers offer optional horse‑in‑transit cover for injury during transport.

Can I use my horsebox for both personal and business use?

Yes, but you must declare this. Commercial use – such as transporting horses for clients – requires specialist cover and may increase premiums.

Does horsebox insurance cover breakdown and horse recovery?

Standard breakdown cover may not include horse recovery. Many insurers offer specialist equine rescue services that transport both the horsebox and the horses safely.

What factors affect the cost of horsebox insurance?

Insurers consider:

-

Vehicle weight and value

-

Driver age and experience

-

Number of horses transported

-

Mileage and journey frequency

-

Storage and security

-

Private vs commercial use

Can young drivers get motorised horsebox insurance?

Yes, but premiums are higher. Some insurers require drivers under 25 to have additional experience or training.

Does horsebox insurance cover long‑distance travel or competitions?

Yes, but you must declare your typical travel pattern. Some insurers offer extended cover for events, competitions, and long‑distance transport.

Can I insure a self‑converted horsebox?

Yes, but insurers may request photographs, build details, and proof of professional workmanship to ensure safety and compliance.

Does horsebox insurance cover theft of tack and equipment?

Not always. Tack, saddles, and equipment often require optional tack insurance or contents cover. High‑value tack may need separate policies.

Can I insure multiple horseboxes under one policy?

Yes. Multi‑vehicle or fleet‑style policies are available for equestrian businesses, riding schools, and transport companies.

Does horsebox insurance cover damage caused by horses?

Some policies include accidental damage caused by horses inside the horsebox, while others require an add‑on. It’s important to check the wording.

Do I need specialist insurance for a 7.5‑tonne horsebox?

Yes. Larger horseboxes require HGV‑style cover due to their size and weight. Drivers may also need the correct licence category.

Does horsebox insurance cover European travel?

Many insurers offer EU cover for competitions, training, or relocation trips. You may need to request a Green Card depending on the destination.

What documents do I need for a horsebox insurance quote?

You’ll typically need:

-

Vehicle details

-

Driver information

-

Claims history

-

Usage type (private or commercial)

-

Storage location

-

Number of horses transported

Can I get temporary horsebox insurance?

Yes. Temporary cover is available for short‑term needs such as competitions, transport days, or borrowing a horsebox.

Does horsebox insurance cover fire and accidental damage?

Comprehensive policies usually include fire, theft, vandalism, and accidental damage. Third‑party policies do not.

Can I pay for horsebox insurance monthly?

Yes. Most insurers offer monthly instalments through finance agreements.

How can I reduce the cost of horsebox insurance?

You can lower premiums by improving security, storing the horsebox in a locked yard, limiting mileage, maintaining a clean driving record, and choosing a smaller or lower‑value vehicle.

Helpful links

BHS – The British Horse Society – was founded in 1947, and we have grown over the past 70 years to become the largest and most influential equestrian charity in the UK with over 108,000 members. We aim to protect and promote the interests of all horses and those who care about them, including the 3.5 million people in the UK who ride or who drive a horse-drawn carriage

BEF – British Equestrian Federation – The British Equestrian Federation (BEF) is the National Governing Body for horse sports in the UK

Get quotes within minutes of completing our simple form

Last Updated | 26th January 2026

Page updated and reviewed by Sarah Hampton – Insurance specialist

MyMoneyComparison.com connects UK horse owners and businesses with specialist brokers for motorised horsebox insurance, helping compare tailored quotes for private use, transport and equestrian businesses.