Compare Motorhome Insurance Online

Motorhome Insurance Quotes

Quick & Easy Process – Compare online insurance quote instantly.

Trusted Partners – Leading motorhome Insurance providers.

Expert Support – No-obligation quotes, gets quotes 24/7.

Compare motorhome insurance quotes online with some of the top motorhome insurers, including:

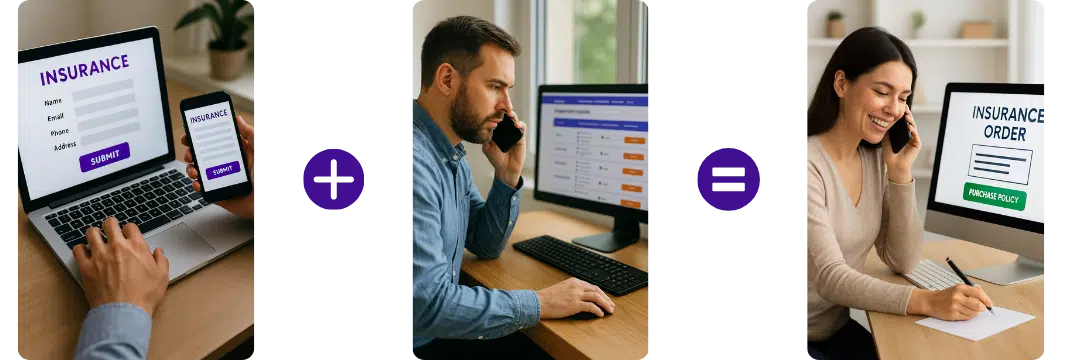

How does it work?

Complete the Simple Form

Provide details about your motorhome, driving history and policy requirements.

Compare Prices

Compare multiple online quotes to find the best value and features.

Purchase Cover

Purchase the policy online or call the provider the following day.

Compare motorhome insurance quotes and buy online.

What Is A Motorhome Insurance Policy?

Motorhome insurance is a specific type of insurance coverage designed to protect owners of motorhomes or recreational vehicles (RVs). It provides financial protection against risks and damages associated with owning and using a motorhome. Motorhome insurance typically covers various aspects, including:

- Liability Coverage: This protects you in case you cause injury to someone else or damage their property while using your motorhome.

- Collision and Comprehensive Coverage: This covers the repair or replacement costs if your motorhome is damaged or totalled due to a collision, fire, theft, vandalism, or other covered perils.

- Personal Belongings Coverage: It provides coverage for personal belongings inside your motorhome, such as clothing, electronics, and other valuables.

- Roadside Assistance: Many motorhome insurance policies offer roadside assistance, which can help with services like towing, tire changes, fuel delivery, and locksmith services.

Motorhome insurance requirements and coverage options can vary, so it’s essential to review the specific policy terms and conditions to ensure you have the appropriate coverage for your motorhome and personal needs.

Motorhome Insurance FAQs

What is motorhome insurance?

Motorhome insurance is a specialist vehicle insurance designed for campervans and motorhomes, protecting against incidents such as accidents, theft, fire, vandalism, and third-party claims. Policies can also include personal possessions, fitted equipment, and travel outside the UK.

How much does motorhome insurance cost in the UK?

The cost depends on the motorhome’s value, size, usage, storage location, and driver profile. Smaller campervans may cost a few hundred pounds per year, while larger A-class or American-style motorhomes typically cost more.

What types of motorhomes can be insured?

Most insurers accept:

-

Coachbuilt motorhomes

-

A-class motorhomes

-

Campervans and panel van conversions

-

Self-build or DIY conversions

-

American RVs and micro-campers

Acceptance depends on safety standards and declared specifications.

Are personal belongings inside a motorhome insured?

Many policies include an allowance for personal possessions such as clothing, electronics, and camping equipment. Higher-value items may need to be listed separately.

Can a self-converted motorhome be insured?

Yes. Insurers usually ask for photographs, conversion details, receipts, and confirmation that gas and electrical work meets recognised safety standards.

Does motorhome insurance allow travel in Europe?

Most UK policies include a limited number of days for European travel, often between 30 and 90 days. Longer trips usually require an extension.

What affects the price of motorhome insurance?

Key factors include:

-

Vehicle value and type

-

Driver age and experience

-

Annual mileage

-

Storage location and security

-

Previous claims

-

Declared modifications

Is breakdown assistance included with motorhome insurance?

Breakdown assistance is not always included as standard. Many drivers add specialist motorhome recovery, which accounts for vehicle size, height, and weight.

Can I live in my motorhome full-time and still be insured?

Full-time living requires specialist motorhome insurance. Standard leisure policies usually exclude permanent residency.

Are awnings and accessories insured on a motorhome policy?

Awnings, bike racks, solar panels, and satellite systems are commonly accepted but must be declared. Some items may have individual value limits.

Can I take my motorhome abroad for extended trips?

Yes, provided the policy allows extended European or international travel. Duration limits and destination restrictions vary by insurer.

Does motorhome insurance include accidental damage?

Comprehensive policies typically include accidental damage such as collisions, reversing incidents, and storm-related damage.

Can younger drivers insure a motorhome?

Drivers under 25 can be accepted, but insurers often apply higher premiums, minimum licence periods, or driver restrictions.

Are gas bottles and camping equipment included?

Some policies allow for gas bottles and external camping equipment, though limits apply. Expensive items may need to be specified.

Can I insure a motorhome kept on my driveway?

Yes. Insurers may require security measures such as alarms, wheel clamps, trackers, or locked gates. Secure storage often reduces premiums.

Does motorhome insurance allow hire or rental use?

No. Hiring out a motorhome requires specialist self-drive hire insurance, not standard leisure motorhome insurance.

What information is needed for a motorhome insurance quote?

You’ll usually need:

-

Motorhome details and value

-

Driver details

-

Claims history

-

Storage location

-

Intended usage

-

Modifications and accessories

Is water damage or damp insured?

Sudden water ingress may be accepted, but gradual damp, wear, or poor maintenance is usually excluded. Some insurers offer optional protection for this risk.

Can motorhome insurance be paid monthly?

Yes. Most insurers offer monthly instalments through finance agreements, subject to approval and interest.

How can I reduce the cost of motorhome insurance?

You can reduce costs by improving security, limiting mileage, choosing secure storage, maintaining a clean driving record, and comparing specialist motorhome insurers.

Helpful links

10 Best Motorhome & Caravan Clubs

27 of the best campsites in the UK

ABI – Association of British Insurers – The Association of British Insurers is the leading trade association for insurers and providers of long term savings. … need to contact their insurer for a Green Card which they will need to carry on them if they wish to drive their vehicle in the EU.

BIBA – British Insurance Brokers’ Association – The British Insurance Brokers’ Association (BIBA) is the UK ‘s leading general insurance organisation.

Online motorhome insurance comparison, quote and buy.

Last Updated | 26th January 2026

Page updated and reviewed by Sarah Hampton – Insurance specialist