Compare Convicted Drivers Insurance

Convicted Drivers Insurance Quotes

Quick & Easy Process – Complete a simple form.

All Types of Convictions – Specialist in all types of driving convictions.

Expert Support – No-obligation quotes tailored to your needs.

Compare insurance for driving convictions with some of the UK's top providers, including:

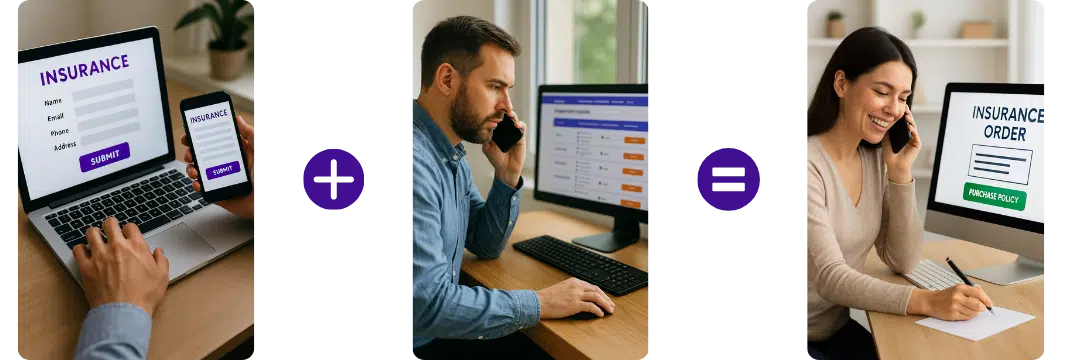

How does it work?

Complete the Simple Form

Provide details about you, your convictions and driving history.

Compare Prices

Compare from multiple UK providers to find the best value and features.

Purchase Cover

Select the policy that fits your business and purchase directly with the provider.

Gets quotes within minutes of completing our simple form

Specialist Car Insurance For Convicted Drivers

A conviction is arguably the worst calamity that can befall a driver. Apart from the stiff punishment you get, you also get a very hefty insurance. This is because many insurance brokers will increase their insurance premium if you have a driving conviction or ban.

Mymoneycomparison is here to help you find young convicted driver insurance quotes. We have a large and very detailed database of convicted driver insurance online and this helps us aptly various insurance premiums. Whether you were convicted for drunk driving, speeding ban, driving without insurance or any other vice, we got you covered.

Convicted Drivers Insurance FAQs

What is convicted drivers insurance?

Convicted driver’s insurance, also known as car insurance for drivers with convictions, is a type of auto insurance policy designed for individuals who have criminal convictions, whether these are driving-related or not.

In the United Kingdom, insurers will ask about any unspent convictions as part of their risk assessment when applying for car insurance. A conviction is considered “spent” after a certain amount of time, depending on the length and type of sentence. The Rehabilitation of Offenders Act 1974 provides the rules around spent convictions in the UK.

Insurance companies typically see drivers with convictions as a higher risk. This can be due to driving convictions, like drink under the influence or speeding tickets, which may suggest a disregard for road safety rules. Non-driving convictions can also influence an insurer’s decision, as they may perceive these individuals to be more likely to make a claim or act dishonestly.

The consequence of this perceived increased risk is typically higher insurance premiums. However, the degree of increase can vary significantly depending on the nature and severity of the conviction, how long ago it was, and the individual insurer’s policies.

While many mainstream insurance companies may decline to insure convicted drivers or charge prohibitively high premiums, specialist insurers and brokers in the UK cater to this market. These companies offer convicted drivers insurance specifically for individuals with prior convictions.

These providers understand the unique circumstances of convicted drivers and can often provide more competitive rates. They will still take the nature of your conviction, your driving history, and other factors into account when determining your premiums, but they specialise in helping high-risk drivers obtain the coverage they need.

It’s important to note that disclosing unspent convictions is legally required when applying for car insurance. Failure to disclose this information when asked could result in invalidating the insurance policy, non-payment of claims, and potential legal repercussions.

It’s also worth noting that drivers with convictions must inform their insurance company of their convictions. The insurer may then decide whether or not to continue providing cover.

Can I get car insurance with a conviction?

Yes, you can get car insurance with a conviction in the UK, but it may be more challenging and potentially more expensive. This is because insurance providers may see you as a higher risk due to your conviction, and they price their policies accordingly.

When applying for car insurance, you are required to disclose any unspent convictions you have. If you don’t, your policy could be invalidated, which means your insurer won’t pay out if you make a claim, and you could also face further legal consequences.

There are specialist insurance providers and brokers in the UK who offer policies for convicted drivers. These companies are accustomed to dealing with all types of convictions, including driving offences such as drink driving (DR10), driving without insurance (IN10), and speeding (SP30), as well as non-driving-related convictions.

While these specialist providers might offer more competitive rates than mainstream insurers for convicted drivers, premiums are often higher than standard car insurance. To try and keep costs down, you might want to consider the following:

- Drive a Lower Risk Vehicle: Driving a car with a smaller engine or one in a low insurance group, could help reduce your premium.

- Increase Your Excess: Agreeing to pay a higher excess in the event of a claim could reduce your overall insurance cost, but make sure you can afford to pay the excess if you need to make a claim.

- Limit Your Mileage: If you can limit your mileage, insurers might offer you a cheaper premium, as less time on the road can equate to a reduced risk.

- Secure Your Vehicle: Installing approved security devices on your car could also help to lower your premium.

- Consider a Telematics Policy: Also known as black box insurance, a telematics policy monitors your driving habits and could lead to lower premiums if you demonstrate safe driving.

How convicted drivers insurance can be lowered?

After we help you compare cheap convicted drivers insurance quotes, there are other techniques you can use to reduce your insurance premium.

Higher Insurance Excess

This is the portion of an insurance claim which the convicted driver willingly offers to pay. Normally, insurance firms set a compulsory excess, however, you can reduce your premium by offering to pay a higher, voluntary excess.

Lower Mileage

After we help you compare cheap convicted driver insurance quotes, we also advise you to reduce your annual mileage as drivers with higher annual mileage often pay higher premiums. If you are a convicted driver, you might be able to reduce your car insurance if your annual mileage is limited.

Black Box

Even after you get cheap convicted driver insurance online, it is also a good idea to install a black box, as it can lead to cheaper insurance for convicted drivers. A black box is a small device which makes use of satellite technology to record vital information about your car. It is fitted inside the convicted driver’s car, and it records information such as acceleration habits, driving speed, mileage, and cornering. Insurance brokers often use this information to assess the risk level of the convicted driver. The implication is that a convicted driver could earn lower premiums by driving safely, maintaining low mileage, and avoiding night-time driving.

Optional Extras

Drivers often add one or more options to their insurance policy for additional protection, but these add-ons might increase the cost of insurance premiums. Although, with our convicted driver insurance comparison, this shouldn’t be a burden on you. These options include breakdown insurance; which provides roadside assistance in the event of a breakdown, and legal expenses cover. You can also get windscreen cover, which is normally included in comprehensive policies.

List of driving offences and codes

Insurance to Cover Drivers with a Range of Motoring Convictions

Accident offences

| Code | Offence | Penalty points |

| AC10 | Failing to stop and/or give particulars after an accident | 5 to 10 |

| AC20 | Failing to give particulars or report an accident within 24 hours | 5 to 10 |

| AC30 | Undefined accident offences | 4 to 9 |

Careless driving

| Code | Offence | Penalty points |

| CD10 | Driving without due care and attention | 3 to 9 |

| CD20 | Driving without reasonable consideration for other road users | 3 to 9 |

| CD30 | Driving without due care and attention or without reasonable consideration | 3 to 9 |

| CD40 | Causing death — careless driving when unfit through drink | 3 to 11 |

| CD50 | Causing death — careless driving when unfit through drugs | 3 to 11 |

| CD60 | Causing death — careless driving with an alcohol level above the limit | 3 to 11 |

| CD70 | Causing death — careless driving and failing to supply a specimen | 3 to 11 |

Construction and use offences

| Code | Offence | Penalty points |

| CU10 | Using a vehicle with defective brakes | 3 |

| CU20 | Using a vehicle with parts or accessories in a dangerous condition | 3 |

| CU30 | Using a vehicle with defective tyres | 3 |

| CU40 | Using a vehicle with defective steering | 3 |

| CU50 | Causing or likely to cause danger by reason of load or passengers | 3 |

| CU60 | Undefined failure to comply with construction and use regulations | 3 |

| CU80 | Breach of requirements as to control of the vehicle, such as using a mobile phone | 3 to 6 |

Disqualified driver

| Code | Offence | Penalty points |

| BA10 | Driving while disqualified by order of the court | 6 |

| BA20 | Driving while disqualified as under age | 6 |

| BA30 | Attempting to drive while disqualified by order of the court | 6 |

Drink

| Code | Offence | Penalty points |

| DR10 | Driving or attempting to drive with alcohol above the limit | 3 to 11 |

| DR20 | Driving or attempting to drive while unfit through drink | 3 to 11 |

| DR30 | Driving or attempting to drive and refusing or failing to supply a specimen | 3 to 11 |

| DR40 | In charge of a vehicle with an alcohol level above the limit | 10 |

| DR50 | In charge of a vehicle while unfit through drink or drugs | 10 |

| DR60 | Failure to provide a specimen for analysis other than driving | 10 |

| DR70 | Failure to provide a specimen for a breath test | 4 |

| DR80 | Driving or attempting to drive when unfit through drugs | 3 to 11 |

| DR90 | In charge of a vehicle when unfit through drugs | 10 |

Drugs

| Code | Offence | Penalty points |

| DG10 | Driving or attempting to drive with a drug level above the specified limit | 3 to 11 |

| DG60 | Causing death by careless driving with drug levels above the limit | 3 to 11 |

| DR80 | Driving or attempting to drive when unfit through drugs | 3 to 11 |

Insurance offences

| Code | Offence | Penalty points |

| IN10 | Using a vehicle uninsured against third-party risks | 6 to 8 |

Licence offences

| Code | Offence | Penalty points |

| LC10 | Driving without a licence | 3 to 6 |

| LC20 | Driving otherwise than in accordance with a licence | 3 to 6 |

| LC30 | Driving after making a false declaration about fitness | 3 to 6 |

| LC40 | Driving a vehicle having failed to notify a disability | 3 to 6 |

| LC50 | Driving after a licence has been revoked or refused on medical grounds | 3 to 6 |

Miscellaneous offences

| Code | Offence | Penalty points |

| MS10 | Leaving a vehicle in a dangerous position | 3 |

| MS20 | Unlawful pillion riding | 3 |

| MS30 | Play street offences | 2 |

| MS50 | Motor racing on the highway | 3 to 11 |

| MS60 | Offences not covered by other codes (including offences relating to breach of requirements as to control of the vehicle) | 3 |

| MS70 | Driving with uncorrected defective eyesight | 3 |

| MS80 | Refusing to submit to an eyesight test | 3 |

| MS90 | Failure to give information as to the identity of the driver etc. | 6 |

Motorway offences

| Code | Offence | Penalty points |

| MW10 | Contravention of special roads regulations | 3 |

Pedestrian crossings

| Code | Offence | Penalty points |

| PC10 | Undefined contravention of a pedestrian crossing regulation | 3 |

| PC20 | Contravention of pedestrian crossing regulations — moving vehicles | 3 |

| PC30 | Contravention of pedestrian crossing regulations — stationary vehicles | 3 |

Provisional

| Code | Offence |

| PL10 | Driving without L-plates |

| PL20 | Not accompanied by a qualified person |

| PL30 | Carrying a person not qualified |

| PL40 | Drawing an unauthorised trailer |

| PL50 | Undefined failure to comply with conditions of a provisional licence |

Reckless/dangerous driving

| Code | Offence | Penalty points |

| DD10 | Driving in a dangerous manner | 3 to 11 |

| DD40 | Dangerous driving | 3 to 11 |

| DD60 | Manslaughter or culpable homicide while driving a vehicle | 3 to 11 |

| DD80 | Causing death by dangerous driving | 3 to 11 |

| DD90 | Furious driving | 3 to 9 |

Speed limits

| Code | Offence | Penalty points |

| SP10 | Exceeding goods vehicle speed limits | 3 to 6 |

| SP20 | Exceeding the speed limit for the type of vehicle (excluding goods or passenger vehicles) | 3 to 6 |

| SP30 | Exceeding the statutory speed limit on a public road | 3 to 6 |

| SP40 | Exceeding the passenger vehicle speed limit | 3 to 6 |

| SP50 | Exceeding the speed limit on a motorway | 3 to 6 |

| SP60 | Undefined speed limit offence | 3 to 6 |

Theft or unauthorised taking

| Code | Offence | Penalty points |

| UT10 | Taking and driving away without consent or attempt thereof | 3 to 11 |

| UT20 | Stealing or attempting to steal a vehicle | 3 to 11 |

| UT30 | Going equipped for stealing or taking a vehicle | 3 to 11 |

| UT40 | Taking, driving or being carried in a vehicle without consent | 3 to 11 |

| UT50 | Aggravated taking of a vehicle | 3 to 11 |

Traffic directions and signs

| Code | Offence | Penalty points |

| TS10 | Failing to comply with traffic light signals | 3 |

| TS20 | Failing to comply with double white lines | 3 |

| TS30 | Failing to comply with a ‘stop’ sign | 3 |

| TS40 | Failing to comply with the direction of a constable or warden | 3 |

| TS50 | Failing to comply with a traffic sign | 3 |

| TS60 | Failing to comply with a school crossing patrol sign | 3 |

| TS70 | Undefined failure to comply with a traffic direction or sign | 3 |

What’s the difference between SP30 and SP50 speeding convictions?

Driving offence codes are used to classify the type of traffic violation committed. SP30 and SP50 are both codes related to speeding offences, but they differ based on the type of road on which the offence occurred.

- SP30: This is the code for “exceeding the statutory speed limit on a public road”. It’s used for speeding offences that happen on all public roads except motorways.

- SP50: This code stands for “exceeding the speed limit on a motorway”. It is specific to speeding offences that happen on motorways.

For both SP30 and SP50 offences, you could get a fine, points on your licence (usually 3-6), or even be disqualified from driving depending on the severity of the offence. These offences also stay on your driving record for 4 years from the date of the offence.

If you’re convicted of either of these offences, it may affect your car insurance premiums, as insurers typically view drivers with convictions as higher risk. It’s also a legal requirement to inform your insurance provider of any driving convictions you have, otherwise, your policy could be invalidated.

What’s is a CU80 Conviction and how long does it last?

A CU80 conviction code in the UK stands for “Using a mobile phone while driving a motor vehicle.” It was established to address the increasing problem of drivers being distracted by their mobile phones while on the road, which can significantly increase the risk of an accident.

If you’re found guilty of this offence, you could receive a fine and your driving licence will be endorsed with 6 penalty points. This is significant because accumulating 12 points within a three-year period could lead to a driving ban.

A CU80 endorsement remains on your driving licence for 4 years from the date of the offence. However, you must disclose it to your car insurance provider for 5 years, as it can affect your insurance premiums during this period. Not disclosing this information when asked could invalidate your insurance policy and potentially lead to prosecution.

Holding a CU80 conviction could impact your ability to rent a car in the UK. Many car hire companies require a clean licence, and some even specify that they won’t rent to people with mobile phone offences.

The laws and penalties around mobile phone use while driving have become more stringent over the years due to the dangers associated with distracted driving.

What is an IN10 conviction?

An IN10 conviction is the code used for the offence of “using a vehicle uninsured against third-party risks.” This typically means that you’ve been caught driving a vehicle without the required minimum level of insurance coverage.

Under UK law, it is illegal to drive a vehicle on public roads without at least third-party insurance. This type of insurance covers liability for injury to others (including passengers), damage to other people’s property, and liability while towing a caravan or trailer; however, it does not cover damage to the driver’s own vehicle.

The consequences of an IN10 conviction can be quite severe:

- You may be fined. The amount will vary depending on the circumstances but could be significant.

- You’ll likely get 6 to 8 points on your licence.

- In some cases, you may be disqualified from driving.

This conviction will stay on your driving record for 4 years from the date of the offence. However, you must disclose it to your car insurance provider for 5 years, as it will likely impact your insurance premiums. Convictions for driving without insurance are taken seriously by insurers, and as a result, premiums for those with an IN10 conviction tend to be significantly higher.

If you struggle to find coverage, you might need to look into insurers who specialise in coverage for convicted drivers. It’s also worth noting that continuously maintaining car insurance coverage, even while you’re disqualified from driving, can sometimes help lower your insurance premium once you’re back on the road.

What is the drink-driving law in the UK?

Drink-driving, or driving under the influence of alcohol, is a serious crime in the United Kingdom, and the law imposes strict limits on the amount of alcohol that a driver can have in their bloodstream while operating a vehicle.

The legal alcohol limit for drivers in England, Wales, and Northern Ireland is:

- 80 milligrams of alcohol per 100 millilitres of blood

- 35 micrograms per 100 millilitres of breath

- 107 milligrams per 100 millilitres of urine

In Scotland, the limits are lower:

- 50 milligrams of alcohol per 100 millilitres of blood

- 22 micrograms of alcohol per 100 millilitres of breath

- 67 milligrams per 100 millilitres of urine

It’s important to note that the effects of alcohol can vary greatly between individuals based on a range of factors, including weight, age, sex, metabolism, the type and amount of alcohol consumed, what you’ve eaten recently, and stress levels. Therefore, it’s difficult to say exactly how many drinks you can have before exceeding the limit.

To be safe, the best advice is not to drink any alcohol if you plan on driving. Even small amounts of alcohol can impair your ability to drive safely, increasing the risk of accidents.

If you are caught and convicted of drink-driving in the UK, you may face a fine, a driving ban, and even imprisonment, depending on the seriousness of the offence. You will also receive a DR10 conviction which will remain on your licence for 11 years and is likely to significantly increase your car insurance premiums.

Can disqualified drivers get insurance?

Yes, disqualified drivers in the UK can get car insurance, but it can be more challenging and usually more expensive than standard car insurance.

When your disqualification period ends and you regain your licence, you are legally required to have car insurance before you start driving again. However, mainstream insurers may view you as a high-risk driver because of your driving history and may refuse to insure you or offer you coverage at a higher premium.

There are specialist insurance providers in the UK who offer car insurance to drivers with convictions or disqualifications, often referred to as “convicted driver insurance”. These companies are accustomed to working with high-risk drivers and can provide policies that fit your needs.

It’s important to remember that you must disclose your driving convictions and disqualifications when asked by an insurance provider. Failure to disclose this information could lead to your policy being invalidated and could potentially lead to further legal consequences.

It’s also worth noting that maintaining car insurance during your disqualification period (even if you aren’t driving), if feasible, may help lower your insurance premiums when you regain your licence. This is because gaps in coverage can lead to higher insurance rates.

Finally, as you establish a safe driving record over time, your insurance premiums should start to decrease. Some insurers may also offer discounts if you complete a safe or defensive driving course.

What is the penalty for running a red light?

Running a red light is a serious offence that is governed by the Traffic Sign Regulations and General Directions 2002. The typical offence code used for running a red light is TS10 – “failing to comply with traffic light signals”.

If you are caught running a red light, you can expect a Fixed Penalty Notice (FPN). The standard penalty for running a red light in the UK is:

- A £100 fine

- 3 penalty points will be added to your licence

The points will remain on your licence for 4 years from the date of the offence.

If you contest the FPN and the case goes to court, the maximum penalty could be up to £1,000 or £2,500 if you were driving a bus, coach, or heavy goods vehicle. You may also face disqualification and between 3 and 6 penalty points.

If you accrue 12 or more penalty points within a three-year period, you can be disqualified from driving. For new drivers (those who have held a licence for two years or less), the limit is 6 points before their licence is revoked.

It’s worth noting that these penalties can also apply if you are caught on camera running a red light, not just if you are stopped by the police at the time of the offence.

What is a TT99 endorsement?

A TT99 endorsement on a driver’s license signifies that the driver has been disqualified from driving because they’ve accumulated 12 or more penalty points within a three year period. This is often referred to as “totting up,” which is where the “TT” in TT99 comes from.

The ’99’ is a code used to show that the disqualification was due to the accumulation of points in the totting-up procedure, rather than for a specific offence.

If you receive a TT99 endorsement, you will be disqualified from driving for a minimum of six months, or longer if you’ve had previous disqualifications.

Once the period of disqualification has ended, you’ll be able to apply for a new license, but the TT99 endorsement will stay on your driving record for 4 years from the date of conviction.

Having a TT99 endorsement on your license will likely increase your car insurance premiums, as insurers will see you as a high-risk driver. You may need to look for specialist insurance providers who offer coverage for drivers with convictions or disqualifications. It’s essential to disclose this information to your insurer, as failing to do so can invalidate your policy and potentially lead to further legal consequences.

How long does a driving ban last?

A driving ban, also known as a disqualification, is a penalty imposed by a court in the UK that temporarily prohibits someone from driving. The length of a driving ban can vary widely and is usually determined by the seriousness of the offence(s) committed.

- Fixed Penalty Notice (FPN): Minor traffic and motoring offences may result in a Fixed Penalty Notice, which often includes a small fine and penalty points on your driving licence rather than a driving ban.

- Totting Up Disqualification: If you accumulate 12 or more penalty points within a three-year period, you’ll likely receive a driving ban under the ‘totting up’ procedure. This typically results in a ban of at least six months.

- Disqualification for Serious Offences: For serious offences, such as dangerous driving or drink driving, the court has the discretion to impose a driving ban of any length. This could be anywhere from several months to several years, depending on the severity of the offence. In extreme cases, a lifetime disqualification can be imposed.

- New Drivers: If you’re within two years of passing your driving test and you accumulate six or more penalty points, your licence will be revoked by the DVLA. You’ll need to reapply for your provisional licence and pass your theory and practical tests again to regain a full licence.

After your disqualification period ends, you need to apply for a new licence before you can start driving again. You might also have to retake your driving test, or you might need to take an extended driving test, which is longer and more demanding than the standard test. This will be determined by the court when your disqualification is imposed.

It’s important to note that being caught driving while disqualified is a serious offence that can result in further penalties, including imprisonment. It’s always best to follow the court’s order and the advice of legal professionals when dealing with a driving disqualification.

What is an MS90 conviction?

An MS90 conviction in the UK refers to a failure to provide information about the driver’s identity as required by law. This usually arises in situations where a traffic offence has been committed (like speeding or running a red light) and a Notice of Intended Prosecution (NIP) or a request for driver information has been sent to the registered keeper of the vehicle involved.

If the registered keeper doesn’t respond to the NIP or doesn’t provide sufficient information for the actual driver to be identified, they could face an MS90 conviction. This might happen if the NIP is ignored, or if there’s a dispute or confusion over who was driving at the time of the offence.

The penalty for an MS90 conviction is significant:

- A fine which can vary depending on the circumstances but can be substantial.

- 6 penalty points on your driving licence.

The conviction will stay on your driving record for 4 years from the date of the offence. However, you must disclose it to your car insurance provider for 5 years, which can significantly increase your insurance premiums.

If you find yourself in a situation where you’re unable to identify who was driving your vehicle at the time of an offence.

What is an CD10 conviction?

A CD10 conviction stands for “Driving without due care and attention” or “careless driving”. This offence is committed when a person’s standard of driving falls below what would be expected of a competent and careful driver.

Careless driving can cover a broad range of driving behaviours, including:

- Tailgating other vehicles

- Overtaking on the inside

- Not giving way at a junction

- Using a mobile phone while driving

- Driving aggressively

The penalties for a CD10 conviction can be severe and depend on the seriousness of the offence. They can include:

- 3 to 9 penalty points on your licence

- A fine of up to £5,000

- A discretionary disqualification from driving

The conviction will stay on your driving record for 4 years from the date of the offence. You must also disclose it to your car insurance provider, which will likely increase your insurance premiums as insurers typically view drivers with convictions as higher risk.

It’s worth noting that ‘driving without due care and attention’ is different from ‘dangerous driving’, which is a more serious offence involving a much higher degree of fault, such as driving at very high speeds in the wrong direction along a busy road or street. The penalties for dangerous driving are more severe, including mandatory disqualification and a prison sentence.

Helpful links

ABI – Association of British Insurers – The Association of British Insurers is the leading trade association for insurers and providers of long term savings. … need to contact their insurer for a Green Card which they will need to carry on them if they wish to drive their vehicle in the EU.

BIBA – British Insurance Brokers’ Association – The British Insurance Brokers’ Association (BIBA) is the UK ‘s leading general insurance organisation.

Gets quotes within minutes of completing our simple form

Last Updated | 27th October 2025

Page updated and reviewed by Sarah Hampton – Insurance specialist