Doctors Surgery Insurance

Compare Surgery Insurance Quotes

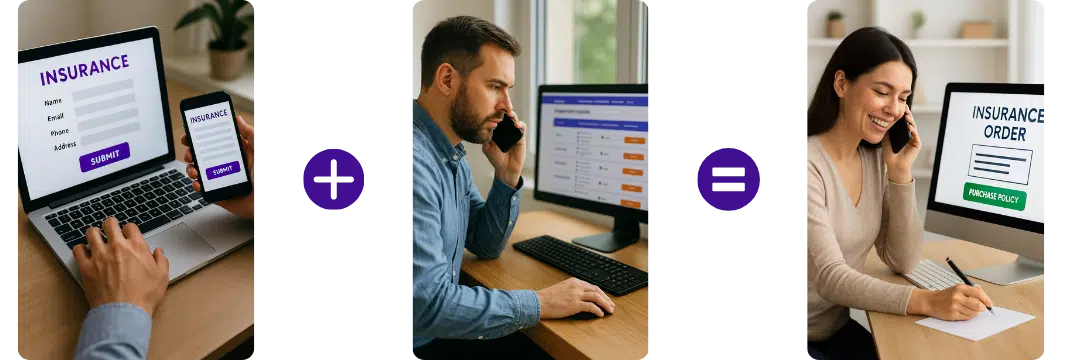

Quick & Easy Process – Complete a simple form or call directly for a quote.

Trusted Partners – Work with leading UK Providers.

Expert Support – No-obligation quotes tailored to your needs.

Compare surgery insurance quotes with some of the UK's top providers, including:

How does it work?

Complete the Simple Form

Provide details about your practice and policy requirements in our simple form.

Compare Prices

Compare from multiple UK providers to find the best value and features.

Purchase Cover

Select the policy that fits your business and purchase directly with the provider.

Gets quotes within minutes of completing our simple form

Surgery Insurance FAQs

What are the different types of Surgical Insurance?

Professional Indemnity Surgical Insurance

As a professional, any claims against you or your staffs regarding the quality of service rendered might prove costly. Some of the possible faults that can arise include loss of vital data, negligence, or even accidents while performing surgery. In order to avoid protracted court cases and calumny, you should get GP surgery insurance for your business.

Professional indemnity is a core aspect of any business. The benefits enjoyed far outweighs the stress and cost. You can also compare cheap surgery insurance so as to get sweet deals on your premium.

Public Liability Insurance

If a member of the public suffers loss or injury as a result of your service, they are free to make claims. Depending on the impact of the injury or loss, the amount accrued can amount to millions. If care is not taken, your surgery business can be crippled. The standard amount for this cover is about 5 million euros, however, some local authorities request 10 million. This is another reason to compare surgery insurance so as to avoid making the wrong selection.

Employer’s Practice Liability Insurance

Your staffs are vulnerable to attacks, injuries, and all sorts of business-related risks. Injury, illnesses, and other forms of liabilities might bring about huge losses. If you compare surgery business insurance quotes, you are guaranteed a safe landing.

Surgery Insurance For Equipment

That sophisticated equipment in your office can easily burn. They can even get damaged or stolen. As you know, the cost of these instruments are on the high side and replacing it might cause a dent in your account. The level of cover you require will depend on the value of gadgets you utilize. Also, the location will determine the cost of the surgery business insurance you get.

Vaccine Cover

As a medical practitioner, you need vaccination. Are you a doctor, vet, or dentist? You are not let out. There is a cover available for vaccines stored in your practice refrigerators. Vaccines against occasional flu, travel, etc. are under the protection if you acquire surgery insurance for GP.

Surgery Building Insurance

This is arguably the most important cover available. As a business entity, you cannot operate without a functioning building to house the patients. If damage or fire or flood occurs and you are unable to go about your operation, the loss incurred might be detrimental.

However, with a suitable surgery insurance cover, this can be avoided. The fittings, the content, the assets, personal belongings, cash, pieces of furniture, etc. are all covered. One thing, though, is that you need to carefully make a valuation of the inventory in your possession. This might take a while, but it is worth it. After getting the list of assets and the cost, you should endeavour to carry out monthly calculations so as to keep it updated.

Are you ready to take full control of your surgery business? Begin here.

Useful links - Insurance Associations

ABI – Association of British Insurers – The Association of British Insurers is the leading trade association for insurers and providers of long term savings. … need to contact their insurer for a Green Card which they will need to carry on them if they wish to drive their vehicle in the EU.

BIBA – British Insurance Brokers’ Association – The British Insurance Brokers’ Association (BIBA) is the UK ‘s leading general insurance organisation.

Related products

Employers Liability Insurance

Professional Indemnity Insurance

Public Liability

Insurance

Gets quotes within minutes of completing our simple form

Last Updated | 7th October 2025

Page updated and reviewed by Sarah Hampton – Insurance specialist