HGV Insurance

Compare HGV Insurance Quotes

Quick & Easy Process – Complete a simple form.

Trusted Partners – Work with leading UK Providers.

All Types of HGV’s – No-obligation quotes tailored to your needs.

Compare HGV insurance quotes with some of the UK's top providers, including:

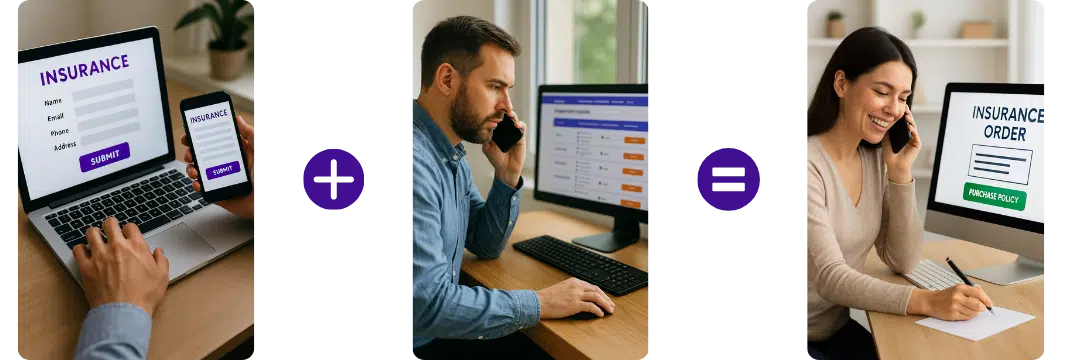

How does it work?

Complete the Simple Form

Provide details about your HGV and policy requirements.

Compare Prices

Compare from multiple UK providers to find the best value and features.

Purchase Cover

Select the policy that fits your business and purchase directly with the provider.

Gets quotes within minutes of completing our simple form

Why Compare HGV Insurance with

My Money Comparison

Operating heavy goods vehicles carries specific risks and responsibilities that require careful management. Having the right HGV insurance in place safeguards your vehicles, your drivers, and your business operations. By exploring quotes from multiple insurers, you can secure the most suitable policy while optimising both cost and cover.

Fully Authorised & Regulated

We are Financial Conduct Authority (FCA) authorised and fully regulated, ensuring you receive a trusted and compliant service

Make Informed Decisions

Our panel providers will provide you with clear, easy-to-understand insurance quotes and policy details, which lets you choose the right cover for your business, giving you confidence in your insurance decision.

Find the most Affordable Quotes & Fleet Cover

Find tailored insurance quotes for all types of HGVs from 7.5 tonne – 44 tonne+ articulated lorries with an operator’s licence or have an application pending, ensuring you only pay for the protection your business needs.

Save you Time & Reduces Hassle

We help you save time searching the internet for a fleet insurance quote by helping you match the right provider with your fleet requirements which can help you save money and time.

Access Multiple Broker Quotes

Compare offers from trusted UK insurance providers in one place, giving you a complete view of available options.

Large Panel of Specialist Providers

We have partnered up with an extensive network of top UK providers who have the experience and knowledge to provide you with specialist HGV insurance quotes which meet your business requirements.

Compare Operator’s HGV Insurance Quotes

Specialist HGV / Lorry insurance brokers for drivers and companies with the goods (o) operators licence, which is a legal requirement for any vehicle above 7.5 tonnes in weight.

Many people who drive Heavy Goods Vehicles (HGV), otherwise known as lorries, are always very busy. However, no matter how busy you are, the law mandates that you get a form of HGV insurance to cover your vehicle.

Considering the work, you do, scouting around to compare cheap lorry insurance is probably not a wise call. Not to worry, we have you covered! Mymoneycomparison is the best stop for you to get cheap HGV insurance quotes for your business.

Even if your lorry is currently off-road, the law requires you to get a form of truck insurance. This is why it is advisable to get cheap HGV insurance quotes for your van so you can compare and get very good deals. The only exception to this is if you have registered it as off the road with a Statutory Off Road Notice (SORN).

What Your HGV Insurance Policy Could Include:

What is HGV Insurance?

HGV, also referred to as lorry or haulage insurance, is a type of insurance policy that has been specifically designed for vehicles that are 7.5 ton or LGV vehicle up to 44 ton HGV’s or you could go up to the super heavy haulage of 200 tons +. This insurance covers the cab, trailer, goods being transported, along driver.

Insurers offer a wide variety of HGV insurance, with each policy slightly different in what is covered or not. The type of coverage needed will depend on your company’s unique needs. This is the reason it is imperative to do the research and shop around for a policy that is the best fit.

HGV Insurance FAQs

What is HGV insurance?

HGV insurance is a specialist policy designed to cover heavy goods vehicles used for haulage, logistics, and commercial transport. It protects the vehicle, driver, and third parties in the event of an accident, theft, or damage.

How much does HGV insurance cost?

HGV insurance costs vary widely depending on the vehicle type, driver experience, mileage, goods carried, and claims history. Policies can start from a few thousand pounds per year for low‑risk operators, but higher‑risk or long‑distance haulage fleets may pay more. The only accurate way to get a price is to compare quotes from specialist HGV brokers.

What factors affect the price of HGV insurance?

Insurers may consider:

- Vehicle weight and value

- Driver age and experience

- Claims history

- Type of goods carried

- Mileage and routes

- Security measures

- Operating base location

Do I need specialist insurance for an articulated lorry?

Yes. Articulated lorries require specialist HGV insurance due to their size, value, and operational risks. Many insurers offer tailored cover for 44‑tonne artics.

Does HGV insurance cover goods in transit?

Not automatically. Goods in Transit (GIT) cover is usually added as an optional extra to protect the cargo you’re transporting.

Can I get HGV insurance for international haulage?

Yes. Many insurers offer extended cover for EU and international routes, but you must declare your destinations and frequency of travel.

Does HGV insurance cover trailers?

Some policies include trailer cover, but others require it as an add‑on. You must list any owned, hired, or interchangeable trailers.

Can I insure multiple HGVs under one policy?

Yes. If you operate more than one vehicle, a fleet or multi‑vehicle HGV policy may be cheaper and easier to manage.

What types of HGV insurance cover are available?

The main levels are:

-

Third Party Only

-

Third Party, Fire & Theft

-

Comprehensive Optional extras include breakdown, legal expenses, and windscreen cover.

Does HGV insurance cover drivers under 25?

Some insurers will cover younger drivers, but premiums are usually higher. Specialist brokers can help find suitable policies.

What is the difference between haulage and carriage of own goods?

Haulage involves transporting goods for clients, while carriage of own goods covers businesses moving their own equipment or stock. Insurers rate these risks differently.

Can I get temporary HGV insurance?

Yes. Temporary HGV insurance is available for short‑term needs such as vehicle collection, seasonal work, or driver changes.

Does HGV insurance include breakdown cover?

Not by default. You can add roadside assistance, recovery, and onward travel as optional extras.

What documents do I need for an HGV insurance quote?

You’ll typically need:

-

Vehicle details

-

Driver information

-

Claims history

-

Operating base

-

Type of goods carried

-

Estimated mileage

Does HGV insurance cover public liability?

Public liability is not included automatically. Many operators add it to protect against claims for injury or property damage caused during loading, unloading, or site access.

Can I get HGV insurance with previous claims or convictions?

Yes. Specialist brokers can arrange cover for higher‑risk drivers or operators, though premiums may be higher.

Does HGV insurance cover damage during loading and unloading?

Some policies include this, but others require an add‑on. It’s important to check your policy wording.

Can I pay for HGV insurance monthly?

Yes. Most insurers offer monthly payment plans through finance agreements.

Does HGV insurance cover personal use of the vehicle?

HGVs used privately must be declared, and not all insurers offer this. Most policies are strictly for commercial use.

How can I reduce the cost of HGV insurance?

You can lower premiums by:

-

Improving driver training

-

Installing telematics

-

Increasing security

-

Reducing claims

-

Using secure overnight parking

-

Maintaining a clean operator compliance record

Helpful Links

RHA – Road Haulage Association

Gets quotes within minutes of completing our simple form

Last Updated | 26th January 2026

Page updated and reviewed by Sarah Hampton – Insurance specialist