Compare Landlord Insurance

Landlord Insurance Quotes

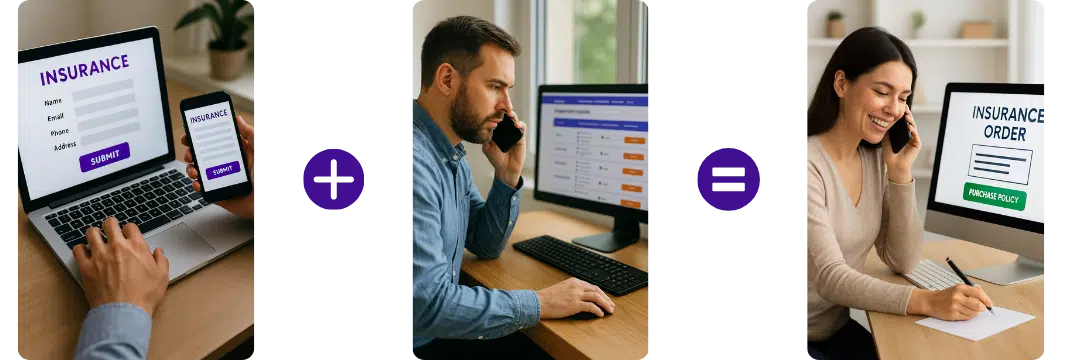

Quick & Easy Process – Complete a simple form or call directly for a quote.

Trusted Partners – Insurance for commercial and residential properties.

Expert Support – No-obligation quotes tailored to your needs.

Compare landlord insurance quotes with some of the UK's top providers, including:

How does it work?

Complete the Simple Form

Provide details about your property(s), policy details, and required cover.

Compare Prices

Compare from multiple UK providers to find the best value and features.

Purchase Cover

Select the policy that fits your business and purchase directly with the provider.

Gets quotes within minutes of completing our simple form

What Is Landlord Insurance

Landlord insurance is a specialised policy designed to protect property owners who rent out homes, flats, or commercial premises to tenants. Unlike standard home insurance, landlord insurance covers the additional risks that come with letting a property, including damage to the building, loss of rental income, and liability claims.

Most landlord insurance policies include building insurance to protect the structure against fire, flood, or vandalism, as well as optional contents cover for furnished properties. Many landlords who own offices, shops, or mixed-use buildings also take out commercial property insurance to ensure their investment is fully protected.

Together, these covers provide peace of mind, helping landlords safeguard their assets while continuing to generate reliable rental income.

Landlord Insurance FAQs

What is landlord insurance?

Landlord insurance is a specialised type of insurance designed to protect property owners who rent out their properties to tenants. Unlike standard home insurance, which typically covers owner-occupied homes, landlord insurance offers coverage tailored to rental properties’ unique risks and liabilities.

Key components of landlord insurance include:

- Buildings Insurance: This covers the structure of the rental property against risks such as fire, flood, storms, and vandalism. It ensures that the landlord can repair or rebuild the property if it is damaged.

- Contents Insurance: If the rental property is furnished, contents insurance protects the landlord’s furnishings, appliances, and other items provided for the tenants’ use. This cover is crucial for landlords who provide fully or partially furnished rentals.

- Liability Insurance: This component protects landlords against legal claims if a tenant or visitor is injured on the property. It covers legal fees and compensation costs, providing crucial financial protection in the event of a lawsuit.

- Loss of Rental Income: If the rental property becomes uninhabitable due to an insured event (like a fire or flood), this cover compensates the landlord for the loss of rental income during the repair period. It ensures that the landlord’s income stream is protected even when the property is not generating rent.

- Rent Guarantee Insurance: This optional cover protects landlords if tenants default on their rent payments. It ensures that the landlord continues to receive rental income even if tenants fail to pay.

Landlord insurance policies can be tailored to meet specific needs, with additional cover options such as accidental damage cover, legal expenses cover, and emergency assistance. It is essential for landlords to carefully review and compare policies to ensure they have comprehensive coverage that meets their requirements.

Why do landlords need insurance?

Landlords need insurance to protect their investment properties from risks and liabilities resulting in significant financial losses. Here are several reasons why landlord insurance is essential:

-

Protection Against Property Damage: Rental properties are exposed to risks such as fire, flood, storms, and vandalism. Landlord insurance provides building cover to repair or rebuild the property if it is damaged, ensuring the landlord is not left with substantial repair costs.

-

Coverage for Landlord’s Contents: For furnished rental properties, contents insurance protects the landlord’s furnishings, appliances, and other items provided for tenant use. It ensures that the landlord can replace or repair these items if they are damaged or stolen.

-

Liability Protection: Landlords can be held legally responsible if a tenant or visitor is injured on the property. Liability insurance covers legal fees and compensation costs, protecting the landlord from potentially expensive legal claims.

-

Loss of Rental Income: If the rental property becomes uninhabitable due to an insured event, loss of rental income cover compensates the landlord for the lost rent during the repair period. This ensures the landlord’s income stream is protected even when the property is not generating rent.

-

Rent Guarantee: Tenants may sometimes default on their rent payments. Rent guarantee insurance provides financial protection by covering unpaid rent, ensuring that the landlord receives income despite tenant non-payment.

-

Legal Expenses Cover: Landlord insurance can include cover for legal expenses incurred in disputes with tenants, such as evictions or claims for property damage. This cover helps manage the costs of legal proceedings, providing financial support during tenant disputes.

-

Peace of Mind: Having landlord insurance ensures that the rental property and the landlord’s income are protected. It allows landlords to confidently manage their properties, knowing they have financial protection against unexpected events.

Landowner insurance is a crucial tool for managing the risks of renting out properties. It provides comprehensive protection against property damage, liability claims, and income loss, ensuring landlords can safeguard their investments and maintain financial stability.

What does landlord insurance cover?

Landlord insurance typically includes several key components designed to protect rental properties and the landlord’s financial interests. Here is an overview of what landlord insurance generally covers:

-

Buildings Insurance: This covers the physical structure of the rental property, including walls, roofs, floors, and fixtures, against risks such as fire, flood, storms, vandalism, and accidental damage. It ensures that the landlord can repair or rebuild the property if it is damaged.

-

Contents Insurance: If the rental property is furnished, contents insurance covers the landlord’s furnishings, appliances, and other items provided for tenant use. This cover protects against loss or damage due to fire, theft, or vandalism.

-

Liability Insurance: This component protects the landlord against legal claims if a tenant or visitor is injured on the property. It covers legal fees and compensation costs, providing financial protection in the event of a lawsuit.

-

Loss of Rental Income: If the rental property becomes uninhabitable due to an insured event (like a fire or flood), loss of rental income cover compensates the landlord for the lost rent during the repair period. This ensures that the landlord’s income stream is protected even when the property is not generating rent.

-

Rent Guarantee Insurance: This optional cover protects landlords if tenants default on their rent payments. It ensures that the landlord continues to receive rental income even if tenants fail to pay.

-

Accidental Damage Cover: This covers accidental damage to the property or its contents caused by tenants. It provides additional protection beyond standard wear and tear, ensuring that the landlord can repair or replace damaged items.

-

Legal Expenses Cover: This covers legal costs incurred in disputes with tenants, such as evictions, property damage claims, or recovering unpaid rent. It provides financial support for legal proceedings, helping landlords manage tenant disputes.

-

Emergency Assistance: Some policies include cover for emergency repairs, such as fixing a burst pipe or a broken boiler. This ensures that essential repairs can be carried out quickly, minimising disruption for tenants and potential further damage to the property.

How much does landlord insurance cost?

The cost of landlord insurance can vary widely depending on several factors, including the location and type of property, the level of cover required, and the insurer. On average, landlords can expect to pay between £150 and £500 per year for a basic landlord insurance policy. However, premiums can be higher for properties with additional risk factors or more extensive coverage needs.

Is landlord insurance mandatory in the UK?

Landlord insurance is not legally required in the UK, but it is highly recommended. Mortgage lenders often require landlord insurance as a condition of the loan. Even if not mandated, having landlord insurance provides essential protection against risks and liabilities, safeguarding the landlord’s investment.

What is the difference between landlord insurance and home insurance?

Landlord insurance and home insurance differ in their coverage and purpose. Home insurance covers owner-occupied properties and includes buildings and contents insurance. Landlord insurance, on the other hand, is designed for rental properties and includes additional coverages such as liability, loss of rental income, and rent guarantee. Landlord insurance provides broader protection tailored to the risks associated with renting out property.

Can landlord insurance cover loss of rental income?

Yes, landlord insurance can cover loss of rental income. This cover compensates the landlord for lost rent if the property becomes uninhabitable due to an insured event, such as a fire or flood. It ensures that the landlord’s income stream is protected even when the property is not generating rent.

What is rent guarantee insurance?

Rent guarantee insurance is an optional cover that protects landlords if tenants default on their rent payments. It ensures that the landlord receives rental income even if tenants fail to pay. Rent guarantee insurance typically covers unpaid rent for a specified period, providing financial stability for landlords.

How do I choose the best landlord insurance policy?

To choose the best landlord insurance policy, compare quotes from multiple insurers, assess the coverage options, and consider the specific needs of your property and tenants. Look for comprehensive policies that include buildings and contents insurance, liability cover, loss of rental income, and rent guarantee. It’s also important to read customer reviews and check the insurer’s reputation for claims handling and customer service.

What are the benefits of landlord insurance?

Landlord insurance offers several benefits, including protection against property damage, liability claims, and loss of rental income. It ensures that landlords can repair or rebuild their properties if damaged, cover legal fees and compensation costs in the event of a lawsuit, and maintain their income even when the property is uninhabitable. Also, landlord insurance provides peace of mind, knowing the investment is safeguarded against various risks.

What does landlord liability insurance cover?

Landlord liability insurance covers legal fees and compensation costs if a tenant or visitor is injured on the property. It protects the landlord against claims for injuries or property damage caused by negligence, such as failing to maintain the property or provide a safe environment.

Can landlord insurance cover tenant damage?

Yes, landlord insurance can cover tenant damage. Accidental damage cover is an optional addition to landlord insurance policies that protect against damage caused by tenants. This cover goes beyond standard wear and tear and ensures the landlord can repair or replace damaged items.

How can I get cheap landlord insurance?

To get cheap landlord insurance, compare quotes from multiple insurers, consider bundling policies, and look for discounts. Maintaining a good claims history and implementing safety measures like installing smoke alarms and security systems can also help reduce premiums. It’s important to balance cost with the level of coverage to ensure adequate protection.

Do I need landlord insurance for a furnished rental property?

Yes, landlord insurance is recommended for furnished rental properties. In addition to buildings insurance, contents insurance is crucial to protect the landlord’s furnishings, appliances, and other items provided for tenant use. This cover ensures that the landlord can replace or repair these items if damaged or stolen.

What are the legal requirements for landlord insurance in the UK?

While landlord insurance is not legally required in the UK, mortgage lenders often require it as a loan condition. Even if not mandated, having landlord insurance is highly recommended to protect against various risks and liabilities. Legal requirements may vary, so checking with your lender and ensuring compliance with any specific obligations is important.

How does landlord insurance handle property repairs?

Landlord insurance covers the cost of property repairs resulting from insured events, such as fire, flood, or vandalism. The insurer will assess the damage and approve the repairs, often working with approved contractors. The landlord may need to pay an excess, and the insurer will cover the remaining repair costs.

What additional coverages can I add to my landlord insurance policy?

Additional coverages for landlord insurance policies include accidental damage cover, legal expenses cover, rent guarantee insurance, and emergency assistance. These optional covers protect against various risks, ensuring comprehensive coverage for the landlord’s investment.

What is buildings insurance for landlords?

Buildings insurance for landlords covers the physical structure of the rental property against risks such as fire, flood, storms, and vandalism. It ensures that the landlord can repair or rebuild the property if it is damaged, protecting the investment from significant financial loss.

Does landlord insurance cover emergency repairs?

Some landlord insurance policies include cover for emergency repairs, such as fixing a burst pipe or a broken boiler. This cover ensures that essential repairs can be carried out quickly, minimising disruption for tenants and preventing further damage to the property.

What factors affect the cost of landlord insurance?

Factors affecting the cost of landlord insurance include the location and type of property, the level of cover required, the landlord’s claims history, and the security measures in place. Additional coverages, such as rent guarantee or accidental damage, can also increase premiums. Comparing quotes from multiple insurers can help find the best deal.

Can I claim landlord insurance on tax?

Yes, landlords can typically claim the cost of landlord insurance as a tax-deductible expense. This reduces the taxable rental income, lowering the overall tax liability. It’s important to keep detailed records of insurance payments and consult a tax professional for specific advice.

What is contents insurance for landlords?

Contents insurance for landlords covers the landlord’s furnishings, appliances, and other items provided for tenant use in a furnished rental property. It protects against loss or damage due to fire, theft, or vandalism, ensuring that the landlord can replace or repair these items if necessary.

What should I look for in a landlord insurance policy?

When choosing a landlord insurance policy, look for comprehensive coverage that includes buildings and contents insurance, liability cover, loss of rental income, and rent guarantee. Consider optional coverages, such as accidental damage and legal expenses. Compare quotes from multiple insurers, read customer reviews, and check the insurer’s reputation for claims handling and customer service.

How often should I review my landlord insurance policy?

It is advisable to review your landlord insurance policy annually, at the time of renewal. Additionally, review the policy whenever there are significant changes to the property, such as renovations or changes in how the property is used. Regular reviews ensure that your coverage remains adequate and that you are not overpaying for your insurance.

Are there discounts available for landlord insurance?

Yes, there are often discounts available for landlord insurance. These can include multi-policy discounts, no-claims bonuses, and discounts for implementing safety measures such as installing smoke alarms, security systems, and maintaining a good claims history. Bundling landlord insurance with other policies, such as home or car insurance, can also lead to additional savings.

How do I make a claim on my landlord insurance?

To make a claim on your landlord insurance, follow these steps:

- Notify your insurer as soon as possible after an incident.

- Provide details of the incident, including the date, time, and description of the damage or loss.

- Submit any required documentation, such as photographs, police reports, or receipts.

- Work with the insurer’s claims adjuster to assess the damage and approve repairs or replacements.

- Keep detailed records of all communication and expenses related to the claim.

Can I get landlord insurance for multiple properties?

Yes, you can get landlord insurance for multiple properties. Many insurers offer portfolio insurance, which covers several rental properties under a single policy. This simplifies management and often provides cost savings through bulk discounts.

What is accidental damage cover in landlord insurance?

Accidental damage cover is an optional addition to landlord insurance policies that protects against damage caused by tenants. This cover goes beyond standard wear and tear, ensuring that the landlord can repair or replace damaged items due to accidental incidents.

Does landlord insurance cover legal expenses?

Yes, landlord insurance can include cover for legal expenses incurred in disputes with tenants, such as evictions, property damage claims, or recovering unpaid rent. This cover helps manage the costs of legal proceedings, providing financial support during tenant disputes.

Comprehensive guide to landlord insurance

Comprehensive Guide to Landlord Insurance

Landlord insurance is a crucial safeguard for property owners renting out their properties to tenants. This type of insurance is specifically designed to address the unique risks and liabilities associated with rental properties, offering more comprehensive protection than standard home insurance in this article, we’ll explore the intricacies of landlord insurance, including various types of coverage, why it’s essential, and how to compare landlord insurance quotes to find the best landlord insurance in the UK.

What is Landlord Insurance?

A landlord insurance policy protects rental property owners from financial losses due to damage, liability claims, and loss of rental income. Unlike standard home insurance, which covers owner-occupied homes, landlord insurance policies are tailored to the specific needs of rental properties. This includes coverage for buildings, contents, and various liabilities arising from renting out the property.

Types of Landlord Insurance Policies

Landlord Buildings Insurance: This is the most basic form of landlord insurance, covering the structure of the rental property against risks such as fire, flood, storms, and vandalism. Landlord buildings insurance ensures that the landlord can repair or rebuild the property if it is damaged.

Landlord Contents Insurance: If the rental property is furnished, contents insurance is necessary to protect the landlord’s furnishings, appliances, and other items provided for tenant use. This coverage ensures that the landlord can replace or repair these items if they are damaged or stolen.

Liability Insurance: Liability insurance covers legal fees and compensation costs if a tenant or visitor is injured on the property. This is a crucial component of a landlord insurance policy, protecting the landlord from potentially expensive legal claims.

Loss of Rental Income: If the rental property becomes uninhabitable due to an insured event, such as a fire or flood, loss of rental income cover compensates the landlord for the lost rent during the repair period. This ensures that the landlord’s income stream is protected even when the property is not generating rent.

Rent Guarantee Insurance: This optional cover protects landlords if tenants default on their rent payments. Rent guarantee insurance ensures that the landlord continues to receive rental income even if tenants fail to pay.

Accidental Damage Cover: Accidental damage cover protects against damage caused by tenants beyond standard wear and tear. This ensures that the landlord can repair or replace damaged items due to accidental incidents.

Legal Expenses Cover: This covers legal costs incurred in tenant disputes, such as evictions, property damage claims, or recovering unpaid rent. Legal expenses cover providing financial support for legal proceedings helping landlords manage tenant disputes.

Emergency Assistance: Some policies include cover for emergency repairs, such as fixing a burst pipe or a broken boiler. This ensures that essential repairs can be carried out quickly, minimising disruption for tenants and potential further damage to the property.

Why Do Landlords Need Insurance?

Landlords need insurance to protect their investment properties from various risks and liabilities that can result in significant financial losses. Here are several reasons why a landlord insurance policy is essential:

- Protection Against Property Damage: Rental properties are exposed to risks such as fire, flood, storms, and vandalism. Landlord insurance provides building cover to repair or rebuild the property if it is damaged, ensuring the landlord is not left with substantial repair costs.

- Coverage for Landlord’s Contents: For furnished rental properties, contents insurance protects the landlord’s furnishings, appliances, and other items provided for tenant use. It ensures that the landlord can replace or repair these items if they are damaged or stolen.

- Liability Protection: Landlords can be held legally responsible if a tenant or visitor is injured on the property. Liability insurance covers legal fees and compensation costs, protecting the landlord from potentially expensive legal claims.

- Loss of Rental Income: If the rental property becomes uninhabitable due to an insured event, loss of rental income cover compensates the landlord for the lost rent during the repair period. This ensures that the landlord’s income stream is protected even when the property is not generating rent.

- Rent Guarantee: Tenants may sometimes default on their rent payments. Rent guarantee insurance provides financial protection by covering unpaid rent, ensuring that the landlord continues to receive income despite tenant non-payment.

- Legal Expenses: Landlord insurance can include cover for legal expenses incurred in disputes with tenants, such as evictions or claims for property damage. This cover helps manage the costs of legal proceedings, providing financial support during tenant disputes.

- Peace of Mind: Having landlord insurance provides peace of mind that the rental property and the landlord’s income are protected. It allows landlords to manage their properties with confidence, knowing they have financial protection against unexpected events.

Does Landlord Insurance Cover…

…Accidental Damage? Yes, if accidental damage cover is included in the policy, it will cover damage caused by tenants beyond standard wear and tear. This cover ensures that the landlord can repair or replace damaged items due to accidental incidents.

…Loss of Rental Income? Yes, loss of rental income cover compensates the landlord for lost rent if the property becomes uninhabitable due to an insured event, such as a fire or flood. This ensures that the landlord’s income stream is protected even when the property is not generating rent.

…Legal Expenses? Yes, legal expenses can be covered by landlord insurance policies. It covers legal costs incurred in disputes with tenants, such as evictions, property damage claims, or recovering unpaid rent. This cover provides financial support for legal proceedings, helping landlords manage tenant disputes.

…Tenant Damage? Yes, if accidental damage cover is included in the policy, it will cover damage caused by tenants beyond standard wear and tear. This ensures that the landlord can repair or replace damaged items due to accidental incidents.

How to Compare Landlord Insurance Quotes

To find the best landlord insurance in the UK, it’s essential to compare landlord insurance quotes from multiple insurers. Here are some steps to help you compare:

-

Identify Your Needs: Determine the type of coverage you need, such as building insurance, contents insurance, liability cover, and any additional covers like rent guarantee or accidental damage.

-

Use Comparison Websites: Use online comparison websites to obtain quotes from different insurance providers. This allows you to compare prices and coverage options easily.

-

Consult Brokers: Work with insurance brokers who specialise in landlord insurance. They can provide access to exclusive deals, negotiate better rates, and tailor policies to meet your specific needs.

-

Evaluate Coverage: Ensure that the policies you compare offer the necessary coverage for your rental property. Look for comprehensive policies that cover a wide range of risks.

-

Check for Discounts: Ask about available discounts, such as multi-vehicle discounts, no-claims bonuses, and discounts for implementing security measures or driver training programs.

-

Read Reviews: Consider customer reviews and ratings to gauge the insurer’s reputation for customer service and claims handling.

Commercial Landlord Insurance

Commercial landlord insurance is specifically designed for landlords who rent out commercial properties, such as office buildings, retail spaces, and industrial units. This type of insurance provides comprehensive protection for all business properties, ensuring that accidents, theft, or other incidents do not disrupt operations. It includes coverage for buildings, contents, and public liability and often offers additional benefits like loss of rental income and legal expenses cover.

Home Insurance for Landlord

Home insurance for landlords, also known as landlord insurance home, is tailored to cover rental properties rather than owner-occupied homes. It includes all the essential coverages found in a standard home insurance policy but with additional protections suited to rental properties. This can include building insurance, contents insurance, liability cover, loss of rental income, and rent guarantee.

Finding the Best Landlord Insurance in the UK

Finding the best landlord insurance in the UK involves carefully comparing and evaluating different policies. Here are some tips to help you find the best policy:

-

Assess Your Needs: Determine the specific coverages you need based on your rental property and tenants.

-

Compare Quotes: Use comparison websites and consult brokers to obtain multiple quotes from different insurers.

-

Check Coverage: Ensure the policy includes all necessary coverages, such as buildings and contents insurance, liability cover, loss of rental income, and any additional covers like rent guarantee.

-

Read Reviews: Look for customer reviews and ratings to gauge the insurer’s reputation for claims handling and customer service.

-

Consider Price and Value: While cost is important, consider the coverage’s value and comprehensiveness. The cheapest policy may not always offer the best protection.

Summary

A landlord insurance policy is essential for property owners renting out their properties to tenants. It provides comprehensive protection against various risks and liabilities, safeguarding the landlord’s investment. Whether you need landlord buildings insurance, contents insurance, or additional covers like rent guarantee, it’s important to compare landlord insurance quotes to find the best policy for your needs. By understanding the different types of coverage and the benefits of landlord insurance, you can ensure your rental properties are protected, and your income is secure.

Helpful links

ABI – Association of British Insurers – The Association of British Insurers is the leading trade association for insurers and providers of long term savings. … need to contact their insurer for a Green Card which they will need to carry on them if they wish to drive their vehicle in the EU.

BIBA – British Insurance Brokers’ Association – The British Insurance Brokers’ Association (BIBA) is the UK ‘s leading general insurance organisation.

Gets quotes within minutes of completing our simple form

Last Updated | 7th October 2025

Page updated and reviewed by Sarah Hampton – Insurance specialist