Salon Insurance

Compare Salon Insurance Quotes

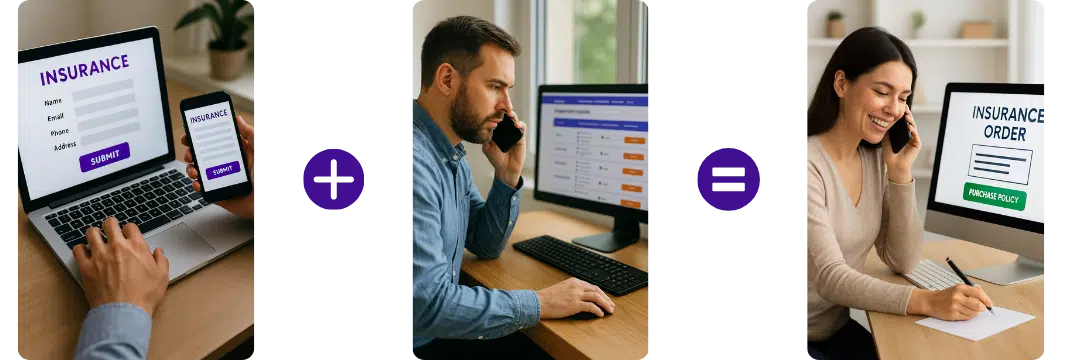

Quick & Easy Process – Complete a simple form or call directly for a quote.

Trusted Partners – Work with leading UK Providers.

Expert Support – No-obligation quotes tailored to your needs.

Compare salon insurance quotes with some of the UK's top providers, including:

How does it work?

Complete the Simple Form

Provide details about your business and policy requirements on our simple form.

Compare Prices

Compare from multiple UK providers to find the best value and features.

Purchase Cover

Select the policy that fits your business and purchase directly with the provider.

Gets quotes within minutes of completing our simple form

What is Salon Insurance?

Salon insurance is a specialised type of insurance coverage designed for businesses in the salon industry. It protects against various risks and liabilities specific to salon operations. Salon insurance typically includes coverage options to safeguard salon owners, employees, clients, and assets. It often includes public liability insurance to protect against claims for injuries or property damage, employer’s liability insurance for staff-related claims, and coverage for salon premises, equipment, and stock. Additional coverage options may include professional indemnity, product liability, and business interruption insurance. Salon insurance helps salon owners mitigate financial risks and ensures peace of mind during unexpected incidents or claims.

Salon Insurance FAQs

What is salon insurance?

Salon insurance in the UK is a specialised type of insurance coverage designed for businesses operating in the salon industry. It protects against various risks and liabilities specific to salon operations. Salon insurance typically combines several types of coverage to meet the unique needs of salon owners.

Here are some common elements typically included in salon insurance policies in the UK:

- Public Liability Insurance: This coverage protects salon owners against claims for bodily injury or property damage caused to third parties (customers, visitors, or suppliers) on the salon premises. It covers legal expenses and any awarded damages.

- Employer’s Liability Insurance: If the salon employs staff, employer’s liability insurance is a legal requirement in the UK. It provides coverage for claims made by employees who suffer work-related illnesses or injuries. It helps cover legal costs and compensation payments.

- Buildings and Contents Insurance: This coverage protects the salon premises, including the building structure, fixtures, equipment, and stock, against risks such as fire, theft, vandalism, or accidental damage. It helps cover the cost of repairs or replacement.

- Business Interruption Insurance: Business interruption insurance compensates salon owners for lost income and additional expenses if the salon is forced to close temporarily due to an insured event, such as fire or flood.

- Treatment Liability Insurance: For salons offering beauty or spa treatments, treatment liability insurance covers claims arising from injuries or damages resulting from treatments provided to customers. It protects against professional liability claims.

- Stock and Product Liability Insurance: This coverage protects against losses or damages to salon stock, including beauty products, haircare supplies, or equipment. It can also provide coverage for liability claims arising from faulty products.

- Money and Theft Insurance: Money and theft insurance covers cash on the salon premises and provides coverage for theft or burglary of salon property.

It is vital for salon owners to carefully review policy terms, limits, exclusions, and any specific requirements within the insurance policy. Working with an insurance provider or broker specialising in salon insurance can help salon owners customise their coverage to meet their needs and ensure comprehensive protection for their business.

Which businesses are covered under salon insurance?

Salon insurance typically covers a range of businesses operating within the salon industry. While the specific coverage options and terms can vary among insurance providers, salon insurance generally applies to the following types of companies:

- Hair Salons: Hair salons offer haircuts, styling, colouring, perming, and treatments.

- Beauty Salons: Beauty salons provide a wide range of beauty treatments, including facials, waxing, manicures, pedicures, makeup application, eyelash extensions, and more.

- Nail Salons: Nail salons specializing in nail care and services, including manicures, pedicures, gel nails, acrylic nails, and nail art.

- Barbershops: Barbershops primarily cater to men’s grooming needs, including haircuts, beard trims, shaves, and hairstyling.

- Tanning Salons: Tanning salons offer services such as sunbed tanning, spray tanning, or self-tanning treatments.

- Spa and Wellness Centers: Spa facilities provide relaxation and wellness treatments, including massages, body treatments, saunas, steam rooms, and holistic therapies.

- Aesthetic Clinics: Aesthetic clinics offer non-surgical cosmetic treatments like Botox, dermal fillers, laser hair removal, skin rejuvenation, and other medical aesthetic procedures.

It’s important to note that while salon insurance generally covers these types of businesses, the specific coverage and policy terms can differ among insurance providers. Salon owners should carefully review policy details to ensure their particular services and treatments are included in the scope. Consulting with an insurance provider or broker specializing in salon insurance can help salon owners determine the most suitable coverage options for their business needs.

What type of insurance do hairdressers need?

Hairdressers typically require a combination of insurance coverage to adequately protect their business, clients, and assets. Here are the key types of insurance that hairdressers often consider:

- Public Liability Insurance: Public liability insurance is crucial for hairdressers as it covers bodily injury or property damage claims by clients or third parties. It protects hairdressers if a client slips, trips, or sustains an injury in the salon or if any damage occurs to a client’s property.

- Professional Indemnity Insurance: Professional indemnity insurance is recommended for hairdressers as it covers claims arising from professional negligence or errors in the provision of services. It protects hairdressers if a client suffers harm or loss due to mistakes made during hair treatments or styling.

- Employer’s Liability Insurance: If hairdressers employ staff, employer’s liability insurance is legally required in the UK. It covers claims made by employees for work-related injuries or illnesses. It helps cover legal costs and compensation if an employee falls ill or gets injured while working in the salon.

- Buildings and Contents Insurance: Hairdressers should consider buildings and contents insurance to protect their physical salon premises, equipment, and stock. This coverage guard against risks such as fire, theft, flood, or damage to salon property and ensures the cost of repairs or replacements are covered.

- Business Interruption Insurance: Business interruption insurance covers financial loss from unexpected disruptions to the hairdressing business, such as fire or flood damage. It compensates for lost income and helps cover ongoing expenses during interruption.

- Product Liability Insurance: Hairdressers may also need product liability insurance to protect against claims arising from injuries or damages caused by hair products used or sold in the salon. This coverage is critical if the salon sells its brand of haircare products.

Hairdressers need to consult with insurance providers or brokers specializing in salon or hairdressing insurance to determine the specific coverage needs of their business. Policies and coverage options may vary, so carefully reviewing policy terms and conditions is essential to ensure comprehensive protection for the hairdressing business.

Useful links - Insurance Associations

ABI – Association of British Insurers – The Association of British Insurers is the leading trade association for insurers and providers of long term savings. … need to contact their insurer for a Green Card which they will need to carry on them if they wish to drive their vehicle in the EU.

BIBA – British Insurance Brokers’ Association – The British Insurance Brokers’ Association (BIBA) is the UK ‘s leading general insurance organisation.

Related products

Employers Liability Insurance

Professional Indemnity Insurance

Public Liability

Insurance

Gets quotes within minutes of completing our simple form

Last Updated | 7th October 2025

Page updated and reviewed by Sarah Hampton – Insurance specialist