Compare Professional Indemnity Insurance

Professional Indemnity Insurance

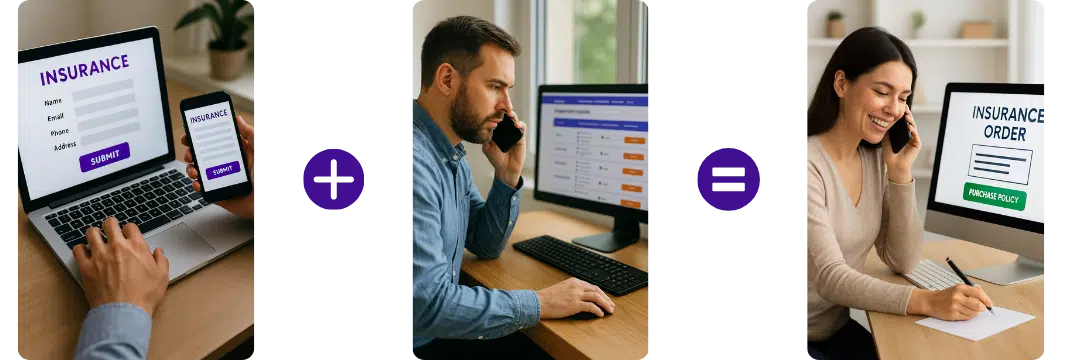

Quick & Easy Process – Complete a simple form or call directly for a quote.

Trusted Partners – Work with leading UK Providers.

Expert Support – No-obligation quotes tailored to your needs.

Compare professional indemnity insurance quotes with some of the UK's top providers, including:

How does it work?

Complete the Simple Form

Provide details about your business and policy requirements.

Compare Prices

Compare from multiple UK providers to find the best value and features.

Purchase Cover

Select the policy that fits your business and purchase directly with the provider.

Gets quotes within minutes of completing our simple form

What Is Professional Indemnity Insurance?

For many business owners who provide services to clients, professional indemnity is needed to help protect the business from different claims made by dissatisfied clients. When your customers report errors or mistakes in the service rendered, the next step is that they file for a compensation. On many occasions, you might not be able to afford a lawsuit or court case so it’s best you compare professional indemnity premiums to help assuage the situation.

You might ask “but I didn’t even do any wrong, why should I be liable?” well, that is the beauty of justice. Sometimes, the innocent ones are the victims of circumstance. Even if you eventually win the case, the amount you must’ve spent on it is not worth it. To avoid this, compare professional indemnity insurance quotes now and get the best cover for your business.

Professional Indemnity FAQs

What Level of Professional Indemnity Insurance Cover Do I Need?Key points

When you compare professional indemnity insurance quotes, you need to indicate the level of cover you require. When you fill our survey here, you will have an idea of which quote you need. Typically, it ranges between £50,000 and £5,000,000.

How Does Professional Indemnity Cover Work?

To help you understand, here is an example. If a builder screws up a building project and the mistake is only discovered after the completion of the project, this will have consequences. The owner of the building will want a refund or compensation for the cost of rebuilding the project. The client might even press for indirect costs such as time. Whatever the case, the builder is in a dicey situation.

This is where professional indemnity insurance comes to play. With this cover, your legal fees and compensation for any loss our negligence or ignorance costs your client is accounted for. If you get cheap professional indemnity insurance cover online, you do not have to spend a fortune on these.

Are you an accountant? Financial Adviser? Business Consultant? Then you should get these professional indemnity insurance quotes on our website. The same applies to engineers, IT consultants, architects, builders, etc. Compare professional indemnity insurance cover now and protect your business.

Other mistakes like an infraction of duty, giving wrong/bad/illegal/unethical advice, negligence, are all covered under professional indemnity insurance policies. If you also happen to infringe on your client’s copyright-protected content intentionally or unintentionally, this cover safeguards your security.

Mistakes like a breach of confidentiality, loss of documents, compromise of data, defamation, libel, slander, etc. are quite rampant, and there is provision when you compare professional indemnity insurance quotes.

Why Do I Need Professional Indemnity Insurance?

Humans are naturally prone to error. The probability of satisfying every client you have is infinitesimal. Humans are also very hard to please and insatiable, you can never get it right with some clients. For these reasons, we advocate that you compare professional indemnity insurance and get the right deal for your business. Also, some people just patronize you so they can sue you and get easy money from your business. With cheap professional indemnity cover, you have no cause for alarm.

Is Professional Indemnity Insurance Compulsory?

Before you can be awarded contracts, many awarding agencies require your proof of professional indemnity insurance. If you fail to provide this, the client might go to a more deserving candidate. You should note that you can compare cheap professional indemnity insurance premiums online, so you should not allow this cost you that project.

To be clear, it is not a legal requirement to have this cover. Although, it is highly recommended by legal professionals. You save the huge cost of legal suits when you get this insurance cover.

It doesn’t matter if your firm is small or medium. You should keep in mind that it is a wiser decision to go for cheap professional indemnity insurance cover than to struggle with lawsuit fees and protection.

What is The Limit of Professional Indemnity Available?

This is entirely dependent on your firm. If you land a particular contract and you need professional indemnity insurance cover for just this contract, you will definitely have a specified minimum amount. When you compare these covers, we advise you to check carefully that it meets your requirement.

Useful links - Insurance Associations

ABI – Association of British Insurers – The Association of British Insurers is the leading trade association for insurers and providers of long term savings. … need to contact their insurer for a Green Card which they will need to carry on them if they wish to drive their vehicle in the EU.

BIBA – British Insurance Brokers’ Association – The British Insurance Brokers’ Association (BIBA) is the UK ‘s leading general insurance organisation.

Related products

Employers Liability Insurance

Tradesmen Liability Insurance

Public Liability

Insurance

Gets quotes within minutes of completing our simple form

Last Updated | 7th October 2025

Page reviewed by Sarah Hampton – Insurance specialist