Compare Courier Insurance

Courier Insurance Quotes

Quick & Easy Process – Complete our simple form.

Trusted Partners – Work with leading courier insurance providers.

Expert Support – No-obligation quotes tailored to your needs.

Compare courier insurance quotes with some of the top courier insurers, including:

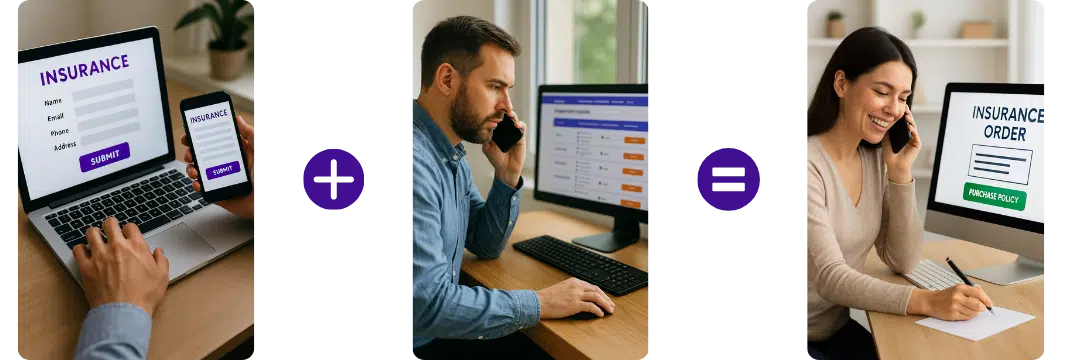

How does it work?

Complete the Simple Form

Provide details about your business, vehicle details, driving history and policy requirements.

Compare Prices

Compare from multiple courier insurance providers to find the best value and features.

Purchase Cover

Select the policy that fits your business and purchase directly with the provider.

Gets quotes within minutes of completing our simple form

Compare a number of different specialist brokers who deal with courier insurance.

Courier insurance is a hire-and-reward insurance policy, which is a legal requirement if you are delivering food, parcels or any other products for the purpose of making money from it as a business. Find the most competitive policy to suit your needs today by filling out the form above and letting us help you get covered.

Compare Courier Insurance

Courier insurance is a specific type of commercial vehicle insurance tailored for those using their vehicle to deliver goods on behalf of customers or clients. It covers not only the vehicle but also the goods being transported, offering protection against potential financial losses from accidents, theft, damage, or public liability issues. In the UK, if you’re operating as a courier, standard car or van insurance usually won’t suffice, as these don’t cover goods for transport professionally.

Courier insurance can vary depending on the type of vehicle, the driver’s history, the goods being carried, and the geographical area of operation. The cover is available for various vehicles, including cars, vans, bikes, and motorcycles. While it can be more expensive than standard vehicle insurance due to the higher perceived risks, careful shopping around, improving vehicle security, and maintaining a clean driving record can help reduce the costs.

Different Types of Courier Insurance Products

What are the levels of Courier Insurance?

Comprehensive: This type of insurance covers you for third party, fire, and theft. It goes further to cover your vehicle if it gets lost or damaged in an accident. This courier insurance is loved by many and offers the most perks. You can get to compare cheap haulage insurance here to have an idea of the range of premiums.

Third-Party, Fire, and Theft: This insurance cover will pay money to a third party in the event of a loss or damage in which you are legally liable. This type of insurance also covers the cost if your courier vehicle is stolen or damaged by attempted theft or fire. The price is also quite exorbitant but gets affordable when you get cheap courier insurance quotes from us.

Third-Party Only: This form of insurance will only pay money to a third party who suffers loss or damage which you are responsible for. Here you get the cheapest premium and this is the most basic form of cover for your courier business.

Couriers Hire and Reward Insurance Policy Can Include:

Courier Insurance FAQs

What is courier insurance and why do couriers need it?

Courier insurance is a specialist hire‑and‑reward policy designed for drivers who deliver parcels, food, documents, or goods. It covers the increased risks of multi‑drop driving, tight deadlines, and carrying items for payment – something standard car or van insurance does not allow.

How much does courier insurance cost?

Prices vary depending on vehicle type, mileage, delivery type (parcels, food, same‑day), location, and claims history. Car‑based couriers may pay from around £1,200 – £2,000 per year, while van couriers or high‑mileage drivers may pay more. Goods in transit and liability cover add to the cost.

What’s the difference between courier insurance and standard car or van insurance?

Standard insurance only covers social or commuting use. Courier insurance includes hire & reward, allowing you to deliver goods for payment. Without it, your insurer can refuse claims.

Does courier insurance cover food delivery for apps like Uber Eats, Deliveroo, or Just Eat?

Yes, but you must declare food delivery. Many insurers offer specific policies for hot food, grocery, and takeaway delivery.

Does courier insurance cover parcels and packages?

Not automatically. You need goods in transit (GIT) cover to protect parcels against theft, loss, or damage while being delivered.

What types of vehicles can be covered under courier insurance?

Courier insurance is available for cars, vans, motorbikes, scooters, mopeds, and electric bikes used for paid deliveries.

Does courier insurance cover same‑day or long‑distance delivery work?

Yes, but insurers may charge more for long‑distance, same‑day, or time‑critical delivery work due to increased risk.

What factors affect the price of courier insurance?

Insurers consider:

-

Vehicle type and value

-

Delivery type (food, parcels, documents)

-

Mileage and working hours

-

Claims and driving history

-

Location and risk level

-

Goods carried

Do I need goods in transit insurance as a courier?

Yes, if you carry parcels, packages, or goods. GIT protects items against theft, loss, or damage while in your vehicle or during delivery.

Does courier insurance cover theft from my vehicle?

Goods in transit may cover theft, but insurers often require secure locks, alarms, or overnight storage. Leaving a vehicle unattended may void cover.

Can I get courier insurance if I’m self‑employed?

Yes. Most courier drivers are self‑employed, and insurers offer flexible policies for independent couriers, gig‑economy drivers, and subcontractors.

Does courier insurance cover me for multiple delivery platforms?

Yes. You can be covered for multiple apps (e.g., Amazon Flex, Evri, DPD, Deliveroo, Uber Eats) under one policy, as long as you declare them.

Does courier insurance include public liability cover?

Not automatically. Public liability protects you if you injure someone or damage property while delivering. Many couriers add it for extra protection.

Can I get courier insurance for a leased or financed vehicle?

Yes. Insurers can cover leased, financed, or rented vehicles used for courier work, including short‑term hire vans.

Does courier insurance cover high‑value items?

Some goods in transit policies include high‑value items, but limits vary. You may need specialist cover for electronics, jewellery, or medical equipment.

Can young drivers get courier insurance?

Yes, but premiums are higher. Some insurers require drivers under 25 to have additional experience or training.

Does courier insurance cover breakdown recovery?

Not automatically. You can add breakdown cover, including roadside assistance and onward travel, which is essential for time‑critical delivery work.

What documents do I need for a courier insurance quote?

You’ll typically need:

-

Driving licence

-

Claims history

-

Vehicle details

-

Delivery type (food, parcels, etc.)

-

Mileage estimates

-

Platform or employer details

Can I pay for courier insurance monthly?

Yes. Most insurers offer monthly instalments through finance agreements.

How can I reduce the cost of courier insurance?

You can lower premiums by choosing a smaller vehicle, limiting mileage, improving security, maintaining a clean driving record, and comparing quotes from specialist courier insurers.

Helpful Links

ABI – Association of British Insurers – The Association of British Insurers is the leading trade association for insurers and providers of long term savings. … need to contact their insurer for a Green Card which they will need to carry on them if they wish to drive their vehicle in the EU.

BIBA – British Insurance Brokers’ Association – The British Insurance Brokers’ Association (BIBA) is the UK ‘s leading general insurance organisation.

Gets quotes within minutes of completing our simple form

Last Updated | 26th January 2026

Page update and reviewed by Sarah Hampton – Insurance specialist