Hotel Business Insurance

Compare Hotel Insurance Quotes

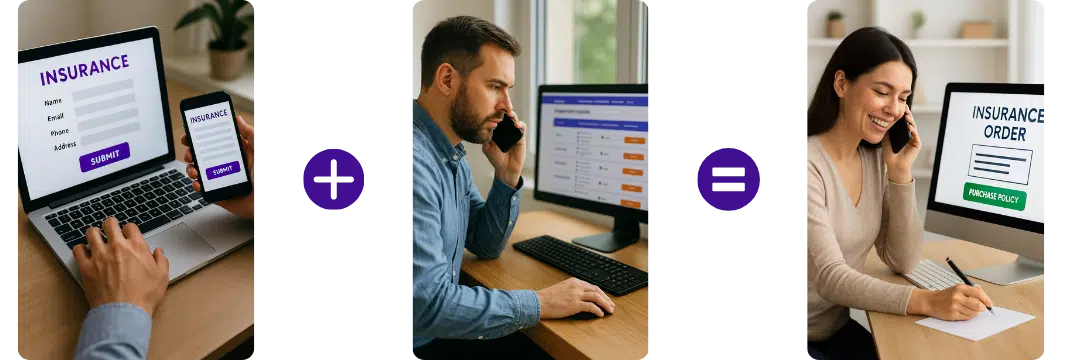

Quick & Easy Process – Complete a simple form or call the broker direct.

Trusted Partners – Work with leading UK Providers.

Expert Support – No-obligation quotes tailored to your needs.

Compare hotel insurance quotes with some of the UK's top providers, including:

How does it work?

Complete the Simple Form

Provide details about your hotel business on our simple form.

Compare Prices

Compare quotes with providers to find the best value and features.

Purchase Cover

Select the policy that fits your business and purchase directly with the provider.

Gets quotes within minutes of completing our simple form

Compare cheap hotel & guesthouse insurance

Hotels are the hallmark of comfort, elegance, and style. Owning one is seen as a very viable investment as the returns can be huge if done wisely. One thing to note though is how to ensure the security of the investment. Hotel and guesthouse insurance is important because it guards against losses and any form of damages which might be incurred.

Before you compare hotel insurance, there are few basic factors to be considered. These factors would determine how much you expend on the insurance and the level of cover available to you. For example, some of the important covers which are provided when you purchase standard hotel insurance or guest house insurance are explained below.

Hotel Insurance FAQs

What is hotel insurance?

UK hotel insurance is a business insurance tailored specifically to meet the needs of hotel owners and operators. It offers a range of coverages to protect against risks associated with operating a hotel or similar establishment in the United Kingdom.

Here are some of the common components of UK hotel insurance:

- Buildings and Contents Insurance: This covers damage to the hotel building and its contents due to fire, flood, storm, or theft.

- Public Liability Insurance: Protects the hotel if a guest or other third party suffers injury or property damage on your premises, and your business is held legally liable.

- Employers’ Liability Insurance: This is a legal requirement in the UK if you have employees. It covers compensation costs if an employee becomes ill or injured due to their work for you.

- Business Interruption Insurance: If an insured event like a fire or flood forces you to close or disrupt your business, this can compensate for your lost income during the restoration period.

- Guests’ Effects Cover: Provides coverage if a guest’s belongings are stolen or damaged while on your premises.

- Product Liability Insurance: If you offer food and beverages, this can protect you if a guest becomes ill due to something they ate or drank at your hotel.

- Legal Expenses Cover: Provides coverage for legal fees and expenses arising from legal disputes related to your hotel operations.

- Cyber Liability Insurance: Given the rise in cyber threats, this covers data breaches and cyber-attacks.

Each hotel’s needs are unique, so the policy can usually be tailored to meet specific needs, whether a small boutique hotel, a large city-centre establishment, or a chain of hotels. The cost of hotel insurance in the UK varies based on factors like the size of the hotel, its location, the number of employees, and the specific services provided.

What does UK hotel insurance cover in its policy?

UK hotel insurance is designed to cover a variety of risks that hotels typically face. While the exact coverage can vary depending on the insurer and the specific policy, common elements often include:

- Buildings and Contents Cover: This protects the physical building and its contents, such as furniture, fixtures, and equipment, against damage or loss due to incidents like fire, flood, storm, theft, or vandalism.

- Public and Products Liability Insurance: This provides protection in case a guest or third party suffers injury or property damage on your premises or as a result of the products you provide, such as food and beverages.

- Employers’ Liability Insurance: Required by law in the UK if you have employees, this covers compensation costs and legal fees if an employee gets injured or ill as a result of their work.

- Business Interruption Insurance: If your hotel needs to close temporarily or operate at reduced capacity due to a covered incident (like a fire or flood), this can compensate for your lost income during the disruption.

- Guests’ Effects Cover: Provides protection in case a guest’s belongings are damaged or stolen while on your premises.

- Legal Expenses Cover: This covers legal costs that may arise from disputes related to employment, contracts, property, and other aspects of your hotel operations.

- Cyber Liability Insurance: Offers protection against losses stemming from cyber threats like data breaches or cyber-attacks, which is important given the amount of personal data hotels often handle.

- Money Cover: Protects cash kept on the premises against theft.

Different types of hotels in the UK?

Hotels in the UK come in various styles and types to cater to diverse needs and preferences. Here are some common types of hotels you’ll find across the UK:

- Country House Hotels: These are often historic homes or manors in the countryside, offering a quiet, serene environment. They usually have a limited number of rooms and provides a high level of service.

- Budget Hotels: These offer basic, no-frills accommodation at an affordable price. Brands like Premier Inn and Travelodge are examples of budget hotels in the UK.

- Boutique Hotels: These are small, stylish hotels that prioritize unique design, culture, and personalised service.

- Luxury Hotels: These offer high-end accommodations with top-tier service, amenities, and facilities. Examples include the Ritz London, The Savoy, and Claridge’s.

- Bed and Breakfasts (B&Bs): These are small establishments, often located in residential areas, offering a cosy, home-like atmosphere. They typically provide a room and breakfast.

- Inns: Traditionally, these are establishments where travellers can rest, eat and drink. In the UK, many inns are found in the countryside and offer rooms above a pub.

- Serviced Apartments: These fully furnished apartments provide hotel-like services such as housekeeping, a reception desk, and sometimes breakfast.

- Resort Hotels: Though less common in the UK than in some countries, these are typically located in popular holiday destinations and offer recreational facilities and activities.

- Business Hotels: These cater to business travellers, providing amenities like meeting rooms, high-speed internet, and work desks in the rooms.

- Hostels: These offers budget-oriented, shared accommodation, typically in dormitory-style rooms, making them popular among backpackers and solo travellers.

- Guest Houses: Similar to B&Bs, these are typically small, owner-occupied establishments offering a limited number of rooms and a more personalised service.

- Chain Hotels: These are part of larger hotel chains and offer a consistent level of service and amenities across all their locations. Examples include Hilton, Marriott, and Holiday Inn.

- Eco-Hotels or Green Hotels: These are committed to environmental sustainability, using renewable energy, eco-friendly products, and implementing waste reduction practices.

- Heritage or Historic Hotels: These are often located in buildings of historical or architectural significance, offering guests a unique glimpse into the past.

What types of building does hotel insurance cover?

Hotel insurance covers a wide variety of buildings associated with the hospitality industry. Here are some types of buildings typically covered under hotel insurance:

- Main Hotel Buildings: This is the primary building or buildings where guest rooms or suites are located. This can include everything from small boutique hotels to large, multi-story hotel complexes.

- Adjacent Buildings: Many hotels have additional buildings on the same property. These can include things like separate wings or sections of the hotel, annexe buildings with additional rooms, conference centres, event spaces, or other outbuildings.

- Recreational Facilities: If the hotel property includes facilities like a fitness centre, a spa, a pool, a golf course, tennis courts, or similar recreational areas, these structures are usually covered by hotel insurance.

- Restaurants and Bars: Many hotels have one or more restaurants, bars, or cafes on the premises. The buildings that house these food and drink establishments would typically be covered.

- Parking Structures: Hotels often have parking garages or carports for guest use. These structures can also be covered under a hotel insurance policy.

- Other Structures: This can include any other structures located on the hotel property, like maintenance buildings, storage sheds, gatehouses, or staff accommodation buildings.

It’s important to note that while hotel insurance can cover a wide range of building types, the specific coverage will depend on the terms and conditions within the policy.

How do I find the best hotel insurance quote?

Finding the best hotel insurance quote in the UK, or any other kind of business insurance quote, involves a similar process to finding personal insurance, although there are some differences due to the complexity of these types of policies. Here are the steps you should follow:

- Understand Your Needs: The first step in getting a hotel insurance quote is to fully understand the specific risks associated with your business and decide what type of coverage you need. Hotel insurance can include a variety of coverages, such as buildings and contents insurance, public and product liability, employers’ liability, business interruption, and legal expenses cover.

- Use Comparison Sites: Some comparison websites in the UK provide business insurance quotes, although these can sometimes be a bit more complex than personal insurance quotes. Some examples include GoCompare, Compare the Market, and Confused.com. However, these may not always be able to provide accurate quotes for complex businesses like hotels, and not all insurance providers are represented on these sites.

- Contact Insurance Brokers: Insurance brokers can be very helpful in finding hotel insurance, as they can access policies from a range of insurers, including those not available to the general public. They can also provide advice on the type and level of insurance you need. The British Insurance Brokers’ Association (BIBA) can help you find a broker if you need one.

- Directly Approach Insurers: Some insurers specialise in business or hotel insurance and may be able to provide you with a bespoke policy that suits your needs. Direct Line, AXA, and NFU Mutual are just a few examples of insurers who provide business insurance in the UK.

- Review Company Reputation: As with personal insurance, you should always review the reputation of the insurer. Check their customer service ratings and see how they handle claims.

- Understand the Quote: When you get a quote, make sure you fully understand what is included. Check the policy’s excess (the amount you have to pay towards a claim), any exclusions, and whether the policy includes cover for all the risks you’ve identified.

- Negotiate: Don’t be afraid to negotiate with insurers to try to get the best deal. They may be willing to offer discounts to win your business, especially if you’re bringing multiple types of insurance to them.

- Regularly Review: Business risks can change over time, so it’s important to review your policy regularly to make sure it still meets your needs.

Useful links - Insurance Associations

ABI – Association of British Insurers – The Association of British Insurers is the leading trade association for insurers and providers of long term savings. … need to contact their insurer for a Green Card which they will need to carry on them if they wish to drive their vehicle in the EU.

BIBA – British Insurance Brokers’ Association – The British Insurance Brokers’ Association (BIBA) is the UK ‘s leading general insurance organisation.

Related products

Employers Liability Insurance

Professional Indemnity Insurance

Public Liability

Insurance

Gets quotes within minutes of completing our simple form

Last Updated | 7th October 2025

Page updated and reviewed by Sarah Hampton – Insurance specialist