Compare Hire and Reward Insurance

Hire and Reward Insurance Quotes

Quick & Easy Process – Complete our simple form.

Trusted Partners – Covering delivery vans and courier cars.

Expert Support – No-obligation quotes tailored to your needs.

Compare hire and reward insurance quotes with some of the UK's top providers, including:

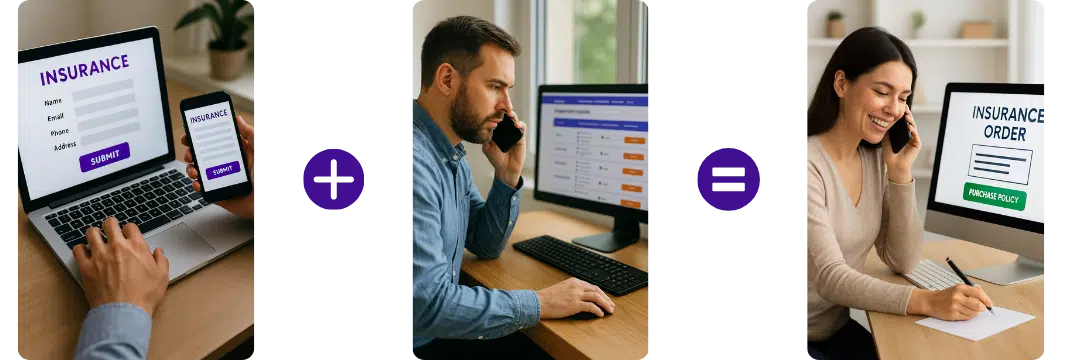

How does it work?

Complete the Simple Form

Provide details about the types of deliveries, vehicle details, and driving history.

Compare Prices

Compare from multiple UK providers to find the best value and features.

Purchase Cover

Select the policy that fits your business and purchase directly with the provider.

Gets quotes within minutes of completing our simple form

Compare Specialist Brokers for Hire and Reward Insurance

Hire and reward insurance is a legal requirement for businesses delivering goods, such as food, parcels, or other products, in exchange for payment. Compare competitive policies to find the best option for your needs by filling out the form above and letting us help you secure the right cover.

What is Hire and Reward Insurance?

Hire and reward insurance is for anyone using their vehicle to transport goods or people for a fee. It’s the cover you need if you’re delivering packages, meals, or any other items for payment. This isn’t regular car insurance; it’s a policy specifically designed to protect against the unique risks associated with driving your vehicle for work.

This insurance covers both you and your vehicle while working. Whether you’re using a van, car, or motorbike for deliveries, hire and reward insurance ensures you’re legally covered, protecting you from unexpected expenses if something goes wrong on the road.

You are also required by law to have business insurance if you are delivering goods in a vehicle for a job. If you don’t have this type of insurance and are stopped by the police, you risk having your vehicle seized, being fined, and receiving penalty points on your licence.

How much does Hire and Reward Insurance cost?

The cost of hire and reward insurance depends on several factors, including the type of vehicle you drive, your driving experience, and the kind of work you do. For example, if you’re a brand-new driver, it may be difficult to find affordable cover – or if you can, it will likely be very expensive. If you’re using pay-as-you-go delivery insurance,

Hire and reward insurance can cost anywhere from 80p to £3.29 an hour on average. Monthly policies typically range from £110 to £150, and annual policies could be anywhere between £1,100 and £1,500. However, if you’re a new driver, have no claims bonus, have made claims in the past five years, or have motoring convictions like penalty points, these will all influence the final price. These factors are important to keep in mind when looking for a policy.

Why is Hire and Reward Insurance expensive?

Hire and reward insurance can be expensive due to several factors that increase the risks associated with using a vehicle for commercial purposes. Here’s why:

1 - Higher Risk Involved

Unlike personal car insurance, hire and reward insurance covers the risks associated with transporting goods or passengers for payment. This type of driving is considered riskier because you’re transporting valuable items, which increases the chance of accidents, damage, or theft. Insurers charge more to cover these additional risks.

2 - Vehicle Type Used

The type of vehicle you use affects the cost. Larger vehicles, such as vans or high-performance cars, typically come with higher premiums. These vehicles are more expensive to repair and replace, which increases the insurance cost. Additionally, if you’re using a vehicle for multiple deliveries, it’s likely to accrue more miles, which raises the likelihood of damage or accidents, which increases the risk.

3 - Drivers Experience

New or young drivers are generally seen as higher risk due to their lack of experience on the road. As a result, premiums are typically higher for drivers who are under 25 or those who have recently passed their test. A lack of experience can increase the likelihood of accidents, making insurers charge more.

4 - Claim History and Penalty Points

If you’ve made claims in the past or have penalty points on your licence, your premium will likely be higher. Insurers consider these factors as signs of higher risk, meaning they’ll charge more to cover the potential costs of any future incidents.

5 - Delivery Type

The nature of the goods being transported also plays a role in determining if you are able to be insured or not. Delivering high-value items or hazardous goods increases the risk of damage or loss, which raises the cost of insurance. For instance, food delivery is less risky than delivering electronics, and transporting perishable items adds another layer of complexity.

6 - Location

If you’re driving in a busy area with heavy traffic, ie city centre deliveries, the chances of accidents increase. Similarly, areas with higher crime rates can make insurance more expensive due to the increased risk of theft or damage to the vehicle and goods.

7 - Higher Mileage

As a hire and reward delivery driver, you’re likely to be driving more miles than a standard driver. The more you drive, the higher the risk of being involved in an accident, which contributes to higher insurance premiums.

In short, hire and reward insurance is expensive because it covers a wider range of risk factors which the insurers needs to take into account, including valuable goods, longer driving hours, and less experienced drivers. The nature of the work itself – combined with the potential for accidents or claims – means insurers need to charge more to cover these added risks.

What are the different types of Hire and Reward Insurance available?

There are various hire and reward insurance policies to suit different business needs, from pay-as-you-go to hire and reward courier insurance. Pay-as-you-go insurance is ideal for part-time or occasional drivers, such as those working with platforms like Uber Eats, Just Eat, or Amazon Flex. It offers flexibility by allowing you to pay only when you’re driving for work.

For full-time drivers, hire and reward courier insurance provides comprehensive coverage for vehicles, goods, and liability. If you’re delivering food for Just Eat or parcels for Evri drivers, specific policies for food delivery insurance or parcel delivery insurance are essential, ensuring you’re legally covered while transporting goods.

Specialised policies like Amazon Flex insurance or Just Eat insurance offer tailored protection for specific delivery services, covering risks like accidental damage, theft, or loss of goods.

Your Hire and Reward Insurance Policy Could Include:

Hire And Reward Insurance FAQs

What is Hire and Reward insurance in the UK?

Hire and Reward insurance is a specialist policy that covers you when you’re paid to transport people, parcels, food, or goods. It’s required by law for couriers, delivery drivers, taxi drivers, and gig‑economy workers.

Who needs Hire and Reward insurance?

Anyone earning money from transporting passengers or goods, including couriers, taxi drivers, food delivery riders, and self‑employed drivers using cars, vans, scooters, or motorbikes, must have Hire and Reward cover.

Is Hire and Reward insurance the same as courier insurance?

Courier insurance is a type of Hire and Reward cover specifically for delivering parcels, packages, and goods. Hire and Reward is the broader category that includes taxi, private hire, food delivery, and courier work.

How much does Hire and Reward insurance cost in the UK?

Prices vary based on vehicle type, location, mileage, and usage. Car and van policies typically cost more than scooter or motorbike policies due to higher risk and mileage.

Do I need Hire and Reward insurance for Uber, Bolt, or private hire work?

Yes. Private hire drivers must have Hire and Reward insurance to legally carry paying passengers in the UK.

Can I get Hire and Reward insurance for a car I use for part‑time delivery work?

Yes. Many insurers offer part‑time or flexible Hire and Reward policies for drivers using their personal car for evening or weekend delivery shifts.

Do food delivery riders on scooters or motorbikes need Hire and Reward insurance?

Is Hire and Reward insurance required for Amazon Flex drivers?

Yes. Amazon Flex drivers must have Hire and Reward insurance to deliver parcels legally and be covered while working.

Can I use my normal car insurance for delivery driving?

No. Standard social, domestic, and pleasure insurance does not cover paid delivery or passenger transport. You must have Hire and Reward cover.

What vehicles can be covered under Hire and Reward insurance?

Cars, vans, motorbikes, scooters, mopeds, and even e‑bikes can be covered, depending on the insurer and the type of delivery or transport work.

What vehicles can be covered under Hire and Reward insurance?

Cars, vans, motorbikes, scooters, mopeds, and even e‑bikes can be covered, depending on the insurer and the type of delivery or transport work.

Does Hire and Reward insurance cover multi‑drop courier work?

Yes. Multi‑drop courier work is one of the most common uses for Hire and Reward insurance, especially for vans and small commercial vehicles.

Can I get temporary or short‑term Hire and Reward insurance?

Some insurers offer short‑term or pay‑as‑you‑go Hire and Reward policies, ideal for part‑time couriers or seasonal delivery drivers.

Does Hire and Reward insurance cover food delivery and parcel delivery together?

Many policies allow mixed‑use delivery, covering both hot food and parcel delivery, but you must check your policy wording to confirm.

Is Hire and Reward insurance more expensive in big UK cities?

Yes. Areas like London, Manchester, Birmingham, and Leeds often have higher premiums due to increased traffic, accident rates, and delivery demand.

Do I need business insurance as well as Hire and Reward?

Some drivers may need additional business use or goods‑in‑transit cover, depending on the type of work and the insurer’s requirements.

Does Hire and Reward insurance cover my goods or parcels?

Not always. Goods‑in‑transit insurance is often required separately to protect the items you’re transporting.

Can I get Hire and Reward insurance for a leased or financed vehicle?

Yes. Most insurers allow Hire and Reward cover on leased, financed, or PCP vehicles, as long as the finance agreement permits commercial use.

Do taxi drivers need Hire and Reward insurance?

Yes. Taxi drivers, both private hire and public hire, must have Hire and Reward insurance to legally carry paying passengers.

Can I add Hire and Reward insurance to my existing policy?

Some insurers allow you to upgrade your existing policy, while others require a standalone Hire and Reward policy. It depends on your provider.

Does Hire and Reward insurance cover me when I’m not working?

Many policies include social, domestic, and pleasure use, but not all. Some require a separate SD&P policy, especially for motorbikes and scooters.

Gets quotes within minutes of completing our simple form

Last Updated | 27th January 2026

Page updated and reviewed by Sarah Hampton – Insurance specialist