Compare Hire and Reward Insurance

Hire and Reward Insurance Quotes

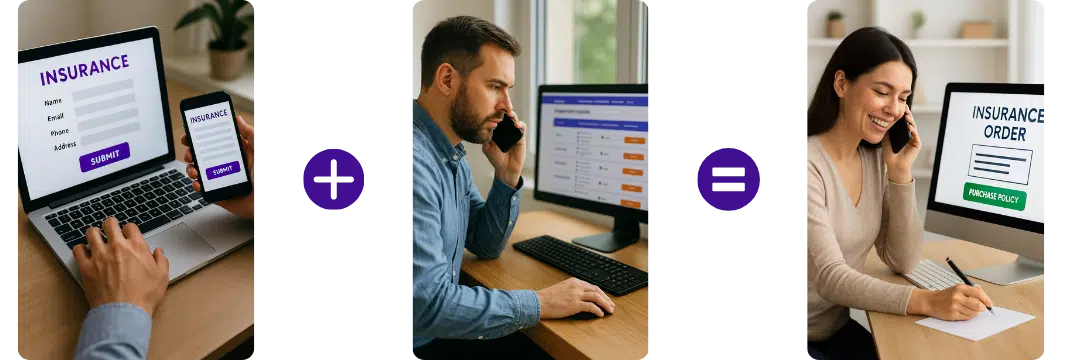

Quick & Easy Process – Complete our simple form.

Trusted Partners – Covering delivery vans and courier cars.

Expert Support – No-obligation quotes tailored to your needs.

Compare hire and reward insurance quotes with some of the UK's top providers, including:

How does it work?

Complete the Simple Form

Provide details about the types of deliveries, vehicle details, and driving history.

Compare Prices

Compare from multiple UK providers to find the best value and features.

Purchase Cover

Select the policy that fits your business and purchase directly with the provider.

Gets quotes within minutes of completing our simple form

Compare Specialist Brokers for Hire and Reward Insurance

Hire and reward insurance is a legal requirement for businesses delivering goods, such as food, parcels, or other products, in exchange for payment. Compare competitive policies to find the best option for your needs by filling out the form above and letting us help you secure the right cover.

What is Hire and Reward Insurance?

Hire and reward insurance is for anyone using their vehicle to transport goods or people for a fee. It’s the cover you need if you’re delivering packages, meals, or any other items for payment. This isn’t regular car insurance; it’s a policy specifically designed to protect against the unique risks associated with driving your vehicle for work.

This insurance covers both you and your vehicle while working. Whether you’re using a van, car, or motorbike for deliveries, hire and reward insurance ensures you’re legally covered, protecting you from unexpected expenses if something goes wrong on the road.

You are also required by law to have business insurance if you are delivering goods in a vehicle for a job. If you don’t have this type of insurance and are stopped by the police, you risk having your vehicle seized, being fined, and receiving penalty points on your licence.

How much does Hire and Reward Insurance cost?

The cost of hire and reward insurance depends on several factors, including the type of vehicle you drive, your driving experience, and the kind of work you do. For example, if you’re a brand-new driver, it may be difficult to find affordable cover – or if you can, it will likely be very expensive. If you’re using pay-as-you-go delivery insurance,

Hire and reward insurance can cost anywhere from 80p to £3.29 an hour on average. Monthly policies typically range from £110 to £150, and annual policies could be anywhere between £1,100 and £1,500. However, if you’re a new driver, have no claims bonus, have made claims in the past five years, or have motoring convictions like penalty points, these will all influence the final price. These factors are important to keep in mind when looking for a policy.

Why is Hire and Reward Insurance expensive?

Hire and reward insurance can be expensive due to several factors that increase the risks associated with using a vehicle for commercial purposes. Here’s why:

1 - Higher Risk Involved

Unlike personal car insurance, hire and reward insurance covers the risks associated with transporting goods or passengers for payment. This type of driving is considered riskier because you’re transporting valuable items, which increases the chance of accidents, damage, or theft. Insurers charge more to cover these additional risks.

2 - Vehicle Type Used

The type of vehicle you use affects the cost. Larger vehicles, such as vans or high-performance cars, typically come with higher premiums. These vehicles are more expensive to repair and replace, which increases the insurance cost. Additionally, if you’re using a vehicle for multiple deliveries, it’s likely to accrue more miles, which raises the likelihood of damage or accidents, which increases the risk.

3 - Drivers Experience

New or young drivers are generally seen as higher risk due to their lack of experience on the road. As a result, premiums are typically higher for drivers who are under 25 or those who have recently passed their test. A lack of experience can increase the likelihood of accidents, making insurers charge more.

4 - Claim History and Penalty Points

If you’ve made claims in the past or have penalty points on your licence, your premium will likely be higher. Insurers consider these factors as signs of higher risk, meaning they’ll charge more to cover the potential costs of any future incidents.

5 - Delivery Type

The nature of the goods being transported also plays a role in determining if you are able to be insured or not. Delivering high-value items or hazardous goods increases the risk of damage or loss, which raises the cost of insurance. For instance, food delivery is less risky than delivering electronics, and transporting perishable items adds another layer of complexity.

6 - Location

If you’re driving in a busy area with heavy traffic, ie city centre deliveries, the chances of accidents increase. Similarly, areas with higher crime rates can make insurance more expensive due to the increased risk of theft or damage to the vehicle and goods.

7 - Higher Mileage

As a hire and reward delivery driver, you’re likely to be driving more miles than a standard driver. The more you drive, the higher the risk of being involved in an accident, which contributes to higher insurance premiums.

In short, hire and reward insurance is expensive because it covers a wider range of risk factors which the insurers needs to take into account, including valuable goods, longer driving hours, and less experienced drivers. The nature of the work itself – combined with the potential for accidents or claims – means insurers need to charge more to cover these added risks.

What are the different types of Hire and Reward Insurance available?

There are various hire and reward insurance policies to suit different business needs, from pay-as-you-go to hire and reward courier insurance. Pay-as-you-go insurance is ideal for part-time or occasional drivers, such as those working with platforms like Uber Eats, Just Eat, or Amazon Flex. It offers flexibility by allowing you to pay only when you’re driving for work.

For full-time drivers, hire and reward courier insurance provides comprehensive coverage for vehicles, goods, and liability. If you’re delivering food for Just Eat or parcels for Evri drivers, specific policies for food delivery insurance or parcel delivery insurance are essential, ensuring you’re legally covered while transporting goods.

Specialised policies like Amazon Flex insurance or Just Eat insurance offer tailored protection for specific delivery services, covering risks like accidental damage, theft, or loss of goods.

Your Hire and Reward Insurance Policy Could Include:

Hire And Reward Insurance FAQs

What does hire and reward insurance mean?

Hire and reward insurance is a specific type of insurance coverage designed for businesses or individuals in the UK who use their vehicles to transport goods or passengers for payment. It is a legal requirement for vehicles used in the hire and reward industry, including couriers, delivery drivers, taxi drivers, and private hire vehicles.

Hire and reward insurance provides coverage for using your vehicle to transport goods or passengers in exchange for payment. It ensures that you are appropriately insured when operating your vehicle for commercial purposes, as standard personal car insurance policies typically exclude business use.

This type of insurance covers various risks associated with the hire and reward industry, including accidents, damage to your vehicle, liability for third-party injury or property damage, and theft of goods or damage to cargo.

By having hire and reward insurance, you comply with legal requirements and protect yourself financially in case of accidents or incidents that may occur during your business operations. It is vital to select an insurance policy that suits the specific needs of your hire and reward activities, considering factors such as the type of vehicle, the nature of the goods or passengers being transported, and the distance covered.

Consulting with insurance providers or brokers specialising in hire and reward insurance can help you find the most suitable coverage options and ensure that you meet the necessary insurance obligations for your business.

Do I need Hire And Rewards insurance?

Whether or not you need hire and reward insurance depends on the nature of your business activities. If you use your vehicle to transport goods or passengers in exchange for payment, you will require hire and reward insurance. Here are some scenarios where hire and reward insurance are typically necessary:

- Courier and Delivery Services: If you operate as a courier or provide delivery services, using your vehicle to transport goods for payment, hire and reward insurance is typically required. This ensures you are properly insured for commercial use and protects against potential risks.

- Taxi and Private Hire Services: If you work as a taxi driver or provide private hire services, transporting passengers for payment, hire and reward insurance is essential. It is a legal requirement and provides coverage for passenger transportation.

- Goods Transportation: If your business involves transporting goods for payment, such as a haulage or logistics company, hire, and reward insurance is necessary. It covers the goods in transit, protects against potential damages or theft, and ensures compliance with legal requirements.

It is important to note that standard personal car insurance policies usually exclude business or commercial use. Therefore, if you use your vehicle for any form of hire and reward activities, it is advisable to consult with insurance providers or brokers specialising in hire and reward insurance. They can assess your business activities and help you determine the appropriate coverage needed to protect yourself, your vehicle, and any transported goods or passengers.

Types of hire and reward insurance

Hire and reward insurance typically encompasses different types of coverage options to meet the specific needs of businesses or individuals engaged in hire and reward activities. The types of hire and reward insurance coverage can include:

- Hire and Reward Vehicle Insurance: The core component of hire and reward insurance covers the vehicle used for hire and reward purposes. It provides protection against risks such as accidents, damage, theft, fire, or vandalism. The coverage can be tailored to the specific type of vehicle, whether it’s a car, van, truck, or other commercial vehicle.

- Goods in Transit Insurance: Goods in transit insurance provides coverage for the goods or cargo being transported for hire and reward. It protects against loss, damage, or theft of goods while in transit. This coverage is particularly important for businesses involved in courier services, delivery operations, or transportation of goods.

- Passenger Liability Insurance: If your hire and reward activities involve transporting passengers, passenger liability insurance is essential. It covers liability for bodily injury or property damage to passengers while they are being transported in your vehicle.

- Public Liability Insurance: Public liability insurance covers liability for bodily injury or property damage caused to third parties during the course of your hire and reward activities. It provides financial protection in case someone is injured, or their property is damaged as a result of your business operations.

- Employers’ Liability Insurance: If you have employees working for your hire and reward business, employers’ liability insurance is a legal requirement in the UK. It covers claims from employees who suffer injuries or illnesses in the course of their employment.

It’s important to assess your specific needs and consult with insurance providers or brokers specialising in hire and reward insurance. They can help determine the most suitable coverage options and ensure comprehensive protection for your hire and reward business, vehicles, goods, passengers, and liabilities.

Getting the right courier cover

If your business involves you driving a vehicle for dispatch or delivery, you’ll need to consider courier insurance. If you think it’s too expensive, don’t worry, mymoneycomparison has you covered. We compare courier insurance in a detailed manner so that you have access to the cheap courier insurance and you can make your pick from a wide array of courier insurance options. This will ensure proper coverage for your courier business in case you’re involved in an accident or if your vehicle is damaged or stolen.

Haulage or Courier?

Courier Van insurance & hire and reward insurance, you’ll need to specify whether you need cover for social only, carriage of own goods, carriage for reward or hire, or haulage. The general knowledge is that couriers do multiple drop-offs and hauliers drive a very long distance to deliver a single load. This is, however, not a rule of thumb as different courier insurance brokers go with different definitions.

If you think yours is a courier and the insurance firm confirms that it you have been carrying out haulage work, in the event of a claim, your policy might be rendered invalid. It is always safer to check with your insurance provider in order to ensure that there is an agreement on the cover offered. This is why we advocate that you use our courier hire and reward insurance comparison to get a decent and befitting courier insurance quote for your business.

What is Included in the Hire and Reward Insurance?

Hire and reward insurance is a type of insurance specifically designed for individuals or businesses using their vehicles to transport goods or passengers in exchange for payment. The specific coverage included in hire and reward insurance can depend on the insurance provider and policy. However, here are some common elements that may be included:

- Vehicle Coverage: Hire and reward insurance typically provides coverage for the insured vehicle itself. This includes protection against accidental damage, theft, fire, and other perils that may result in damage or loss of the vehicle.

- Third-Party Liability: Hire and reward insurance usually includes third-party liability coverage. This covers the insured’s legal liability for any injury or property damage caused to third parties during the course of their hire and reward activities.

- Goods in Transit (Optional): For policies that cover the transportation of goods, goods in transit insurance may be included. This provides coverage for loss, damage, or theft of the goods being transported.

- Passenger Liability (For Passenger Transportation): If the hire and reward activities involve transporting passengers, passenger liability coverage may be included. This protects against liability for bodily injury or property damage caused to passengers during transportation.

- Breakdown Assistance (Optional): Some hire and reward insurance policies may offer optional breakdown assistance coverage. This provides roadside assistance, recovery services, and support in case the insured vehicle breaks down during transportation.

- Legal Expenses (Optional): Optional legal expenses coverage may be included in hire and reward insurance. This covers legal costs associated with defending or pursuing claims related to the insured activities.

It’s important to carefully review the terms and conditions of your hire and reward insurance policy to understand the specific coverage included and any exclusions or limitations that may apply. Consulting with insurance providers or brokers specialising in hire and reward insurance can help you determine the most suitable coverage options for your specific needs and requirements.

Will the size of my van make a difference to my insurance?

If the vehicle you use for your courier service weighs above 3.5 tonnes simple cheap courier insurance will not suffice. Other vans and vehicles that weigh less than this stipulated weight are classified as light goods vehicles (LGVs).

How To Get A Quote

It shouldn’t take too long to compare insurance quotes. You can get it done in minutes. Simply provide us with your information and we will give you a quote for hire and reward insurance to get started. Start a quote here.

Whether you’re looking for courier van insurance or delivery driver insurance, we can provide you with options to choose the cover you and your job requirements.

Our highly experienced team of courier insurance specialists work with the top courier van insurance brokers so you have a variety of options. Get your courier insurance quote today

What is classed as hire or reward?

In the context of insurance, “hire or reward” refers to the act of using a vehicle to transport goods or passengers in exchange for payment. It is a term commonly used to define certain types of commercial activities involving the use of vehicles for hire.

The concept of hire or reward encompasses various scenarios, including:

- Goods Transportation: If you use your vehicle to transport goods on behalf of others in exchange for payment, it is considered a hire or reward activity. This can include delivery services, courier operations, logistics companies, or any other business where you transport goods for commercial purposes.

- Passenger Transportation: If you transport passengers in your vehicle and receive payment for the service, it falls under the category of hire or reward. This includes activities such as taxi services, private hire services, chauffeur-driven vehicles, or ride-sharing services where passengers pay for transportation.

It is important to note that engaging in hire or reward activities may have specific legal requirements and insurance obligations. In many areas, commercial use of vehicles for hire or reward typically requires appropriate licensing, permits, and insurance coverage tailored to the specific activities. It’s advisable to consult with local authorities, insurance providers, or professional advisors to ensure compliance with the applicable regulations and obtain the necessary insurance coverage for your hire or reward activities.

How much is hire and reward insurance UK?

The cost of hire and reward insurance in the UK can vary significantly depending on several factors, including the type of vehicle, the nature of the hire and reward activities, the location, the driver’s experience, and the insurance provider itself. It is challenging to provide an exact figure as insurance premiums are calculated based on individual circumstances. However, hire and reward insurance tends to be more expensive than standard personal car insurance due to the increased risks and liabilities involved.

To get an accurate idea of the cost, it is advisable to obtain quotes from multiple insurance providers that offer hire and reward insurance. You can provide them with specific details about your vehicle, the nature of your hire and reward activities, and any other relevant information to receive personalized quotes. By comparing quotes and considering different coverage options, you can find the most competitive rates that suit your specific needs.

It’s important to note that while cost is a significant consideration, it’s equally crucial to ensure that you have adequate coverage to protect yourself, your vehicle, and any liabilities that may arise from your hire and reward activities.

Which professions require hire and reward insurance?

Top of FormSeveral professions and activities typically require hire and reward insurance to ensure appropriate coverage for their commercial operations. Some of the occupations and activities that often necessitate hire and reward insurance include:

- Taxi Drivers: Taxi drivers who transport passengers for a fee require hire and reward insurance. This applies to both traditional taxi services and app-based ride-hailing services.

- Private Hire Drivers: Private hire drivers who provide pre-booked transportation services also need hire and reward insurance. This includes services like chauffeur-driven cars and private hire vehicles.

- Courier and Delivery Services: Individuals or businesses engaged in courier or delivery services, transporting goods or parcels for payment, require hire and reward insurance. This covers various delivery operations, including same-day delivery, next-day delivery, and scheduled courier services.

- Haulage and Freight: Professionals in the haulage and freight industry, transporting goods on behalf of clients or companies, typically require hire and reward insurance. This includes truck drivers, freight forwarders, and logistics companies.

- Removals and Storage: Removals and storage companies that transport household or commercial goods for customers as part of their services require hire and reward insurance. This applies to both local and long-distance removals.

- Mobile Pet Services: Professionals offering mobile pet grooming, pet transportation, or pet sitting services often require hire and reward insurance. This ensures coverage while transporting pets or providing services at clients’ locations.

- Wedding Car Hire: Companies or individuals offering wedding car hire services, transporting couples and guests on their special day, require hire and reward insurance. This includes classic cars, vintage cars, and luxury vehicles.

It’s important to note that the specific requirements for hire and reward insurance may vary based on local regulations and the nature of the activities involved. It’s advisable to consult with insurance providers or brokers specialising in hire and reward insurance to determine the most suitable coverage options for your specific profession or activity.

What type of hire and reward insurance is there?

There are three different types of courier insurance these are:

Comprehensive: This type of insurance covers you for third party, fire, and theft. It goes further to cover your vehicle if it gets lost or damaged in an accident. This hire and reward insurance is loved by many and offers the most perks. You can get to compare cheap haulage insurance here to have an idea of the range of premiums.

Third-Party, Fire, and Theft: This insurance cover will pay money to a third party in the event of a loss or damage in which you are legally liable. This type of insurance also covers the cost if your courier vehicle is stolen or damaged by attempted theft or fire. The price is also quite exorbitant but gets affordable when you get cheap courier insurance quotes from us.

Third-Party Only: This form of insurance will only pay money to a third party who suffers loss or damage which you are responsible for. Here you get the cheapest premium and this is the most basic form of cover for your courier business.

Courier vehicle insurance – Whether you use a car, van or small lorry, you depend on your vehicle more than anything else whilst at work. So in order to keep your business moving, you will require some sort of courier vehicle cover. This is where a company like mymoneycomparison.com can help by shopping and comparing a number of providers for a competitive quotation on your behalf. Call our team of experts today on 0333 006 9438 or fill in our online form here.

Public liability insurance – can cover couriers against legal costs and compensation payments as a result of injuries or property damage to your clients, contractors or members of the public which is caused by you or one of your employees.

Goods in transit insurance – covers the goods that are being delivered from one place to another. If you are a courier, haulier or even a furniture remover then you are taking possession and responsibility of items for delivery. This also means you have a duty of care to the items that are being delivered if they are stolen, lost or damaged then the owner of the goods will want compensation for this value. To have Goods in Transit (GiT) insurance means you are covered for this loss.

Do you need insurance to deliver parcels?

The goods-in-transit cover isn’t compulsory, but you are responsible for any loss, damage or theft that happens to the goods while you‘re delivering them, and insurance will meet the cost of any claims against you.

What does Hire and Reward Insurance Cover?

Hire and Reward will protect you in the event that you’re in an accident and are using your vehicle for business purposes. It’s designed to cover the additional risks that drivers face while using their vehicle for payment, such as:

- Long hours on the road

- Distractions from mobile phone/app

- Unfamiliar roads/destinations

- Vehicle wear and tear from above average mileage

- Rushing to meet tight delivery deadlines

If you opt for a full-time Hire and Reward policy (which is sometimes referred to as Commercial Vehicle insurance) then you’ll be covered by that policy at all times, irrespective of whether you’re driving for work or not. With a top-up/pay-as-you-go coverage, it’s important you’re clear about what you were doing when the accident occurred (i.e. working/not), so you know which of your insurances will be responsible for covering you.

And keep in mind if you haven’t informed your insurer that you’re using your car for business purposes then they may be well within their rights to refuse to pay out (and may even void your coverage all together)—so make sure you do so at the earliest possible moment.

Do I need hire and reward insurance?

Hire and Reward Insurance is essential for couriers, hauliers, taxi drivers, furniture removers and anyone who carries people or the property of others in exchange for a fee. … However, even if you only carry goods you own as part of your job, you will still require a business to use insurance

Which insurance is a minimum for couriers?

Courier Van Insurance is for when you have up to five vans. There are three levels of cover available: third party only, comprehensive, and third party, fire and theft insurance. Third-party cover is the minimum you need to be able to deal with public safety.

You may also require goods in transit insurance, to protect the value of the goods you transport should they be lost, damaged or stolen, and public liability insurance, in case you are involved in an accident involving the public. If you have employees, you might need to consider employers’ liability insurance.

Using our brokers industry knowledge and depending on your needs, we may also be able to include the following features in your policy:

Protected No Claims Discount

• Drivers aged 25 and above

• Excesses from £250 for motor for vehicles up to 3.5GVW

• Free EU cover for up to 90 days (dependent on the insurer)

• Uninsured loss recovery

• Public Liability and Employers’ Liability

• Goods in Transit Cover

• £100 Goods in Transit excess

• Cover for up to six vehicles per policy

• Option to include AA Breakdown & Accident Recovery

What Insurance Do I Need To Be A Courier

Courier insurance is designed for when you are working with multiple-drop deliveries and will cover you in the event that your commercial vehicle is involved in an incident or accident. You may be involved in transporting anything from the ‘traditional’ courier goods such as packages and parcels, or transporting electronics and even essential medical supplies to multiple locations on a time-sensitive basis.

You will need to find a different kind of insurance if you are dealing with single-drop deliveries such as takeaways and haulage, and for taxi firms. You might not realise this, but courier insurance might be necessary if you use your personal car to deliver time-sensitive parcels part-time. However, your private car, motorbike or van insurance – even if you take out Class 1 Business use – will not protect your work as a courier.

If you manage a fleet of courier vehicles, we can help you find the best possible cover for the risks your business faces. We can even advise you and help you find telematics devices that will help you keep the costs down.

What insurance do I need to deliver takeaways?

Drivers must extend their private car insurance policies with the purchase of a hire and reward use, in a similar fashion to a taxi or courier. Hire and reward use covers a driver’s liability when something is delivered from one place to another for a fee, including when delivering food.

Does food delivery need insurance cover?

The short answer is that you need to have Hire & Reward (H&R) insurance in place to cover your food delivery work because your standard Social, Domestic & Pleasure (SD&P) insurance will not cover you for activities like this. Your SD&P covers your personal driving, like driving to the shops or visiting a friend.

What's the difference between Courier and Haulage insurance?

Typically, if you’re using a van for work you’ll need some kind of courier van insurance. But if you’re using a van to distribute goods, then you’ll need courier or haulage insurance. Here’s a brief description of these two cover types:

- Courier Insurance – This is more tailored to allow you to make a number of different drop-offs over the course of your journey. A courier will also have more goods to carry in their vehicle, and courier insurance providers will more likely be aware of this fact.

- Haulage Insurance – This is slightly different insurance, as it looks at covering singular, larger loads for longer journeys. But some insurance providers may consider someone who may seemingly need haulage insurance, to actually need courier insurance. And sometimes vice-versa, too.

And when you to add to the mix the potential for some insurers to also require hire and reward cover (usually associated with taxi insurance), then the world of courier insurance is not always clear-cut.

But if your insurance provider is aware of all your details from the outset, you should be able to find the right courier cover that you need.

How much does courier van insurance cost?

When you’re looking to start using your van for courier or delivery work, you’ll need to make sure you have the correct insurance cover in place. Your standard Social, Domestic & Pleasure cover won’t protect you or your van for your work as a courier driver.

Instead, you need to have Hire & Reward insurance in place to cover your work. But before you start looking for work as a courier driver, it’s a good idea to have an idea of how much courier van insurance is going to cost you.

In this post, we’ll look at how much you can expect to pay for courier van insurance, the different options that are available and how you can get started by getting a quote via our online form or calling 0333 069 438.

How much does courier van insurance cost?

For an annual courier van insurance policy in the UK, you can expect to pay anything from as little as £800 all the way up to several thousand pounds. Your quote will vary significantly depending on your personal information and driving history.

Does hire and reward insurance cover food delivery?

Hire and reward will cover fast food delivery drivers either part-time or full-time drivers, including fast and hot food deliveries by restaurants and takeaways

A Comprehensive Guide to Hire and Reward Insurance

Gets quotes within minutes of completing our simple form

Last Updated | 27th October 2025

Page updated and reviewed by Sarah Hampton – Insurance specialist