Truck Insurance

Compare Truck Insurance Quotes

Quick & Easy Process – Complete our simple form.

Trusted Partners – Work with leading UK Providers.

Expert Support – Quotes provideds for all types & sizes of trucks.

Compare truck insurance quotes with some of the UK's top providers, including:

How does it work?

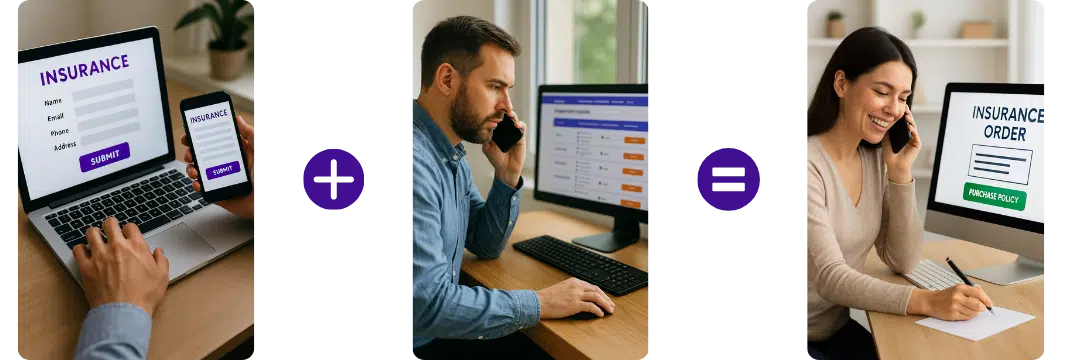

Complete the Simple Form

Provide details about your business, truck details, and driving history.

Compare Prices

Compare from multiple UK providers to find the best value and features.

Purchase Cover

Select the policy that fits your business and purchase directly with the provider.

Get quotes within minutes of completing our simple form

Truck Insurance quotes from an exclusive panel of UK providers

Our HGV Brokers can provide cheap truck Insurance for all types of trucks, whether it is a single Lorry or a fleet of HGV vehicles. Fill in our online form for a quick callback and quote.

Compare Truck Insurance For Operator’s Licence Holders

Specialist Truck insurance brokers for drivers and companies with the goods (o) operators licence, a legal requirement for any vehicle above 7.5 tonnes in weight.

Many people who drive Heavy Goods Vehicles (HGV), known as lorries, are always busy. However, no matter how busy you are, the law mandates that you get truck insurance to cover your vehicle.

Considering your work, scouting around to compare cheap lorry insurance is probably not wise. Not to worry, we have you covered! Mymoneycomparison is the best place to get cheap truck insurance quotes for your business.

Even if your lorry is currently off-road, the law requires you to get truck insurance. You should get cheap truck insurance quotes for your van to compare and get very good deals. The only exception is if you have registered it as off the road with a Statutory Off Road Notice (SORN).

What Your HGV Insurance Policy Could Include:

What is Truck Insurance?

Trucks, also called lorry or haulage insurance, is a type of insurance policy specifically designed for 7.5 ton or LGV vehicles up to 44 tonne HGV, or you could go up to the super heavy haulage of 200 tons +. This insurance covers the cab, trailer, goods being transported, along driver.

Insurers offer various Truck insurance, with each policy slightly different in what is covered or not. The type of coverage needed will depend on your company’s unique needs. This is why it is imperative to do the research and shop around for a policy that best fits.

Truck Insurance FAQs

What is truck insurance?

Truck insurance, also known as commercial truck insurance or commercial vehicle insurance, is a type of insurance coverage specifically designed for trucks and other commercial vehicles used for business purposes. It protects against various risks and liabilities associated with owning and operating trucks in commercial activities. Truck insurance is essential for truck owners, operators, and businesses that rely on trucks.

Truck insurance typically offers coverage for the following:

- Liability Coverage: This is the most fundamental aspect of truck insurance. It protects against third-party bodily injury and property damage claims from accidents involving the insured truck.

- Physical Damage Coverage: This coverage is optional and protects the insured truck against physical damage caused by collisions, theft, vandalism, fire, or other covered perils.

- Cargo Coverage: If the truck is used for transporting goods, cargo coverage protects the cargo against theft, damage, or loss during transit.

- Medical Payments Coverage: This coverage helps pay for medical expenses for injuries sustained by the driver and passengers in the insured truck, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This coverage protects the insured truck and its occupants in an accident with an uninsured or underinsured driver who cannot cover the resulting damages.

- Non-Trucking Liability Coverage: Also known as bobtail insurance, this coverage applies when the truck is operated without a trailer or outside the scope of business-related activities.

Truck insurance costs depend on several factors, including the type of truck, its value, usage (local or long-haul), the driver’s experience and record, the location of operations, and the desired coverage limits. Insurance providers specialising in commercial truck insurance can provide quotes based on these factors.

It is important to note that specific policy terms, coverage options, and requirements may vary among insurance providers and regions. Therefore, it is advisable to consult with an insurance professional or broker to determine the most suitable coverage for your specific trucking needs.

What do Truck Insurance policies include?

Truck insurance policies typically include various types of coverage designed to protect the truck, the driver, and any third parties involved in accidents or incidents. While specific policy terms and coverage options can vary between insurance providers and regions, here are some typical inclusions in truck insurance policies:

- Liability Coverage: This is a foundational component of truck insurance. It provides coverage for bodily injury and property damage liabilities that the insured truck may cause to third parties in the event of an accident. It typically includes both bodily injury liability and property damage liability coverage.

- Physical Damage Coverage: This coverage protects the insured truck against physical damage caused by collisions, theft, fire, vandalism, or other covered perils. It is often divided into two parts:

- a. Collision Coverage: This covers damages to the insured truck resulting from collisions with other vehicles or objects.

- b. Comprehensive Coverage: This covers damages to the insured truck caused by events other than collisions, such as theft, vandalism, fire, natural disasters, or falling objects.

- Cargo Coverage: If the insured truck is used for transporting goods, cargo coverage protects the cargo against theft, damage, or loss during transit.

- Medical Payments Coverage: This coverage helps pay for medical expenses for injuries sustained by the driver and passengers in the insured truck, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This coverage protects the insured truck and its occupants in an accident with an uninsured or underinsured driver who cannot cover the resulting damages.

- Non-Trucking Liability Coverage: Also known as bobtail insurance, this coverage applies when the truck is operated without a trailer or outside the scope of business-related activities. It provides liability coverage for accidents that occur during personal use of the truck.

- Trailer Interchange Coverage: If the insured truck is involved in trailer interchange agreements, this coverage protects against physical damage to non-owned trailers while in the insured’s care.

- Downtime Coverage: This coverage compensates the insured for income lost during the truck’s downtime due to a covered event, such as an accident or mechanical breakdown.

It is important to carefully review the policy terms and conditions to understand the specific coverage, limits, exclusions, and deductibles associated with a truck insurance policy. Working with an insurance professional or broker specialising in commercial truck insurance can help ensure you have the appropriate coverage for your specific trucking needs.

Truck policies may include these features:

- Flexible payment plan (depending on the insurer)

- Breakdown cover in the UK and Europe

- Combined policies

- Attached/detached trailers can be covered

- Immediate cover available

- HGV fleet insurance (Visit Fleet Insurance Page for A Quote)

- Commercial HGV’s

- Cover for classic HGV’s

- Goods in transit

- Employers and public liability cover

- Personal accident and sickness cover

- Legal assistant cover

- Income protection insurance

- Private HGV Insurance

*Please note not all insurers will provide the above, however, these could be offered when insuring your vehicle. You could ask the insurers or broker at the time of quote about optional extras.

Truck Insurance Requirements

In the UK, if you operate a truck or any other commercial vehicle, it is mandatory to have valid insurance coverage in place. The Motor Insurance Directive and the Road Traffic Act 1988 regulate the specific requirements for truck insurance in the UK. Here are the critical insurance requirements for trucks in the UK:

- Third-Party Only (TPO) Insurance: This is the UK’s minimum legal requirement for truck insurance. TPO insurance provides coverage for liability claims from third parties for bodily injury and property damage caused by the insured truck. It does not cover damage to the insured truck itself.

- Certificate of Motor Insurance: You must have a valid Certificate of Motor Insurance for your truck. This certificate serves as proof that you have the required insurance coverage. It should be presented to authorities when requested and displayed on the vehicle.

- Continuous Insurance Enforcement (CIE): The UK operates under the Continuous Insurance Enforcement (CIE) law, which requires all vehicles to have insurance coverage, even if they are not in use or off the road. If you have a truck not in use, you must declare it off-road with a Statutory Off-Road Notification (SORN) or ensure it has valid insurance coverage.

- Road Risks: Truck insurance policies must include coverage for road risks. This covers the truck’s use on public roads and provides liability coverage for accidents and damage caused to third parties.

It is important to note that while TPO insurance is the minimum legal requirement, many truck owners opt for more extensive coverage to protect against additional risks, such as damage to their vehicle, theft, fire, and other perils. Additional coverage options like comprehensive insurance, physical damage coverage, and cargo coverage are available for those who require broader protection.

To ensure compliance with UK truck insurance requirements, it is advisable to work with reputable insurance providers or brokers specialising in commercial vehicle insurance. They can help you understand the specific coverage options available and assist you in obtaining the appropriate insurance policy for your trucking operations.

More details about getting an operators license can be found here: https://www.gov.uk/being-a-goods-vehicle-operator

Types of Haulage Insurance

As you research, you will find many types of haulage insurance available. However, you will find there are several main categories for HGV coverage including:

Third-Party Only HGV Insurance: this is the minimum amount of insurance that is required by law. This covers the driver in the UK for only liabilities including injury to others & passengers in the truck, liability when towing a caravan or trailer, and lastly, damage to third party property. For Third-Party Only lorry insurance, each of your drivers must have the Driver Certificate of Professional Competence (CPC).

Third-Party, Fire & Theft HGV Insurance: this type of insurance covers everything listed above, and includes coverage for fire damage, if a lorry is stolen, and damage to the lorry caused by theft.

Comprehensive HGV Insurance: this is a comprehensive policy that provides the best level of coverage possible. This includes everything above, as well as loss or damage to the truck, damage and loss of personal effects, windscreen coverage, and accidental damage. This type of policy also includes medical expenses; however, be sure to read through the policy to see what is covered or not.

Haulage Fleet Insurance: This is a policy that covers an entire fleet of HGV’s or known as Haulage fleet insurance which covers 2+ HGV’s in a fleet, this can be a very cost-effective option over the previous types of insurance listed above. Here, again, insurers will have their own requirements, what is covered or not in each of their policies. One more note – there can be a cap on the number of HGV’s the insurance covers in a fleet, which can include up to hundreds of HGV’s and is dependent on the insurer at the time.

Telematics HGV Insurance: Some HGV insurance policies require that you install a black box or use a mobile phone app in each truck. These methods are used to collect driving data, which is then used to calculate premiums. The more unsafe drivers are the insurance becomes more expensive. And just the opposite, if drivers are safe and obey driving rules, then the premium comes down. This could be a good option for you, making this type of coverage more affordable, if each of your drivers are safe behind the wheel.

Insurance for Carriage of ADR Hazardous Goods: It is important to note that not all insurers provide insurance for hauling hazardous goods. So, when looking for the right insurer, read through the policy (every part) to make sure you understand what is covered or not.

Another good idea is to speak with an insurance agent to ask questions and learn if there are other requirements that are not apparent.

You will need the right insurance if you want to be insured when carrying hazardous materials and goods.

Do I need Lorry insurance?

No matter how many trucks you operate, whether you’re an owner-driver or a fleet operator, you’re going to need truck insurance; not just because it’s a legal requirement, but because your trucks represent a very significant investment that requires protection. Comprehensive cover provides protection against not just injury or damage caused by your truck, but also loss or damage to the truck itself.

How much does HGV insurance cost?

HGV insurance can be a substantial sum of money. Exactly how much each operator has to pay varies from insurer to insurer and depends on a variety of factors. These may include:

- Whether any of your trucks are of exceptional value

- Where your trucks are driven and whether they go abroad

- The nature of your business activities and whether you ever visit hazardous sites or carry hazardous loads

- The profile of your drivers in terms of age and experience, and accident and conviction history

- Whether you have telematics devices or camera systems deployed actively to monitor and improve driving style and behaviour

A haulier running up to five vehicles will usually see their trucks rated individually. Above that number of trucks, policies tend to be fleet-rated, whereby the premium depends significantly on past claims experience across your HGV fleet.

What vehicles need an operators Licence?

You need an Operator’s Licence if you want to use a vehicle over 3.5tonnes (3500kg) plated weight for the purpose of carrying goods in conjunction with a trade or business. The licence is required whether or not goods carriage is for hire or reward.

How to Save Money on HGV Insurance

As a startup, you may be looking to save as much as possible on HGV insurance. That is understandable, so the temptation is to go with an insurance policy that is priced at a low cost. This type of coverage, while cheap, may not offer all the protection you need for the business. Instead, consider insurance a great investment for your business.

Other ways to save money on HGV insurance include:

- All drivers must have the required experience, along with a safe driving record.

- All newly passed truck drivers must have training about the job

- Install cameras that work to determine who is at fault in an accident

- Fitting the trucks with security devices, which make them more secure against theft

- Have a safe location for parking trucks overnight

- Some insurers offer flexible payment options, while others allow for annual or monthly premiums; an annual is much more affordable than monthly payments

- Build up a great no-claims bonus

Conducting research about the types of coverage your business needs, and shopping around can also help save money on this type of insurance policy.

Along with finding the policy, you can also save money by bartering with the insurer. This way you have a better chance of making sure to choose the right type of insurance as well as one that saves you money.

The most important thing for your startup is to get the right type of insurance and make sure you follow all driving rules, as well as in compliance with the insurer’s rules. HGV insurance is a business investment you cannot afford to skimp on. Choose the best policy you can to protect your business.

How long does an operators Licence application take?

A typical application can take up to 16 weeks to process, depending on the circumstances. Applications relating to new, novel or ridesharing services that require further information to determine the suitability of the application can take significantly longer to process.

What is the difference between operator and driver?

What is the Difference Between a Company Truck Driver and an Owner-Operator? … A company truck driver operates a company-owned truck on behalf of a trucking company and may be paid a salary. An owner-operator drives a truck that they lease or own, and I work independently or accept contract jobs.

Types of operators licences?

There are a variety of O licence types that could be suitable for your needs.

- Standard International Licence:

This allows you to carry your own goods, and goods for other people for hire or reward, both in the UK and on international journeys. It requires that you and your Transport Manager must each satisfy the requirement of good repute and professional competence. - Standard National Licence:

This allows you to carry your own goods on your own account, or other people’s goods for hire or reward, in the UK and to carry your OWN goods on your own account abroad.

It requires that you and your Transport Manager must each satisfy the requirement of good repute and professional competence. - Restricted Licence: This only allows you to carry your own goods on your own account within the UK and the EU. You do not have to satisfy the requirement of professional competence.

Examples of using a restricted license are: If you produce your own products and deliver them yourself or if you use the vehicle to transport tools or equipment to and from a job, e.g. a scaffolder or builder.

Operators licence exemptions

There are a few exemptions when it comes to Operator Licensing. These are the most common:

- Recovery Vehicles are constructed or permanently adapted for the purposes of lifting, towing or transporting a disabled vehicle.

- A vehicle with equipment permanently attached to it for the life of that vehicle. Examples include permanently fixed machines or appliances eg: a road sweeper or cherry picker. The only goods or burden these vehicles are allowed to carry

- Vehicles being used for or in connection with snow clearing, and the distribution of salt or grit.

What are the different types of trucks in the UK?

In the UK, various types of trucks are used for different purposes. Here are some common types of trucks seen on UK roads:

- Articulated Trucks (also known as Tractor-Trailers or Semi-Trucks): Large trucks with a tractor unit (the cab) and a semi-trailer. They are commonly used for long-haul transportation of goods and can haul heavy loads.

- Rigid Trucks: Rigid trucks are single-unit trucks with no separate trailers. They consist of a cab and a rigid body directly attached to it. Rigid trucks come in various sizes and configurations, such as box trucks, flatbed trucks, tipper trucks, and refrigerated trucks. They are used for local or regional transportation of goods.

- Dump Trucks: Dump trucks, also known as tipper trucks, have a hydraulically operated bed or container that can be tilted to unload the contents. They are commonly used in construction and mining industries for transporting loose materials such as sand, gravel, or demolition debris.

- Tanker Trucks: Tanker trucks are designed to transport liquids or gases in bulk. They have specialized tanks or containers to safely carry substances such as fuel, chemicals, water, or food products. Tanker trucks can vary in size and configuration depending on the type of cargo they transport.

- Concrete Mixer Trucks: These trucks are equipped with a rotating drum or mixer at the rear for mixing and transporting concrete to construction sites. Concrete mixer trucks ensure the concrete remains workable during transportation and can be directly discharged at the site when needed.

- Recovery Trucks: Recovery trucks, also known as tow trucks or breakdown trucks, are specifically designed to transport disabled or damaged vehicles. They are equipped with features like winches, cranes, or tilt beds to load safely and transport vehicles needing recovery.

- Refuse Trucks: Refuse trucks, also called waste collection vehicles or rubbish trucks, collect and transport solid waste or recyclable materials from residential or commercial areas to disposal or recycling facilities. These trucks come in different configurations, such as rear loaders, front loaders, or side loaders.

These are just a few examples of the different types of trucks commonly seen on UK roads. Each type of truck serves a specific purpose and has unique features to cater to the requirements of different industries and transportation needs.

- Dry and consumer goods lorries (rigid or articulated) …

- Emergency vehicles. …

- Livestock trucks. …

- Refrigerated trucks. …

- Specialist vehicles. …

- Flatbed lorries. …

- Tankers.

Weights of different HGVs range from 3.6 – 7.5 tonnes LGV, Then 7.6 tonne to the common 44 tonnes / However, super heavy HGVs can go up to 200 tonnes.

What the difference between LGV & HGV?

HGV stands for Heavy Goods Vehicle and LGV stands for Large Goods Vehicle. They both refer to the same type of vehicle. I.e. vehicles that are more than 3.5 tonnes. Such vehicles include trucks and lorries.

What is CPC and do I need I for my HGV licence?

CPC stands for Certificate of Professional Competence. If you wish to operate commercial vehicles above 3.5 tonnes (i.e. those in the HGV/LGV category), you will need to obtain the CPC Qualification. The assessments for this include: Theory test (same test as HGV), Driver CPC case study test, Driving ability test (same test as HGV) and Driver CPC demonstration test.

What is a HGV Insurance policy?

Our HGV (Heavy Goods Vehicle) insurance covers vehicles with a GVW (Gross Vehicle Weight) of over 5 Tonne up to 60 Tonnes. Different cover levels will provide you with a fully Comprehensive cover down to Third Party Only.

Do you offer cover for Lorries carrying hazardous goods?

In general terms vehicles that carry hazardous goods are not acceptable. However, we are prepared to consider risks that involve the carriage of low hazardous goods.

What is covered by an HGV and Truck Insurance policy?

- The loss of, or damage to, the insured HGV or truck by fire, lightning, explosion, theft or attempted theft

- Trailers owned or hired by you

- Accidental damage caused to your vehicle and trailer

- Contribution to replace the lock on your HGV or truck

- Window and windscreen damage

- Foreign use

We can also provide breakdown cover, so you’ll receive roadside assistance if you get stranded. Sometimes this cover isn’t included as standard, so make sure you speak to us so we can arrange it for you.

We can also offer protection for the goods you’re carrying, so if anything happens that results in you not being able to deliver them on time, or on the date, you intended to, you’ll be covered for:

- The loss of, or damage to, the goods

- Any legal costs you may incur as a result of losing or damaging the goods

Public Liability Insurance and Employers’ Liability Insurance policies are also available to help cover the cost of compensation and any legal fees, in the event of a claim made against your business by a member of the public or an employee.

You can also discuss Business Equipment Insurance with us, as we know just how important the tools of your trade are to keeping your business running smoothly. This cover offers protection against theft and malicious or accidental damage, giving you that extra peace of mind.

Who needs a goods vehicle operator’s licence?

**Take note: It is an offence to operate a goods vehicle without a valid licence if one is required. You could be liable to prosecution and your vehicle could be impounded.

You will need a goods vehicle operators licence if you use a goods vehicle of over3.5 tonnes gross plated weight or (where there is no plated weight) an unladen weight of more than 1,525kg to transport goods for hire or reward or in connection with a trade or business. (In this instance ‘goods’ means goods or burden of any description). For a vehicle and trailer combination, generally, you will need a goods vehicle operators licence if the gross plated weights or unladen weight of the vehicle and trailer combined exceed the limits stated above for a single-vehicle.

Helpful Links

RHA – Road Haulage Association

Get quotes within minutes of completing our simple form

Last Updated | 3rd November 2025

Page updated and reviewed by Sarah Hampton – Insurance specialist