Compare Any Driver Fleet Insurance

Any Driver Fleet Insurance Quotes

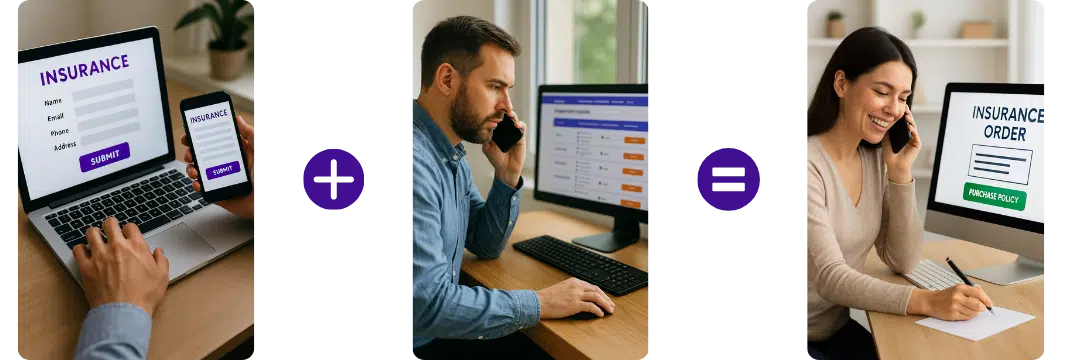

Quick & Easy Process – Complete our simple form or call directly.

Trusted Partners – Cover for drivers aged over 21, 25 and over 30.

Expert Support – No-obligation quotes tailored to your needs.

Compare any driver fleet insurance quotes with some of the UK's top providers, including:

How does it work?

Complete the Simple Form

Provide details about your business, fleet vehicles, and driving history.

Compare Prices

Compare from multiple UK providers to find the best value and features.

Purchase Cover

Select the policy that fits your business and purchase directly with the provider.

Gets quotes within minutes of completing our simple form

What is Any Driver Fleet Insurance?

Any driver fleet insurance is a specific fleet insurance variant that allows authorised drivers to operate the insured vehicles. This means that employees or individuals with the necessary permissions can drive the vehicles without requiring a specific named driver on the policy. This flexibility benefits businesses with multiple drivers needing access to the fleet, such as delivery companies or transportation services.

Businesses can streamline their operations and reduce administrative hassles associated with managing individual driver details by opting for any driver fleet insurance. It provides comprehensive coverage for all drivers within the specified policy terms, including protection against accidents, theft, property damage, and liability claims. The premium for any driver fleet insurance is typically based on the number of vehicles, their types, usage patterns, and the drivers’ driving history.

In summary, any driver fleet insurance offers businesses the convenience and flexibility of allowing authorised drivers to operate their fleet vehicles while providing comprehensive coverage to protect against potential risks and liabilities.

See our quick guide to any driver fleet insurance for more information:

Understading more abour any driver fleet insurance

Different types of vehicle fleets covered:

What Affects the Price of Any Driver Insurance?

Your policy may be more expensive if you have drivers under 25. However, this is the case with most types of driver’s insurance. The reason is that younger drivers are seen as a higher risk because they take more risks when driving.

If you do have a younger driver (under 25), it may be possible to cover them with a separate named policy rather than include them in any driver coverage. This is something to discuss with your insurance provider.

In addition, insurance will be more expensive when transporting goods or machinery for others. The reason is there’s a risk these items could be stolen or damaged in transport.

Vehicle size may also impact any driver insurance premiums. Large lorries or large vans will have a higher premium.

Any Driver Motor Fleet insurance can cover:

Any Driver Fleet Insurance FAQs

Who can get any driver fleet insurance?

Any driver fleet insurance is typically available to businesses and organisations that own a fleet of vehicles and require multiple authorised drivers to operate them. It is particularly suited for companies that rely on a pool of drivers, such as delivery services, transportation companies, or businesses with a large workforce that needs access to company vehicles.

The specific eligibility criteria for any driver fleet insurance can vary depending on the insurance provider. Generally, the following entities can obtain this type of insurance:

- Businesses with multiple vehicles: Any company or organization that owns a fleet of vehicles, including cars, vans, trucks, or specialized vehicles, can be eligible for any driver fleet insurance.

- Authorised drivers: The insurance policy covers authorised drivers who meet the criteria set by the business or organisation. Typically, these drivers should have a valid driver’s license and meet certain age and experience requirements.

- Minimum fleet size: Insurance providers may have a minimum fleet size requirement to qualify for any driver fleet insurance. This requirement varies among insurers, but it is generally more suitable for businesses with a significant number of vehicles.

- Commercial use: Any driver fleet insurance is primarily designed for commercial use, where the vehicles are utilized for business purposes. Personal use of the vehicles may not be covered or may require additional coverage.

It is important to note that the specific terms and conditions, coverage options, and eligibility requirements can differ between insurance providers. Therefore, businesses looking for any driver fleet insurance should consult with insurance companies to understand their specific offerings and determine if they meet the criteria for obtaining this type of coverage.

The different types of any driver fleet insurance cover

Any driver fleet insurance provides comprehensive coverage for businesses with a fleet of vehicles and allows any authorised driver to operate them. The specific types of coverage offered under any driver fleet insurance can vary depending on the insurance provider and the needs of the business. However, some common types of coverage include:

- Third-Party Only (TPO) Coverage: This is the minimum legal requirement for motor insurance. It covers liability for damage or injury caused to third parties, including other vehicles, property, or individuals. TPO coverage does not provide protection for insured vehicles.

- Third-Party, Fire, and Theft (TPFT) Coverage: In addition to third-party liability, this coverage also includes protection against fire damage or theft of insured vehicles. It provides compensation if the vehicles are stolen or damaged by fire.

- Comprehensive Coverage: This is the highest level of coverage available for any driver fleet insurance. It includes all the benefits of TPFT coverage and extends to cover accidental damage, vandalism, and other perils. Comprehensive coverage provides the most extensive protection for insured vehicles.

- Additional Coverage Options: Insurance providers may offer additional coverage options that businesses can choose to enhance their protection. These options can include breakdown assistance, legal expenses coverage, replacement vehicle coverage, or goods-in-transit coverage (if applicable).

It is important for businesses to carefully review the terms and conditions of any driver fleet insurance policies to understand the specific coverage provided. They should also consider their unique operational requirements and discuss with insurance providers to tailor the coverage to their specific needs.

Please note that the availability of coverage options may vary depending on the insurance provider and the policy terms. Businesses should consult with insurance professionals or brokers to determine the most suitable coverage for their fleet.

Any driver fleet insurance policy covers

In the UK, any driver fleet insurance policies provide comprehensive coverage for businesses that own a fleet of vehicles and allow multiple authorized drivers to operate them. While the specific coverage options and policy terms can vary among insurance providers, here are some common types of coverage that are typically included:

- Road Traffic Act (RTA) Liability: This coverage is a legal requirement and protects against claims made by third parties for bodily injury or property damage caused by an accident involving one of the insured vehicles. It covers legal expenses, medical costs, and property repairs or replacements.

- Comprehensive Coverage: Comprehensive coverage protects against a wide range of risks, including damage to the insured vehicles caused by accidents, theft, fire, vandalism, and natural disasters. It provides coverage for the repair or replacement of the insured vehicles in these situations.

- Third-Party Fire and Theft (TPFT) Coverage: This coverage includes protection against fire damage and theft of the insured vehicles. It provides compensation if the vehicles are stolen or damaged by fire.

- Goods in Transit Coverage: If the fleet is used for commercial purposes involving the transportation of goods, goods in transit coverage can be included. It provides protection for the goods being carried in the insured vehicles against loss or damage during transit.

- Public Liability Coverage: Public liability coverage protects against claims made by third parties for bodily injury or property damage arising from the business operations. It provides coverage for legal expenses and compensation to the injured party.

- Employers’ Liability Coverage: If the business has employees operating the fleet vehicles, employers’ liability coverage may be included. It covers claims made by employees for work-related injuries or illnesses and provides compensation for medical expenses and lost wages.

- Breakdown Assistance: Some insurance providers offer optional breakdown assistance coverage, which provides roadside assistance and support in the event of a vehicle breakdown.

It is important for businesses to carefully review the terms and conditions of any driver fleet insurance policies in the UK to understand the specific coverage provided. They should also consult with insurance professionals or brokers to tailor the coverage to their fleet’s unique needs and requirements, ensuring compliance with UK regulations.

How much does fleet insurance cost?

The cost of any driver fleet insurance in the UK can vary significantly based on several factors. Insurance providers consider various elements when determining the premium for fleet insurance policies. While it is challenging to provide an exact cost without specific details, here are some factors that can influence the price:

- Fleet size: The number of vehicles in the fleet will impact the cost. Generally, larger fleets tend to have higher premiums due to the increased risk exposure.

- Vehicle types: The type of vehicles in the fleet, such as cars, vans, trucks, or specialized vehicles, can affect the premium. Certain vehicle types may be considered a higher risk or have higher repair or replacement costs, impacting the insurance cost.

- Vehicle usage: The purpose and usage of the fleet vehicles play a role. Insurance providers consider factors such as mileage, distance travelled, and the nature of business operations. Fleets with higher mileage or that operate in high-risk areas may have higher premiums.

- Driver history: The driving history of authorized drivers is a significant factor. If the drivers have a history of accidents, traffic violations, or claims, it can increase the premium. Maintaining a fleet with drivers who have clean driving records can help lower the cost.

- Driver age and experience: The age and experience of the drivers in the fleet can impact the premium. Younger or less-experienced drivers may be considered a higher risk, leading to higher premiums.

- Claims history: If the fleet has a history of frequent claims or accidents, it can result in higher premiums, as it indicates a higher risk profile.

- Security measures: The security measures implemented by the fleet, such as vehicle tracking systems, immobilisers, or secure parking facilities, can potentially lead to premium discounts as they help reduce the risk of theft or damage.

- Coverage limits and options: The chosen coverage limits and additional coverage options will affect the premium. Higher coverage limits and additional coverage types will generally increase the price.

To determine the specific cost of any driver fleet insurance for a particular business, it is advisable to contact insurance providers directly or work with insurance brokers who can gather relevant information and provide customized quotes based on the fleet’s characteristics and the business’s requirements.

What affects the price of any driver fleet insurance?

The price of any driver fleet insurance is influenced by several factors that insurance providers consider when determining premiums. These factors include:

- Number and type of vehicles: The size and composition of the fleet play a significant role in determining the price. The more vehicles in the fleet, the higher the premium is likely to be.

- Vehicle usage: Insurance providers consider how the vehicles are used. Mileage, purpose (e.g., delivery, transportation), and the geographical areas they operate in can impact the premium.

- Driver history: The driving records of the authorised drivers are taken into account. A history of accidents, traffic violations, or claims can increase the premium, while a clean driving record may result in a lower premium.

- Driver age and experience: The age and experience of the drivers in the fleet can impact the premium. Younger or inexperienced drivers may result in higher premiums due to the perceived higher risk.

- Claims history: If the fleet has a history of frequent claims or accidents, it can result in higher premiums as it indicates a higher risk.

- Security measures: Insurance providers consider the security measures implemented by the fleet, such as vehicle tracking systems, immobilisers, or secure parking facilities. These measures can help reduce the risk of theft or damage and may result in lower premiums.

- Policy coverage and limits: The level of coverage and the limits chosen for the policy will affect the premium. Higher coverage limits and additional coverage options will generally increase the price.

In summary, the price of any driver fleet insurance is influenced by factors such as the number and type of vehicles, vehicle usage, driver history, driver age and experience, claims history, security measures, and policy coverage and limits. Insurance providers assess these factors to determine the premium, aiming to reflect the level of risk associated with insuring the fleet.

Helpful Links

RHA – Road haulage Association – The only UK Trade Association Dedicated Solely to the Needs of UK Road Transport Operators.

FORS – The Fleet Operator Recognition Scheme (FORS) is a voluntary accreditation scheme for fleet operators which aims to raise the level of quality within fleet operations, and to demonstrate which operators are achieving exemplary levels of best practice in safety, efficiency, and environmental protection.

Gets quotes within minutes of completing our simple form

Last Updated | 28th January 2026

Page updated and reviewed by Sarah Hampton – Insurance specialist