Compare Motor Fleet Insurance

Motor Fleet Insurance Quotes

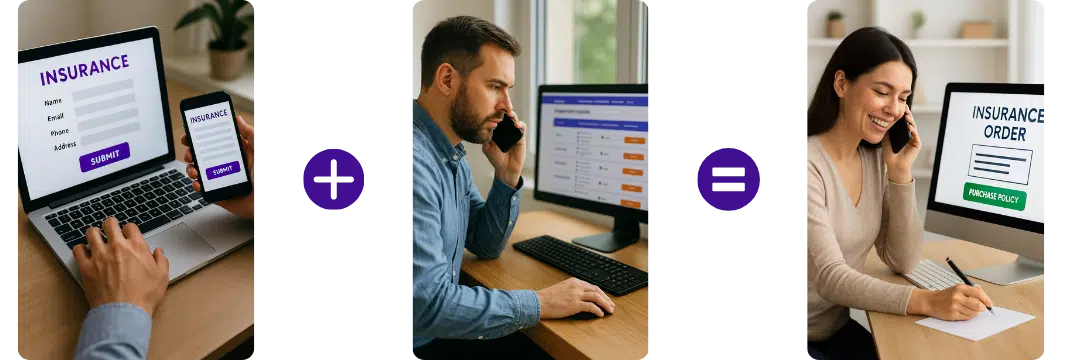

Quick & Easy Process – Complete a simple form or call the broker direct.

All Size Fleets – Cars, vans, buses, taxis, couriers and HGV’s.

Expert Support – No-obligation quotes tailored to your needs.

Compare motor fleet insurance quotes with some of the UK's top providers, including:

How does it work?

Complete the Simple Form

Provide details about your business, fleet vehicles, and driving history.

Compare Prices

Compare from multiple UK providers to find the best value and features.

Purchase Cover

Select the policy that fits your business and purchase directly with the provider.

Gets quotes within minutes of completing our simple form

What is Motor Fleet Insurance?

Motor fleet insurance is a convenient insurance policy for businesses with multiple vehicles. It lets you insure multiple cars, vans or trucks under the same policy, something that’s easier administratively and can be less expensive than insuring each vehicle separately. From small fleet insurance for a handful of vehicles to a more complex fleet, this policy matches your needs.

If you’ve got a company fleet insurance, it’s important to safeguard all vehicles and drivers from third-party liability and damage to your own vehicles. This kind of policy is perfect for companies across industries such as delivery, construction or transportation, where multiple vehicles are in use. A fleet is generally considered to have two or more vehicles, so even small businesses with just a couple of vehicles can benefit from this type of cover.

How much does Motor Fleet Insurance cost?

The estimated annual costs for fleet insurance depend on the size of your fleet. For a small fleet (2–5 vehicles), premiums typically range from £1,000 to £5,000 annually, depending on the specifics of the fleet and business operations. A medium fleet (6–10 vehicles) will generally cost between £5,000 and £10,000, with higher costs for more complex or high-risk fleets. For a large fleet (10+ vehicles), premiums can exceed £10,000 per year, especially if the vehicles are high-value or used in high-risk industries.

Several factors influence fleet insurance costs: the type of vehicles (larger vehicles like HGVs or vans are more expensive to insure), driver experience (inexperienced drivers often lead to higher premiums), claims history (frequent claims raise costs), fleet usage (high-risk activities or traffic-heavy areas increase premiums), and location (areas with high crime rates or accidents can drive up costs).

Different Types of Vehicle Fleets Covered:

The Benefits of Motor Fleet Insurance

Motor fleet insurance provides numerous advantages for businesses that operate multiple vehicles. One of the most significant benefits is the simplification of policy management. Insuring several vehicles under one policy reduces the need for multiple renewals and paperwork, making fleet management far easier. It also typically results in lower premiums when compared to insuring each vehicle separately.

A key benefit of fleet insurance is the flexibility it offers. With a single policy, businesses can insure a wide range of vehicles, from cars and vans to trucks and HGVs. Policies can be tailored to cover the specific needs of your fleet, ensuring that each vehicle is adequately protected based on its usage. This flexibility extends to adding or removing vehicles as needed, making it an ideal option for businesses that experience fleet growth or seasonal changes.

Simplified Administration

-

Manage multiple vehicles under a single policy, reducing paperwork and streamlining the renewal process.

-

One point of contact for all vehicles, making fleet management more efficient.

Cost Savings

-

Insuring multiple vehicles under one policy often results in lower premiums compared to insuring each vehicle separately.

-

Bulk discounts may be available for businesses with larger fleets.

Cover for Various Risks

-

Third-party liability: Covers damage to others or their property.

-

Comprehensive cover: Protects your vehicles from damage, theft, and vandalism.

-

Goods in transit: Ensures that the goods you’re transporting are covered while on the move.

Flexibility

-

Easily add or remove vehicles from the policy as your fleet changes.

-

Policies can be tailored to cover different types of vehicles, including cars, vans, trucks, and HGVs.

Protects Your Drivers

-

Includes cover for drivers, offering protection in case of injury or accidents while using the vehicles for work.

-

Any driver fleet insurance allows flexibility by covering all authorised drivers without needing to list them individually.

Tailored to Business Needs

-

Policies can be adapted to suit the specific nature of your business, whether you’re in delivery, construction, or transportation.

-

Cover options can be adjusted to meet the particular risks faced by your fleet.

Risk Management

- Helps businesses manage and mitigate risk by providing cover for accidents, theft, and damage to vehicles and goods.

- With comprehensive cover, you can protect your fleet from unexpected events that could otherwise lead to significant financial losses.

Legal Compliance

-

Ensures your fleet meets legal requirements, such as third-party liability insurance, to avoid penalties and fines.

-

Keeps your business compliant with regulations regarding insurance for commercial vehicles.

Increased Peace of Mind

-

With motor fleet insurance, you can operate your business knowing your vehicles, drivers, and goods are protected, allowing you to focus on your business operations.

Opportunity for Discounts

-

Some insurers offer discounts for safe driving, telematics usage, and vehicles that are well-maintained.

-

A good claims history can also lead to lower premiums on future renewals.

Motor Fleet Insurance Can Cover:

Motor Fleet Insurance FAQs

What counts as a “motor fleet” for insurance purposes?

A motor fleet is typically defined as two or more vehicles insured under a single policy, including cars, vans, HGVs, taxis, minibuses or mixed-use commercial vehicles.

How does motor fleet insurance work for mixed fleets with different vehicle types?

Mixed fleet policies allow you to insure multiple vehicle classes, such as cars, vans and HGVs, under one contract, with unified renewal dates and simplified admin.

Can I insure electric vehicles under a motor fleet policy?

Yes. Many insurers now include EVs, hybrids and charging‑infrastructure risks within motor fleet policies, often with specialist repair networks.

How does motor fleet insurance differ for courier fleets?

Courier fleets typically require higher mileage cover, goods‑in‑transit protection, and time‑critical breakdown support, which are built into specialist courier fleet policies.

Do taxi fleets need a different type of motor fleet insurance?

Taxi fleets require hire & reward cover, public liability, and passenger liability, which are added to standard motor fleet insurance to meet licensing requirements.

Can I include privately owned vehicles in my business motor fleet policy?

Yes, if they are used for business purposes. These are often added as “grey fleet” vehicles, subject to driver checks and usage declarations.

How does telematics reduce the cost of motor fleet insurance?

Telematics devices track driver behaviour, allowing insurers to reward safer driving, reduce claims, and offer usage‑based pricing for fleets.

What information do insurers need to quote for motor fleet insurance?

Insurers typically require vehicle lists, driver details, claims history, annual mileage, vehicle usage, and operating locations.

Can I add new vehicles to my motor fleet policy mid‑term?

Yes. Motor fleet insurance is designed for flexibility, allowing you to add, remove or replace vehicles at any time with pro‑rata adjustments.

Does motor fleet insurance cover vehicles used outside the UK?

Many policies include EU or international cover, but this varies by insurer. You may need green cards or extended territorial cover for overseas trips.

How does motor fleet insurance work for seasonal or temporary fleets?

Short‑term fleet cover can be arranged for seasonal businesses, allowing you to insure vehicles only when they are in use, reducing annual costs.

What security measures help lower motor fleet insurance premiums?

Insurers often reward fleets with CCTV, tracking devices, secure overnight parking, immobilisers, and driver training programmes.

Can motor fleet insurance cover vehicles with multiple drivers?

Yes. Policies can be set up for any driver over the age of 18, 25, 30, a named driver, or an age‑restricted driver, depending on your risk appetite and budget.

How does claims management work under a motor fleet policy?

Fleet policies often include dedicated claims handlers, 24/7 reporting, and replacement vehicle support, helping minimise downtime.

Are HGV fleets insured differently from car or van fleets?

HGV fleets require specialist cover for heavy loads, long‑distance driving, tachograph compliance, and higher vehicle values, which are built into HGV fleet policies.

Can I insure leased or financed vehicles under a motor fleet policy?

Yes. Leased, financed or contract‑hire vehicles can be included, provided the policy meets the lender’s insurance requirements.

How does motor fleet insurance support businesses with rapid growth?

Fleet policies scale easily, allowing you to add vehicles, expand driver lists, and adjust cover levels without needing new individual policies.

What is the minimum number of vehicles required for a motor fleet policy?

Most insurers start at two vehicles, though some specialist brokers may accept single‑vehicle fleets for businesses planning to expand.

Does motor fleet insurance include breakdown cover as standard?

Breakdown cover is usually an optional add‑on, offering roadside assistance, recovery, and sometimes replacement vehicles for business continuity.

How do insurers assess risk for motor fleet insurance?

Risk is based on driver profiles, vehicle types, claims history, industry sector, annual mileage, and risk‑management measures such as telematics.

Helpful Links

RHA – Road haulage Association – The only UK Trade Association Dedicated Solely to the Needs of UK Road Transport Operators.

FORS – The Fleet Operator Recognition Scheme (FORS) is a voluntary accreditation scheme for fleet operators which aims to raise the level of quality within fleet operations and to demonstrate which operators are achieving exemplary levels of best practice in safety, efficiency, and environmental protection.

Gets quotes within minutes of completing our simple form

Last Updated | 27th January 2026

Page updated and reviewed by Sarah Hampton – Insurance specialist